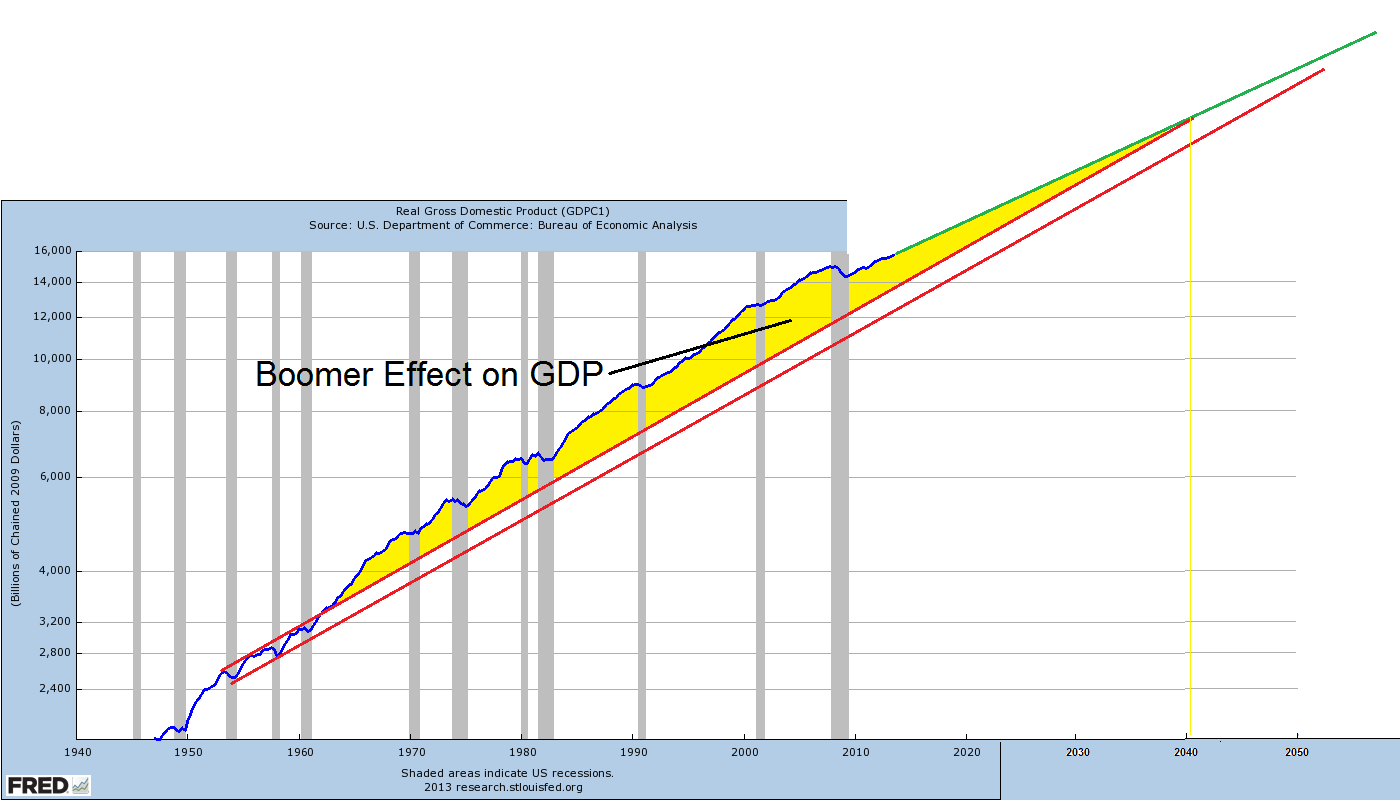

The Boomer Effect On GDP

Econintersect LLC | Dec 01, 2013 04:04AM ET

I have yet to see a model of the economy which can project future dynamics including accurate projections of productivity, employment, inflation, earnings, peak anything, bubbles, social changes, wars, et al.

Economic models use existing trends and extrapolate to forecast. The surprise in the punch bowl is that economic dynamics are not fixed, and dynamics which align to make an economy flourish in one time period can combine with additional “evil” forces sometime in the future to work against the economy. Take the baby boomers for instance.

Economists saw the acceleration of the economic growth of the late 20th century – and projected this growth into the future. The Great Recession of 2007 might be considered the economic reset from a multi-decade period of high economic growth to a “new normal” of relatively bland economic growth. One of the main contributors to this reset was the baby boomers (a population distortion caused by the end of World War II). The economic argument is that young people starting out in life consume more as they start a family and then work their way to a peak in their career path.

As people age, they begin to see retirement – and as people near retirement, they start to squirrel away assets and money to have more spending power available in retirement. When one retires, less funds are available – so spending is less.

It follows then that increased economic growth can triggered by a slug of young entering the workforce (aka boomers beginning in the late 1960s). The 21st century boomers are not spending like they did at the beginning of their working lives – and the economy is reverting to mean that existed in the late 50s and early 60s after the economic distortions of rebuilding the world healed after World War II.

The argument is not as simple as drawing lines on the chart above. I could dazzle with integrations and summations like the economists love to use in their studies. But the truth is that every economic axiom or position requires a set of economic dynamics to maintain defined relationships with each other. There are no definitive tipping points where the wheels could start flying of the economic cart – as the dynamics themselves dissociate or combine with other dynamics to create effects not foreseen in any model.

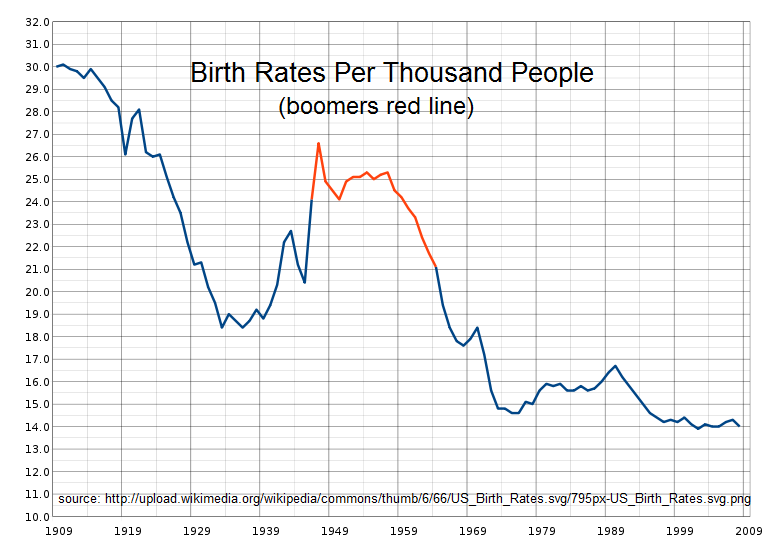

What I find interesting is the declining birth rate leading into the Great Depression of 1929.

It might be argued that the great birthrate cascade from the beginning of the 20th century to the middle of the 1930s was interrupted by the baby boom and what we have seen in recent decades is simply a continuation to a new bottom in the birth rate. This new bottom has not seen “rescue” and “recovery” such as provided by the baby boom.

An aside: Even a dynamic as obvious as the baby boom with its obvious economic implications can be misinterpreted in a major way. An example of this is the published work of Harry Dent who correctly identified the economic trajectory of the boomers impact. But he ended up on the wrong side of history because the baby boom peak influence that he foresaw for the first decade of the 21st century was swamped by other economic factors that he did not include in his forecasts. Rail movements growth trend is continuing to accelerate.

All other data released this week either does not have enough historical correlation to the economy to be considered intuitive, or is simply a coincident indicator to the economy.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.