The Fed As A Fig Leaf

Jeff Miller | May 24, 2013 01:12AM ET

Everyone who has been wrong about the market has now joined in a familiar refrain:

The Fed is printing money. It is the only thing holding up stocks. It will all end badly.

Background

A little research on these sources shows that – as of a few months ago – their take on the Fed included the following:

- The Fed is irrelevant

- The Fed is pushing on a string

- The Fed is in a box

- The effectiveness of QE has declined with each new round.

When the various bearish predictions have not played out, the same sources come up with a NEW VERSION of the theory. In this revised story, no one could possibly have predicted the effect of the Fed's money printing and debasement of the currency. Wow!

Once again this flies in the face of facts:

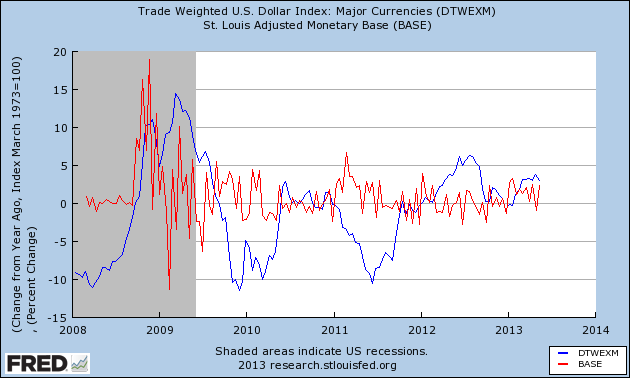

- While the Fed's balance sheet has increased, M2 growth has been modest. Whatever "printing" is taking place seems to be stalled at the level of excess reserves.

- The dollar has actually strengthened. In fact, there is no real correlation to Fed policy – despite the rhetoric.

But it is an easy explanation. Blaming the Fed is a fig leaf for bad analysis.

The Reality – An Alternative Hypothesis

There is a simple reason for higher stock prices: Better economic conditions and higher profits. Over the last three years the most important market worries have lessened.

Most people struggle to understand the "wall of worry" concept. Briefly put, it means that, at any given time, stock prices might be lower than one expected because of headline risks. These are plentiful at all times, fueled by ratings-seeking media and blogs. Trying to explain how Europe will bargain its way to a solution is pretty boring when compared to footage of a run on banks in Cyprus!

It is very difficult to evaluate the worries in real time. To avoid this problem, let us use the Wayback machine to go back three years. In my Dow 20K series, I raised a number of "what if" questions. The commenters were most of the "Miller, you idiot" persuasion. Feel free to go back and first installment . My next post will ask what the effect would be if the Fed unwound the entire balance sheet in one year. What is your guess? Let us suppose two methods:

- No notice at all.

- Announcement of the general plan, but without daily or weekly specifics.

We all know that it could not happen in either of these alternatives, but let us consider them as a useful hypothetical starting point.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.