The Bulls Are Trying To Make A Stand

Chris Ciovacco | Aug 19, 2019 04:38PM ET

Door To A Bullish Bottoming Process Remains Open

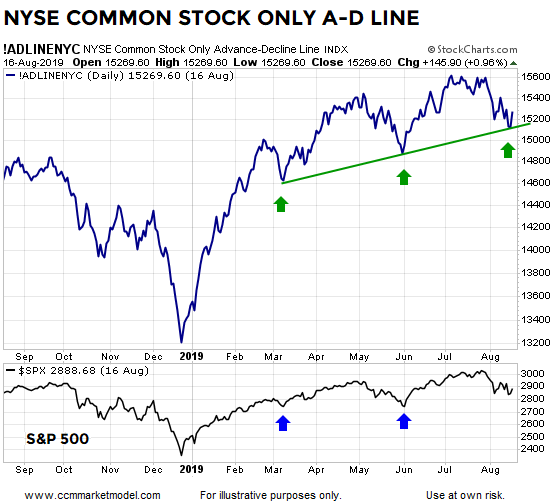

During the trading session on Monday, August 19, the “bottoming process” case for the stock market remained intact. The NYSE Common Stock A-D Line held the line last week at a logical level associated with the S&P 500 reversals in March and June (chart below).

A similar, thus-far-holding-the-line argument can be made using the weekly NASDAQ A-D Volume Ratio. Nothing says breadth will continue to hold these levels, but so far they tell us remain open to stocks trying to push higher in the coming days/weeks.

More Downside Would Not Be Shocking

For our approach and our timeframe, the important thing is not what the market does in the next two or three sessions, but rather how things play out over the next two to three years. Thus far, the S&P 500 has made stands near the area of possible support shown after the ugly session that took place on Monday, August 5. An updated version of the chart is shown below.

As noted on numerous occasions over the past two weeks, we have to tactically and mentally account for the possibility of more downside even if good things eventually happen in the coming weeks and months. We have kept some powder dry in the event the market decides to move back toward the 2760-ish to 2790-ish range. The S&P 500 was trading at 2925 during the session on Monday, August 19.

The Bulls Still Have To Prove It

Bullish setups have been forming since Monday, August 5. Setups can be followed by positive follow-through or failure. Given concerns about global economic weakness, rare behavior in the bond market and a speech from a Fed Chairman that has been known to spook markets via off-the-cuff remarks, it is extremely important that we remain open to all outcomes, from wildly bullish to wildly bearish. We will continue to take it day by day.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.