The CFTC And Outlawing Algorithmic Trading

MrTopStep | May 09, 2014 02:19AM ET

May 6 was the the four year anniversary of the Flash Crash. It was a bitter anniversary for our S&P desk, which has been on the floor since 1985. We took a big hit that day and still wonder why it happened. After working on the floor for 33 years the Flash Crash was not only a wake-up call for us but also the industry and the world as a whole. It can and will happen again if something isn’t changed.

While my background is in S&P 500 index arbitrage, it’s not the same as algorithmic trading where the program jumps in front of customer orders and runs buy and sell stops all day long. It is essentially computerized front-running.

Index arb takes advantage of the spread difference between the price of the S&P futures (CME:SPM14) vs. the S&P cash. Yes, it does move the index up and down, but when you add algorithmic trading on top of it, it’s like throwing gas on a fire. There is an instant response.

CFTC raising the bar

A few years ago there really was not much said about the practice of algorithmic trading, but the Flash Crash brought a new awareness to the practice. A Google search of “cftc and algorithmic trading” shows that new awareness. Maybe investors and traders got sick of having their trading accounts attacked by algorithmic trading.

There are a lot of companies getting fined and forced out of the business but this week was big: The CFTC has finally said it is going to start “investigating.” The current enforcement comes from the SEC but they have been “very ineffective.”

The official report from the SEC (PDF) stated (in their words) that there were many causes of the Flash Crash. The first was worries about the stability of Europe, re Greece; the second part was the big institutional sell order in the CME’s S&P 500 e-mini futures contract and thirdly, delay in data dissemination and of consolidated trade and quote information. What they failed to say was that the CME did not have adequate “circuit breakers” in place.

There are few people in the world, if any, who have the background and knowledge of program trading like Brain Shepard and me. There are few people if any in the world who set up one of the single largest S&P floor desks like we did and there are even fewer that handled the business we saw going over our phones.

From the Abu Dhabi Investment Authority (ADIA) to the Union Bank of Switzerland, from Kidder Peabody to Drexel Burnham Lambert to all the big $10 to $20 billion hedge funds all the way down to the little guy, we fought our hearts out only to be hit by a $5.3 million loss. Sure, over the years we’ve had some errors at the desk, some good and bad periods; but net-net it was a career filled with doing the right thing and fighting for the customers.

Every system needs circuit breakers

The SEC and the CFTC can give all the reasons they like for what happened on May 6, 2010, but I can tell you—from the view we had at the “Top Step” of the S&P pit—all of it could have been avoided had the proper circuit breakers been in place. When that big sell order showed up (47,000 contracts of E-mini S&P 500 futures, ES) and other sellers caught on, the supposed “bids and offers” and all the liquidity the algorithms say they provide were nowhere in sight. They say there are new safeguards, but that’s not going to stop it from happening again.

Overnight, the Asian markets closed modestly higher, and in Europe 8 out of 12 markets are trading higher. Today’s economic schedule starts with chain store sales, Philadelphia Federal Reserve Bank President Charles Plosser speech on monetary policy in New York, jobless claims, Federal Reserve Gov. Daniel Tarullo speech at the Chicago Fed’s banking conference, Federal Reserve Chair Janet Yellen to appear before the Senate Budget Committee in Washington, EIA natural gas report, 30-year note auction, St Louis Federal Reserve Bank President James Bullard remarks to household finance conference in St. Louis, Fed balance sheet, money supply and earnings from Apache (ASX:APA), Dish Network (NASDAQ:DISH), News Corporation (NASDAQ:NWSA), Magna International (NYSE:MGA) and Consolidated Edison (NYSE:ED).

Today’s hashtags: #Putin #Algosrunamok

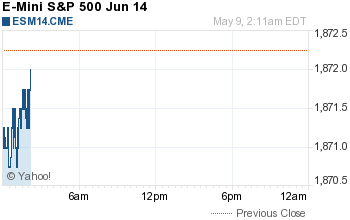

Our view: There is a barrage of Fed speak today. After a big run on the upside the S&P has pulled back for a few days, but with the exception of Tuesday’s 11.5-handle drop, the other down days didn’t provide much downside (May 1 -.20, May 2 -3.3, May 5 +1.4, May 6 -11.5, May 7 +9.9) and after Tuesday’s selloff the ESM14 snapped right back yesterday.

Over the last week or so we have seen a huge uptick in algorithmic and program trading, running the upper end of the range’s buy stops and then reversing and taking out the lower end of the range’s sell stops. On some days the ESM14 did it two or three times in a day.

It’s one thing to see that happen once in a day, but when you see that two or three times you know the algos are loading up. Our view is it looks like the S&P is starting to firm up. We lean to buying the dips. You can take it from there.

As always, please keep an eye on the 10-handle rule and please use stops when trading futures and options.

- In Asia, 9 of 11 markets closed higher: Shanghai Comp. +0.26%, Hang Seng +0.42%, Nikkei +0.93%.

- In Europe, 8 of 12 markets are trading higher: DAX +0.44%, FTSE +0.39%

- Morning headline: “Global Markets Higher After Putin Says Troops To Pull Back”

- Fair Value: S&P -4.55 , Nasdaq -4.95 , Dow -52.12

- Total volume: 2 mil ESM and 4.3kK SPM traded

- Economic calendar: Chain store sales, Charles Plosser speaks, jobless claims, Daniel Tarullo speaks, Janet Yellen speaks, EIA natural gas report, 30-yr note auction, James Bullard speaks, Fed balance sheet, money supply and earnings from Apache (NYSE: APA), Dish Network (NASDAQ: DISH), News Corporation (NASDAQ: NWSA), Magna International (NYSE: MGA), and Consolidated Edison (NYSE: ED).

- E-mini S&P 5001871.50-0.75 - -0.04%

- Crude102.15+0.02 - +0.02%

- Shanghai Composite0.00N/A - N/A

- Hang Seng21837.57+0.451 - +0.00%

- Nikkei 22514190.73+26.95 - +0.19%

- DAX9607.40+86.101 - +0.90%

- FTSE 1006839.25+42.81 - +0.63%

- Euro1.3838

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.