The Commodities Market Has A Sweet Tooth

Wall Street Daily | May 26, 2016 09:54AM ET

Despite appearances that the entire commodities sector is continuing on a major downslide, one resource remains steadfast – sugar.

Sugar has been one of the best-performing commodities so far this year – largely driven by a global supply shortage, after wallowing in a five-year surplus.

Supply woes are pushing futures prices higher, while demand continues to increase on a global basis. In fact, the International Sugar Organization – along with most analysts – forecast global deficits through 2017.

According to the latest bi-annual report , issued May 19, 2016 by the United States Department of Agriculture (USDA), the world production for 2016-17 will be approximately 169 million metric tons (mmt), a figure revised down by 7.2 mmt.

Global sugar consumption is forecast at a record 174 mmt (raw value), exceeding production, and drawing stocks down to the lowest level since 2010-11.

While the rising pace of global consumption has been sustained by drawing down stock levels in recent years, inventories are now approaching historic lows.

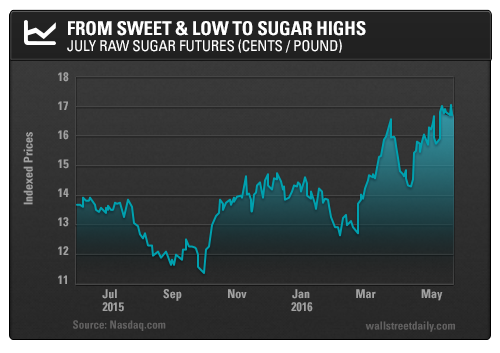

World raw sugar prices, after falling for over a year and then bottoming at less than $0.11 per pound in August 2015, are finally trending higher.

From Sweet and Low to Sugar Highs

Sugar’s price history, these past few years, has been an intriguing drama with an ever-thickening plot.

Since 2011, No. 1 sugar producer, Brazil – along with Australia, Thailand, Mexico, and India – has created an international sugar glut that resulted in a steep drop in world sugar prices from $0.32 per pound to $0.11 per pound.

But the surplus has finally come to an end.

Adding to the effects of the worldwide production shortfall are dry growing conditions in major producer nations, as El Nino weather patterns cause parched fields from Thailand to India – the world’s No. 2 producer of sugar.

Brazil Drives Volatility

Political upheaval in Brazil, the world’s largest sugar-producing country and the largest exporter, has been the key driver of price volatility this year.

Brazilian farmers have become reluctant to sell sugar on the international markets because the Brazilian real has been especially volatile. Farmers have been quick to hold off on sales when it appreciated, and were just as eager to liquidate their supplies when it depreciated.

Fifty-seven percent of Brazil’s sugar cane crop is now converted to ethanol, further contributing to the sugar deficit.

As a result of all this, Coca-Cola Co. (NYSE:KO) reported that it is halting production of its namesake soft drink for the foreseeable future due to sugar shortages.

The US Company, which manufactures out of economically-troubled Venezuela, claims it has run out of the raw material in the country, amidst an economy teetering on the edge of collapse with widespread food shortages and inflation forecast to surpass 700%.

India’s Drought

Insufficient rainfall in India has also affected this sugar shortage, forcing over 100 sugar mills to halt production in February, according to the Indian Sugar Mills Association.

Sugar consumption in India, however, is expected to rise to a record 27.2 mmt while the country’s production is forecast to drop to 25.5 mmt due to smaller areas being cultivated, as well as lower yields.

Drought conditions have encouraged farmers to keep existing cane in production longer rather than planting new cane. Stocks are thus expected to fall 18%.

Furthermore, according to government sources, the country may revoke compulsory sugar export orders after two consecutive droughts have potentially turned the country into a net importer – rather than exporter – next season.

Farmers will no longer receive payment after an order is revoked; thus, without subsidies, Indian mills will struggle to export profitably.

Additionally, production in the European Union is expected to decrease by 650,000 metric tons, to 16.1 mmt — nearly 10% of global production.

China Loves Sugar

China’s production is also down 400,000 metric tons to 10.6 mmt — which is about 6% of global production. But China’s consumption is more important here.

Sugar consumption in China, projected at a record 17.8 mmt, continues to trend higher, bringing stocks down to 3.2 mmt, while production is forecast to decline to 8.2 mmt.

Over recent years, higher land and labor costs, and the cancellation of minimum purchase prices in the Yunnan, Guangdong, and Hainan provinces have resulted in growers opting to grow other, more profitable, crops such as tobacco and bananas. Imports are forecast at a record 7.9 mmt.

A report, China Sugar Blues from April 20, revealed that the sugar industry in China – already having suffered for four consecutive years – continues to struggle with high production costs, the elimination of government support prices, and import competition.

As of early March 2016, approximately 90% of China’s sugar manufacturers were operating at a loss according to industry reports, and a number of mills were already closed.

The United States Shifts Gears

Of course, China is not the only nation that loves its sugar.

The U.S. consumes 10 million short tons (mst) of sugar each year, 20% of which comes from imports. What is important to note, however, is that absolutely none of the sugar grown on U.S. soil is exported.

Production in the U.S. is forecast to be down 200,000 short tons from last year to 7.9 mst, which is based on projected lower cane yields. Meanwhile, imports are expected to rebound 8% to 3.2 mst, and stocks are projected to dip 5% to 1.5 mst.

Until recently, the global price of sugar was not of much concern to U.S. farmers. Even while the international price remains barely half of what it costs to produce the commodity, farmers still have an incentive to grow sugar beets because the USDA actually regulates the amount of sugar produced nationally to protect the industry from outside influences.

By adhering to the World Trade Organization (WTO) rules, the USDA ensures a stable domestic sugar industry, while continuing to bolster relationships with its trade partners.

Both the WTO and the USDA classify sugar as an “essential” food, meaning it’s too important a crop to rely heavily on imports. Members of these organizations control their supply by producing only what they consume.

And while cane was once the dominant sugar in U.S. markets, beet sugar has taken the lead in the past few years.

This is because beets can be grown in colder climates and is, therefore, a more versatile sugar source. Furthermore, cane has to be processed twice, making it more expensive to produce than beet sugar. So, cane producers, like those in Brazil, are moving into the ethanol market.

Anti-GMO Influences

One of the biggest health trends in the U.S. is currently non-GMO.

Food production companies are jumping on the bandwagon in an effort to stay ahead of the curve, causing a major shift in the sugar industry.

In 2008, many farmers switched their crops from regular sugar beets to genetically modified beets, which were engineered to tolerate a weed killer called glyphosate.

GMO beets require the application of weed killer only a few times each season, rather than every 10 days like non-GMO beets, according to an NPR report. Practically all of the U.S. production of sugar beets comes from genetically modified seed.

As a result, there has been a major backlash from the anti-GMO crowd. Slowly but surely the larger players in the food industry, such as Hershey (NYSE:HSY), are buying into the movement. Hershey is shifting its entire candy portfolio out of GMO, thus using a lot more sugar from sugarcane rather than beet sugar.

This poses an additional problem: with so many farms focused on cost-effective beet sugar, the beets of which are GMO-based, there is a sudden shortage of sugarcane.

On May 5, 2016, just days ago, 45 U.S. Representatives signed a letter asking Department of Agriculture Secretary Tom Vilsack to increase the tariff quota for raw sugar, in order to address insufficient domestic supply. The tight supply has sent futures prices even higher.

Sugar Prices – Oh… How Sweet It Is!

Speculators are now taking a more active role in going long sugar, according to recent CFTC reports. And for now sugar looks like it will hold its upward trend. Technically, the charts point to a price of $0.20 per pound.

If you have taken a position in sugar, make sure to keep an eye on the forward curve, and hedge or stop-out your position, because, after all, a sugar high can always turn into a sugar crash.

Good investing,

by Shelley Goldberg

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.