Global Macro Currents

Sober Look | Sep 16, 2015 04:24AM ET

Let's begin in the United States where economic data remains mixed. Here is the latest:

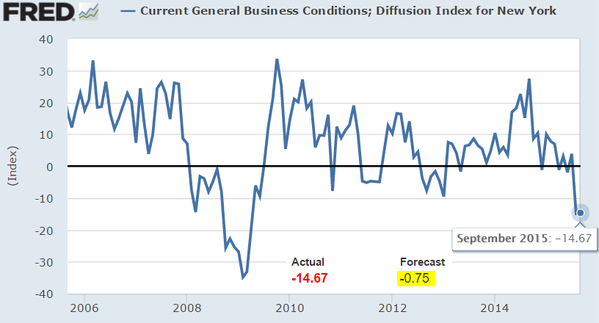

1. The Empire State Manufacturing Index (measuring NY-area manufacturing activity) is quite weak and materially below consensus.

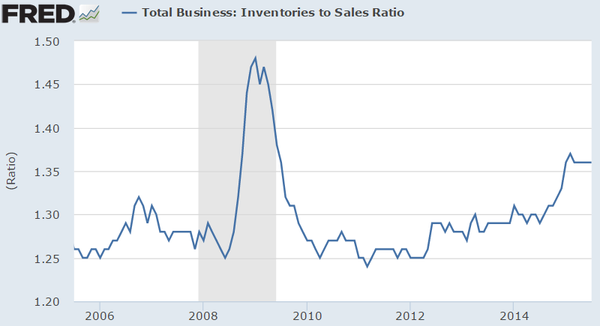

| 2. At the national level the inventories-to-sales ratio is still elevated. This means that US product isn't selling well. |

|

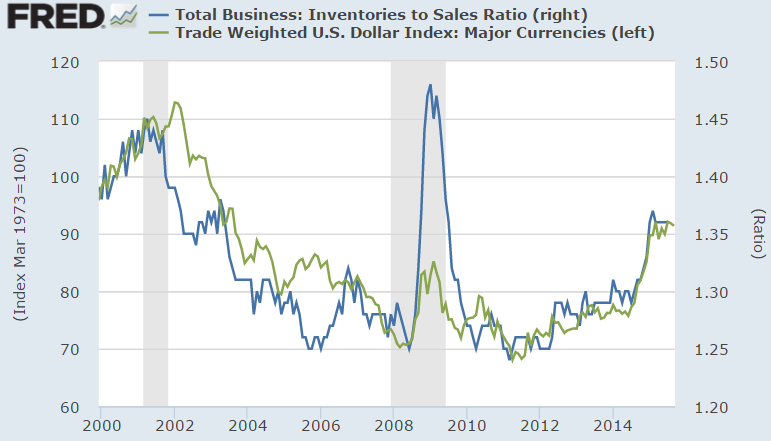

| Moreover, here is the same chart vs. the trade weighted US dollar index - it's not difficult to see the relationship. A rate hike in this environment will push the dollar higher and put even more pressure on sales. |

|

| 3. US industrial production growth has stalled - also as a result of a strong dollar. |

|

| 4. Related to the above, here is the capacity utilization. |

|

| 5. The Atlanta Fed latest GDPNow forecast for Q3 US GDP growth remains at 1.5%. All these indicators should give the FOMC some "food for thought". |

|

| The treasuries market came under pressure on Tuesday. The short end of the curve had a particularly sharp move as the 2-year yield broke through the 75bp resistance. |

|

| On a relative basis the recent increase in the 1-yr bill yield was especially large. |

|

| Related to the above, the spread between the 2-year treasury and Bund yield is at the highest level since 2007. |

|

| Turning to Germany, we see mixed business sentiment data. The ZEW Current Conditions index beat expectations. |

|

| On the other hand future business expectations worsened on China-related jitters, pushing the overall ZEW index below consensus. |

|

| The ECB hopes the latest bout of disinflation (see France's CPI below) in the Eurozone is transient. Nevertheless most economists now expect the QE program to be expanded. |

|

|

| Source: @andretartar, @business |

|

| The euro area trade surplus hit a record recently. |

|

| Much of this is driven by Germany, but other member states have contributed as well. |

|

| Political risks continue to hound Spain as Catalonians push for independence. The Spain-Italy government bond spread has widened further -- in spite of Spain's economy growing faster than most nations in Europe. Spanish stocks are underperforming as well. |

|

| We see conflicting housing data from the UK as the Office of National Statistics index shows UK house prices appreciating at about the same rate as the US. That was considerably below consensus. |

|

| The UK's inflation remains subdued. The BoE is comfortably on hold until 2016 - especially given the cooling housing price appreciation (above).. |

|

| Based on yesterday's discussion, some readers have asked why a strong franc is such a bad thing for Switzerland. Here is just one example. |

|

| Turning to emerging markets, Turkey's latest bond auction resulted in the nation's government paying the highest interest rate in 6 years. The chart below shows Turkish yields rising as the currency falls (one dollar buys increasingly more lira). |

|

| Brazil embraces austerity by announcing spending cuts and higher taxes. Moody's applauded the move, which should be a positive for the nation's debt valuations. Nevertheless the real still trades near record lows vs. the dollar. |

|

|

| Source: barchart (chart shows number of reals one dollar buys) |

|

| For years China wanted to build its own rating agencies. It got them now -- but they are just a bit biased. Too much downgrading would just be "unpatriotic". |

|

|

| Source: @SandyHendry @business |

|

| China's stock market is now down about 7% on the year after being up some 60% in June. Incredible. |

|

|

| Source: @fastFT, @patrickmcgee |

|

| By the way, investors have really downgraded their expectations for China's growth. |

|

| Switching to the energy markets, can more efficiency be wrung out of US oil rigs or are we reaching limits? Efficiency growth seems to have stalled as the less efficient rigs have been taken offline. |

|

| The Swiss-based commodities trader Glencore (LONDON:GLEN) is trying to recapitalize itself in order to survive the collapse in commodity prices. |

|

| It's been particularly hurt by falling coal prices as the (China-driven) good times come to an end. |

|

|

| Source: Google (NASDAQ:GOOGL) |

|

| By the way, coal is not going away any time soon. In fact coal production in the US has risen recently. |

|

| According to BAML, investors are out there buying shares of energy companies. Is this a bet on higher oil prices? |

|

| Staying with the energy theme, HY defaults are about to jump as levered energy firms run out of cash. Yes, energy prices will go up but it will be too little too late. |

|

| Hedge funds have been aggressively deleveraging in this latest selloff. It explains some of the unusually elevated volatility. |

|

| Related to the above, speculative accounts hold an outsize net long position in VIX futures. These are all positive signs for the US equity market. |

|

|

| Source: @Callum_Thomas, @JLyonsFundMgmt |

|

| Finally, before going to Food for Thought, here is another reason a rate hike in the US at this point could be a mistake. Global monetary policy out of sync with the US - and is becoming more out of sync. |

|

Turning to Food for Thought, we have 4 items this morning:

Get The News You Want

Get The News You Want

Read market moving news with a personalized feed of stocks you care about.

Get The App

1. They tell us to avoid "Mount Stupid" (below). However a great deal of social media is built on it.

|

|

| 2. Prevalence of obesity in men by country. |

|

| 3. Business start-ups for select countries. As discussed yesterday, business formation in the US has spiked recently (according to the Morgan Stanley (NYSE:MS) index), but it's not yet reflected in this chart. |

|

| 4. Labor costs vary dramatically across Europe. |

|

|

| Source: @Suntimes (Chicago Sun-Times) |

|

5. This man says the more Donald Trump speaks, the more Trump piñatas he sells. There's going to be tons of business Wednesday evening.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Written By:

Sober Look