U.S. Rates Market Tells Worrying Story

Pepperstone | Jan 31, 2019 01:01AM ET

It’s all about the Fed today and the reaction in markets from all we have heard speaks for itself. I hadn’t expected it to be a volatility event myself, but then if we look at implied vols neither was the market.

I have recorded a short video reviewing the Fed meeting that can be found at the bottom of the article. The focus is on the change in the forward guidance and formal move to a ‘patient’ policy stance. As well as the bank's guidance to adjust the pace and composition of the balance sheet if it is required. I have made mention of liquidity dynamics before, and that the balance sheet, specifically the level of excess reserves in the system is having a huge impact on the USD and sentiment towards U.S. equities, credit and emerging markets more broadly.

The Fed’s balance sheet is the game changer, as a change in the global money supply (we can look here at M2). Although, in reality, while markets may rejoice short-term it’s debatable whether it will turn this synchronized economic downturn around, or whether it is just a vehicle to fight a blazing fire.

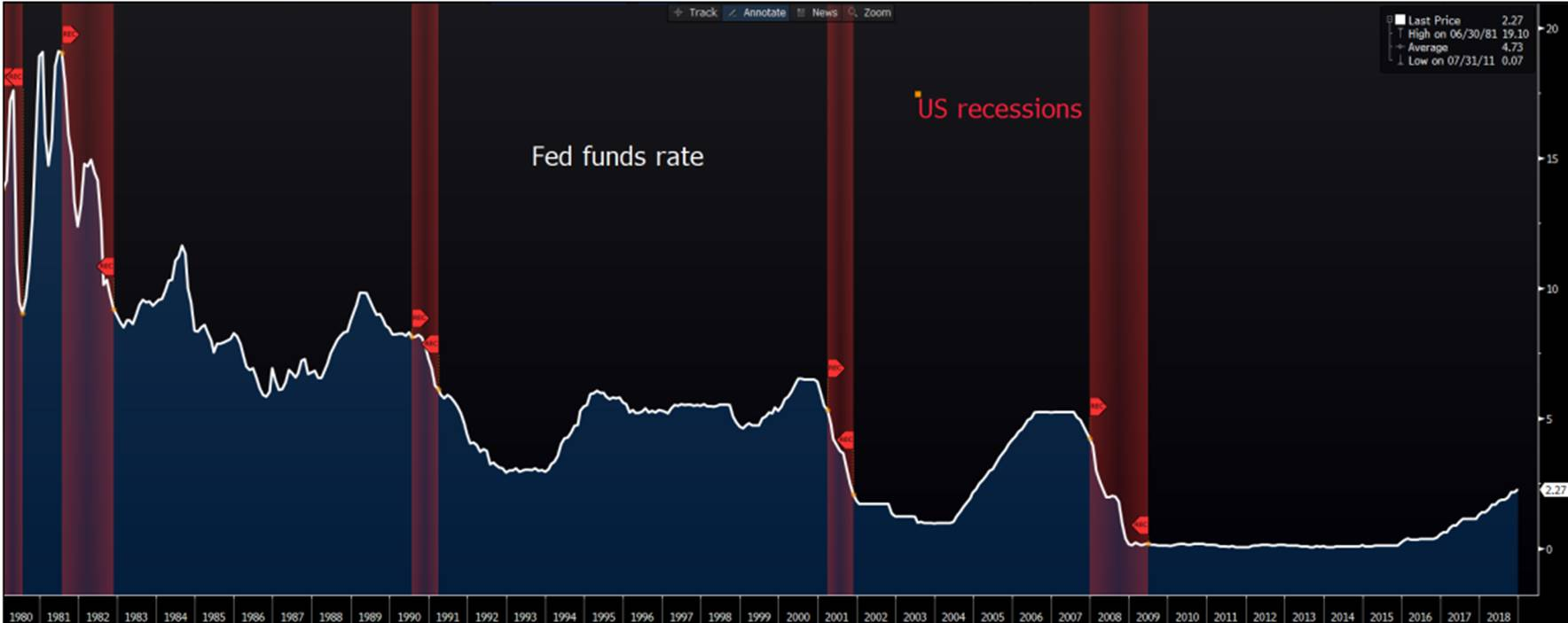

As I suggest that the Fed may have caved to market pressures and told us they wouldn’t be hiking anytime soon – if at all. However, the U.S. rates market tells a very worrying story. That being, we will see the Fed on hold through 2019, with a 76% chance of a cut in 2020. As we can see, into prior U.S. recessions we see a hiking cycle, followed a prolonged pause, then a cut into a recession – this is exactly the message the rates market is telling us now.

The S&P 500 and NASDAQ 100 may have liked what they heard, but this seems to have been driven by a dramatic 12bp drop in ‘real’ 5-year U.S. Treasury yields. Without going into applied finance, lower yields (inflation-adjusted) make the cash flows of U.S.-listed equities relative more attractive and is an important component for business to assess the net present value and internal rate of return for any new investment.

A rampant narrowing of the high yield to investment-grade credit spread is always going to be taken well by U.S. equities. Where, by-and-large, equities always follow credit.

We haven’t seen Asia being blown away with euphoria today, suggesting traders are still cautious, with a beady eye on the US-Sino dialogue and global economics. We have even seen improvement in Chinese PMI data today, although the index sits at 49.5 and remains in contraction. The S&P 500 though has broken out of the recent consolidation range and is testing the September downtrend and a break here would be bullish.

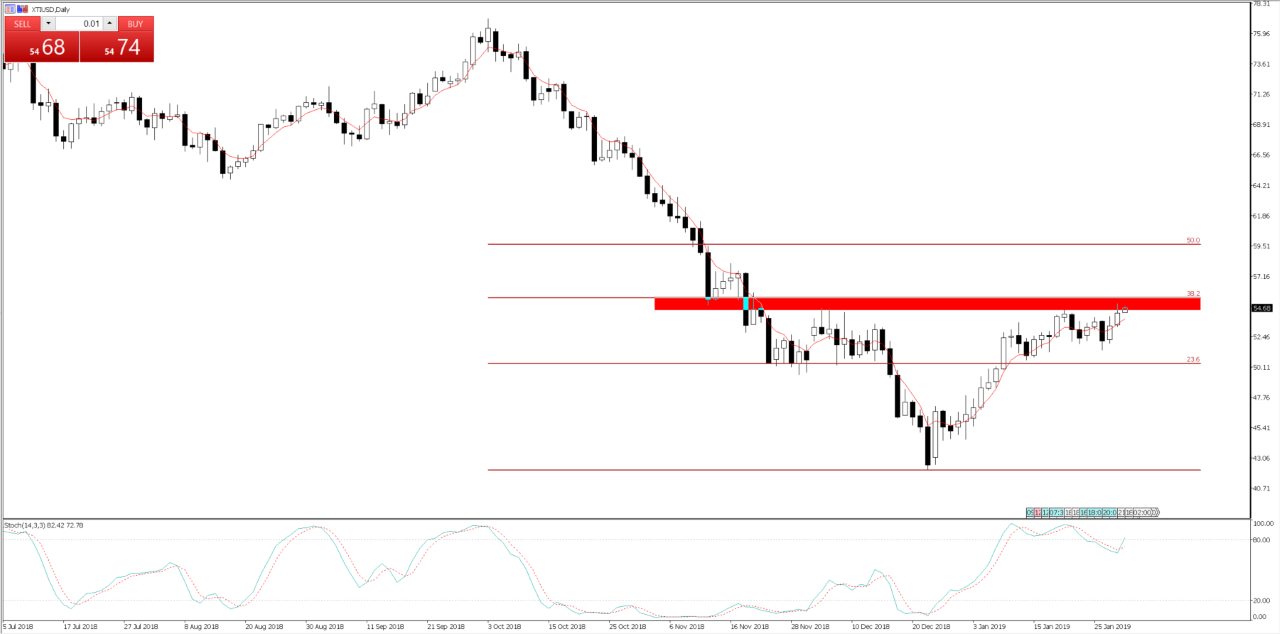

I have also got an eye on crude too, and the 38.2% Fibonacci of the October to December sell-off at $55.55. A close through here would be positive for equities, so watch how price reacts into this level.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.