The Fed Is Scared And Will Not Raise Rates Anytime Soon

Econintersect LLC | Mar 22, 2015 03:15AM ET

Professor Paul Krugman recently told the Federal Reserve: "Don't raise rates until you see the whites of inflation's eyes!"

Oliver Hardy stated in 1930: "Well, here's another nice mess you've gotten me into."

Follow up:

If I was not affected by the Fed's zero interest rate policy - the current situation would be humorous. The Fed has painted itself into a corner, and regardless of they want to do - they simply are deer caught in the headlights. The Fed has always wanted to raise their 6 years old zero bound and unprecedented low interest rates when the economy began to run on all cylinders. The FOMC meeting statement released this week stated in part:

Consistent with its previous statement, the Committee judges that an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. This change in the forward guidance does not indicate that the Committee has decided on the timing of the initial increase in the target range.

Pundits have tried to spin the bold statement in the above paragraph - because it replaced the words that the Fed would be patient in deciding when to raise rates. As a student of macroeconomics and a avid critic of the zero bound Fed interest rate policy - the time is not right to begin to raise rates (the right time was about a year ago). The argument becomes when should the zero bound policy be abandoned?

- Historically USA recessions since 1950 occur with separations of 1 to 10 years. The last recession ended about 6 years ago. Being zero bound, the Fed is out of proven monetary weapons to fight another recession (unless it wants to QE the economy to death. There is no evidence that long term QE flooding the world with dollars, that any additional QE will have any recession fighting capability ESPECIALLY with all the QE going on outside the USA.) The Fed needs to create room in their monetary policy to provide effective recession fighting tools.

- The Federal Reserve has a dual mandate which has the goals of maximum employment with stable prices and moderate long-term interest rates. Employment is inching towards normalization (caution: employment is a lagging indicator). But the USA is entering a deflationary cycle (which the Fed continues to believe was caused by lower fuel prices ... or weakness in other economies ... or weather ... or ??? - and continues to consider inflation running well under their target range of 2.0% to 2.5% a transient condition). Is there any evidence the situation is transient? What data is available to prove that zero bound rates are not deflationary?

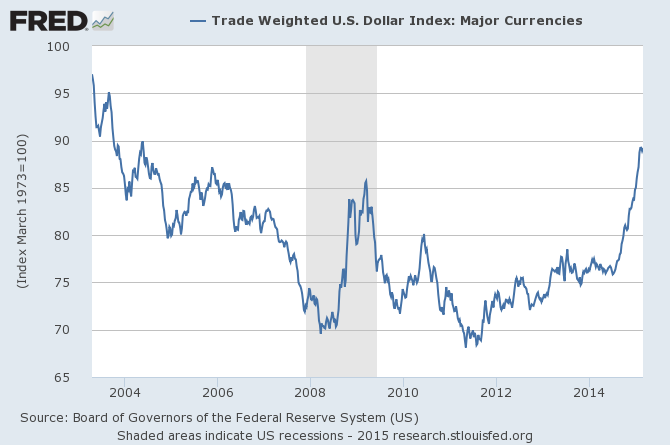

- The Fed is being surprised by the strengthening cycle for the dollar. The consistent error in economic theory is ignoring that sovereign monetary policy can be affected by elements outside of their borders - even for the almighty dollar. (Perhaps especially for the dollar as the world's reserve currency?) Here the European Union and Japan has opened their QE taps more than 100% - and China is taking steps to bolster internal demand which has the effect of weakening their currency. The dollar has taken off like a rocket - undermining USA exports (making exports too expensive) and making imports cheap. This is overall reducing trade (a condition associated with recessions) thus influencing U.S. economy watchers who are seeing an increased probability of recession.

- Japan has failed to hit its inflation targets by weakening its currency (currently the low oil prices are headwinds for its inflation targets). Monetary policy has no weapon other than QE (or its sister which entails burning the debt documents) to weaken its currency. There is a global currency war underway to weaken currencies against the dollar in order to become more competitive in the global marketplace - with the hope this results in strengthening their respective economies. If everyone joins this war - there will be no winners! It is too much of a zero sum game.

- Interest rates have turned negative in the stronger countries in Europe. Let me restate: nominal interest rates have turned negative in the stronger countries in Europe. In this absolutely astounding situation even the low U.S. returns look attractive by comparison. So capital is heading towards the USA, driving the euro down and the dollar up. If the Fed raises interest rates - even more capital will flow - further strengthening the dollar putting an even larger drag on exports. An economy growing only a few percent per year cannot afford to become non-competitive globally.

- Much of the world debt is denominated in dollars. This dollar strengthening cycle is creating a situation where debt (denominated in dollars but income used for repayment of the debt is not in dollars) is hard to pay back. This is building another debt crisis in which the Fed may again be "forced" to defend the banking system. Think back to 1997 and the Asian financial crisis and scale that up to the entire world.

- To protect the dual mandate, the Fed may not be able to raise rates or the dollar will strengthen. The strengthening dollar is a headwind to jobs in export sectors, and a headwind to jobs for products meant for domestic consumption (and cheaper imports now being purchased by consumers). As stated herein, jobs are a lagging indicator - and will soon begin to see the effects of the strengthening dollar cycle.

Here we are - Catch 22 (a paradoxical situation from which cannot be escaped because of contradictory dynamics). The Fed has a need to increase the rates but the effect of the rate increase may cause a recession to a slowed USA economy. Six years of QE and Zero Interest Rates may have embedded these features into the USA economy. Like heroin, the economy needs to be free of artificially pegged interest rates - but the withdrawal within the current economic dynamics may carry too many headwinds.

The Fed likely will take Professor Krugman's advice and wait - but not because they are waiting for inflation. The Fed will be blamed if they raise rates and the economy slows or recesses - but the Fed can blame fiscal policy if they do nothing and the USA economy recesses. In the end, the end of the zero bound policy is now a game of politics.

I asked my partner John Lounsbury for thoughts on this topic:

Perhaps the Fed will create a program which should have been instituted back in 2010 or 2011, when it was apparent the financial system had been stabilized. That would be the creation of money for Main Street in the form of infrastructure development and subsistence level social programs. If you want to create inflation, money must be put in places where it will be spent. Once that has been accomplished then the dollar should weaken (or at least not start the current strengthening moonshot) and interest rates can be increased without the domestic and global disruptions that would be the case as things are today.

As said at the beginning of the discussion, the Fed has painted itself into a corner. This corner is in one room of the U.S. economic house and the rest of the house needs paint. So get another painter and start what should have been done in the first place.

Note 1: What I described described above is really in the domain traditionally considered fiscal policy. The political climate in the U.S. is strongly opposed to such a process with both parties supporting (to varying degrees) "fiscal responsibility" and talking about "balanced budgets". The question of whether there is political will to do the right thing is far from trivial.

Note 2: The problem is not only for the Fed but other central banks as well. The problem facing the ECB (European Central Bank) was just summarized this week by German economist Dirk Ehnts:

In the last 4 years the euro zone authorities have tried to increase investment by talking up markets ("confidence"), by low interest rates (ECB), by pushing wages down, by deregulating and privatizing. After all this did not work, it is now a depreciation of the euro that is supposed to increase aggregate demand in the euro zone ? Is this not the beggar-thy-neighbor strategy that Germany imposed on the rest of Europe which led to the crisis in the first place?

Well, the euro's exchange rate is not fixed, and other countries will retaliate against "gains in competitiveness" that come via depreciation of the euro by depreciating their own currencies. Hence the solution to Europe's economic woes - low investment - cannot lie with the rest of the world. It must lie in Europe.

Other Economic News this Week:

The Econintersect Economic Index for March 2015 continues to show a growing economy, but the rate of growth is decelerating. All tracked sectors of the economy are expanding - but most sectors are showing some slowing in their rate of growth. The negative effects of the recently solved West Coast Port slowdown (a labor dispute which had been going on for months) can be seen be seen in much of the raw data - and it will be an economic drag on 1Q2015 GDP. Although beyond our forecast view, we expect a slight economic bounce in the coming months as a trillion dollars annually of cargo begins to traverse the West Coast Ports again in a normal flow.

The ECRI WLI growth index value crossed slightly into negative territory which implies the economy will not have grown six months from today.

Current ECRI WLI Growth Index

The market was expecting the weekly initial unemployment claims at 275,000 to 305,000 (consensus 293,000) vs the 291,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 302,500 (reported last week as 302,250) to 304,750. The rolling averages have been equal to or under 300,000 for most of the last 6 months, but this week again exceeded this number.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Korea-based Daebo International Shipping Co., Quicksilver Resources, American Spectrum Realty, Sierra Resource Group

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard:

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.