The Daily Fix - Inter-Market Analysis And Macro Insights

Danske Markets | Nov 19, 2018 03:44AM ET

On the re-open of markets for the new trading week, we’ve seen a mixed picture in Asian equities, with the ASX 200 -0.6%, while China, Japan and Hong Kong are all close to 0.5% higher. G10 FX and bond futures have opened on a reasonably calm note, while S&P 500 futures are 0.3% lower.

Credit markets are getting a lot of attention here, with the high yield (HY) credit spread widening relative to investment-grade credit to the highest level since November 2016. Equity takes its cues from the credit market, and the further deterioration the risky end of the credit markets on Friday suggests the equity bulls may struggle to push prices up too far from here. Until I see HY credit start outperforming, then the probability is that the highs have been observed in US equity indices. That said, with so many of the long/short, risk parity and global macro hedge funds underperforming their respective benchmarks this year, the need to be paid could become a key factor in the year-end flow and chasing performance and FOMO will start to become a bigger consideration.

Orange line - S&P 500 (inverted), white - HY CDS/IG CDS spread

Trade tensions have been a theme the market has been sensitive too for some time, and as I touched on Friday, there has been a better feel to the dialogue of late. That has been unwound to an extent by Vice President Mike Pence, who has shown that he is a firm a trade hawk and undone much of the work from Kudlow and Lighthizer last week. It would be good to hear from Trump at some stage, to see who his views are more closely aligned too before we hit the G20 meeting later this month.

My view to focus on soybean market, and the spread between Brazilian and US contracts, is one I still have on the radar, and it will be interesting to see if Pence’s aggressive rhetoric plays into this spread through trade today. At this stage, we see small buying in USDCNH, while AUDUSD and copper are a touch lower, so Asia has noted Pence comments, but they are not acting too intently.

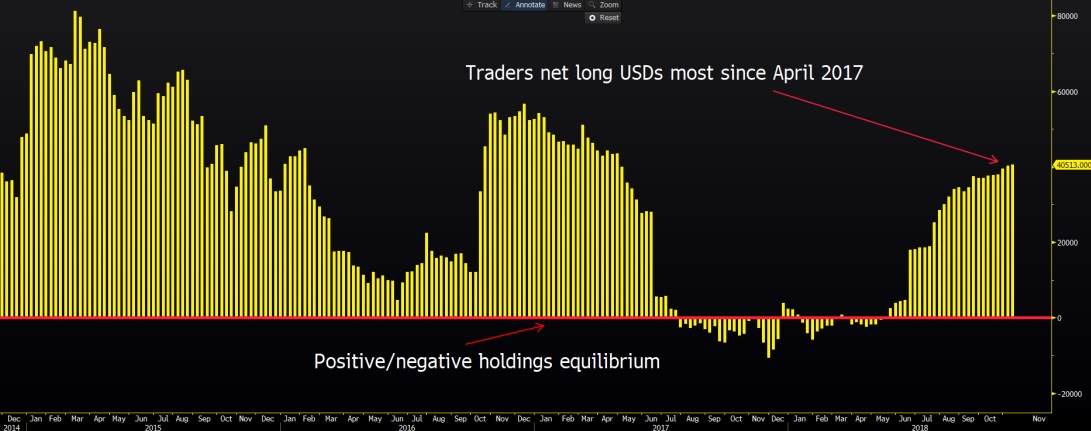

The USD had its first weekly decline last week, after four consecutive positive weeks. I touch on this in my video (https://youtu.be/CAb0evMrm8c ), but there has been a change in communication from the Fed, and this has taken some of the heat out of an over loved and over owned position. We saw a more nuanced speech from Fed Chair Powell last week, with Vice-Chair Clarida giving good insights on Friday, detailing ‘I think being at neutral makes sense’ and ‘currently the policy rate is below that range, but as you can tell, it is getting closer to the vicinity of that range’.

We can also add comments from Dallas Fed president Robert Kaplan and Neel Kashkari. However, for many who have wanted the Fed to acknowledge the risks to the global economy, and the late stage in the economic cycle, then we have had that creep into the narrative, as the re-pricing of US interest rate hike expectations last week was punchy. If I look at the Eurodollar futures and what is priced between December 2018 and December 2020, we can see 16 basis points (bp) priced out of the markets last week. So, once we get a December hike, we have one more hike due and a 30% chance of a second excepted by traders. We can even look further afield and see 2.5bp of rate cuts priced for 2021, so rates traders are sensing a policy mistake from the Fed.

Naturally, we can also see a decent bid in the US treasury market, with the US 10-year testing the 26 October low of 3.05% after starting last week at 3.18%. A break here and we can see the benchmark testing 3%, while 10-year ‘real’ (or inflation-adjusted) yields could pull below 1% and while we tend to look at the relative move, this should manifest into a weaker USD.

Trading EURUSD from the long side is more compelling at the start of the week, and the weekly chart highlights this well, with price trading into 1.1215 before closing the week back above the year-to-date lows of 1.1301. Its always good to look at the weekly set-up and marry with options and futures positioning, to get a more holistic oversight. So, a simple look at price action in EURUSD suggests that should we see a higher high then a move into 1.15 to 1.16 would be a higher probability. That said, when the market is focused on Italy’s fiscal situation, where we should hear back from the EU today on their review of Italy’s budget, then in the immediate term, the risks to the EUR are symmetrical.

Recall, Italy failed to make any changes after being prompted to do so and submitted a budget that won’t be taken well by the EU, and both sides are playing hardball. Talk of financial penalties, through what is known as ‘excessive deficit procedures’, could become a thing and could push Italian bonds yields higher, and again, the feedback loop between an end of ECB QE, higher Italian bond yields and a bleak picture for Italian bank balance sheets will be a theme of the session.

We can also throw in the view that the ECB is looking more likely to lower its inflation forecasts in December, and I revert to my comments my recent gold article, where we may start seeing USD weakness, but then investors are then faced with a genuine lack of options and alternatives.

AUD could emerge as a short-term long, and the weekly close above the September high of 0.7304 has this pair on my ‘high watch’ list. After the breakout, price has pulled back for the re-test of the breakout high, so any move higher is a sign to jump on, and I will be looking for 0.7440. AUDUSD weekly vols give us an implied move (up or down) of 77-points, so for those looking for an explosive move are better off going into GBPUSD, where the markets implied weekly move is 240 points. That said, we can see both leveraged funds and real money (asset managers) are still holding punchy AUD short position, so that is a consideration. Any buying in the period ahead and I will be on this move.

I wrote about GBPUSD on Friday and the risks of a confidence vote promoting an elevated risk of a Monday gap. That hasn’t played out, with the numbers of letters needed from MPs to call a no-confidence vote still shy of the required 48 letters. The elevated nature of GBPUSD implied vols suggests options traders still expect a decent move in spot in the short-term, and this script has many turns left to play out. Keep this in mind as part of your risk management and my view is position sizing has to be kept to a minimum given implied vol. One for the brave, but I have warmed to the idea that a confidence vote will go in favour of Theresa May, which would be a GBP positive where we turn to the EU summit on Sunday, which again could be a GBP positive. Although the parliamentary vote (rumoured to be on 10 December) could have huge negative implications for GBP.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.