The Countdown To 'Fedaggedon' Begins

Dr. Duru | Sep 08, 2015 05:30AM ET

T2108 Status: 14.3%

T2107 Status: 19.8%

VIX Status: 27.8

General (Short-term) Trading Call: Bullish

Active T2108 periods: Day #11 below 20% (oversold), Day #12 under 30%, Day #35 under 40%, Day #75 under 50%, Day #92 under 60%, Day #290 under 70%

Commentary

One of the many urban legends on Wall Street involves trading after the U.S. Labor Day holiday. Supposedly, traders and major investors take the summer off, commonly defined as the period between Memorial Day in late May and Labor Day in early September. During this period, liquidity is poor and the market gyrates aimlessly and unprofitably. Once the big guys, the “serious money”, return after Labor Day, we get a true feel for the market’s inclinations. I last covered the data on this trade way back in 2007 on my old site, so it is due for a SERIOUS update. Here are the most relevant conclusions from that time:

- The performance of the S&P 500 for the year up to Labor Day is very highly correlated with the year-over-year performance of the index. In other words, if the S&P 500 is positive for the year up to Labor Day, then we are almost guaranteed to have an up year overall. This correlation is far more important than the daily trade the day following Labor Day.

- The relationship of the one-day post-Labor Day gains to other time periods of the year has been remarkably consistent throughout 44-year sample.

- The market tends to perform better over time than the single day trade on the day following Labor Day. Of course, the longer the time frame, the more likely performance will exceed that of any given day.

In other words, I did discover enough evidence to indicate that Labor Day is some kind of important marker. If point #1 holds, 2015 will end as a rare post-crisis down year. The current breakdown in the S&P 500 (via the SPDR S&P 500 (NYSE:SPY)) seems severe enough to at least prevent the index from notching a new all-time high this year.

A close-up of the S&P 500’s severe breakdown

The S&P 500 ended trading Friday with a loss of 1.5% in the wake of the U.S. jobs report for August. I do not think it definitively resolved the debate over the timing of the Fed’s lift-off for rates. Regardless, for anyone who actually took a break from the financial markets over the summer (in this day and age of full and ubiquitous connectivity, I am highly doubtful any serious manager of money takes summers completely off), s/he either will return to the desk on Tuesday morning in a panic ready to sell or will jump up in excitement at all the “bargains” that abound. This stylized characterization of market participants could define the battle lines of the week as the countdown to what I will now call “Fedaggedon” (Fed + Armageddon – a play on the now often used Armageddon/apocalypse meme attached to the dramas of the modern age) officially counts down through its most anxious moments.

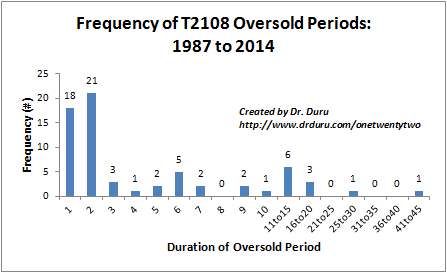

The jobs news sure did not do anything for the current oversold period. T2108 declined back to 14.3% and extended the oversold period to 11 days. If the oversold period does not end this week, T2108 will enter VERY rarefied territory. Given the extended angst over the Fed’s decision next week—Fedaggedon—I am now fully braced for the prospect of the oversold period lasting until the Fed issues its judgement.

The majority of oversold periods last one or two days

Volatility ended the week right on the edge of the “danger zone.” If the oversold period languishes on, I fully expect volatility to get fresh life. I will continue to favor fading volatility during this oversold period, ESPECIALLY ahead of the Fed meeting.

The volatility index, the VIX, has cooled off significantly from the flash crash, but has not yet decisively dropped from the “danger zone.” I define this zone as starting from the low of the last day where volatility experienced a significant surge.

Here are my trading highlights from Friday, another “slow” day given T2108 trading rules did not trigger: sold last round of Caterpillar (NYSE:CAT) puts at a modest profit and watched an earlier batch expire worthless – I will continue to look for opportunities to fade CAT as a small hedge against longs; a limit order to buy a small number ProShares Ultra S&P500 (NYSE:SSO) call options triggered; bought shares in Direxion Daily Energy Bear 3X ETF (NYSE:ERY) as a 2-for-1 hedge on market longs AND a bet that oil will weaken going into the Fed meeting (I am saving bets against oil for later in case oil surprises me and trades higher this week); and doubled down on a current short-term bet against volatility with put options on ProShares Ultra VIX Short-Term Futures (NYSE:UVXY).

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: long SVXY shares, long SSO shares and call options, long ERY, long UVXY put options

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.