The Big 5 Makes Money But Not Enough to Bail Out The S&P 500

VIXCONTANGO.com | May 01, 2020 01:52AM ET

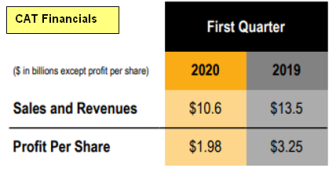

We continue to observe the usual dispersion of results in earnings because of the COVID recession. Analog business suffer, digital business prosper. Industrial name Caterpillar (NYSE:CAT) had big declines in revenues and profits off -20% and -40% respectively as demand for its equipment fell around the world as activity shut down.

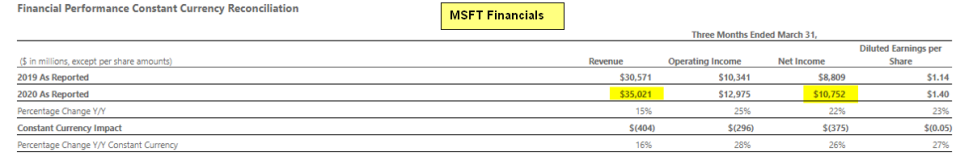

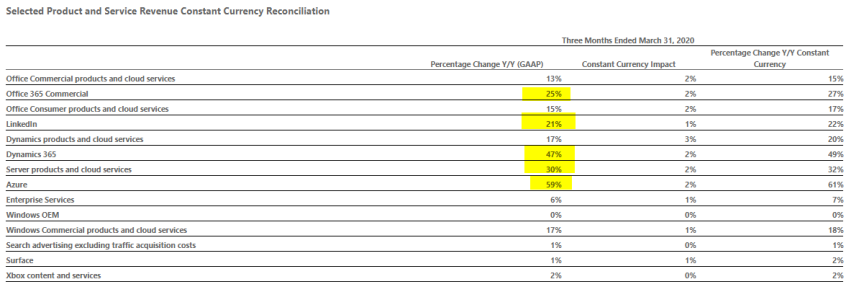

On the other hand, we had Microsoft (NASDAQ:MSFT) putting up the best numbers in its history yet again with revenues up 16% to $35 billion and profits up 22% to $12 billion. Everybody is rushing to the cloud to build websites and generate revenue with their brick and mortar locations closed. There wasn’t a major business that didn’t grow revenues double digits at Microsoft. Azure at 60%, Salesforce (NYSE:CRM) competitor Dynamics 365 at 47%, Servers 30%, Office 365 at 25%, LinkedIn (NYSE:LNKD) at 20%. Just incredible numbers in the middle of this pandemic stoppage.

While I expect Google (NASDAQ:GOOGL), Facebook (NASDAQ:FB), Microsoft and Amazon (NASDAQ:AMZN) to put up good numbers due their position as leaders in the cloud and enablers of online commerce, I think Apple’s earnings will be a disappointment. Apple (NASDAQ:AAPL) just isn’t the same type of company like the other 4 with many retail locations and small cloud footprint.

The stock market seems to be falling too much in love with Big Tech earnings however. Microsoft has $12 billion in net income in the latest quarter, Google 8 billion, Facebook 5 billion, Amazon maybe makes 1 or 2 billion. Let’s pencil in Apple for $10 billion (which is very optimistic). We are talking at best $40 billion of revenue per quarter between these Big 5. Let’s call it $50 billion. At its peak SPX pulled in north of $250 billion per quarter in profits (about $35 GAAP EPS per share).

So FAAMG is responsible at best for about 20% of that with $50 billion. So let’s assume FAAMG makes the big money but the rest of the economy shuts down. S&P 5 will make $200 billion in profit (50B *4) annually vs the normal $1 trillion+. Big 5’s contribution to SPX is roughly equal to about $28 of GAAP EPS or about $7 EPS per quarter. We have the SPX market cap right now at $24 trillion valuation for potentially $28 of rock solid EPS that we know won’t get hurt badly during the COVID recession. This calculation doesn’t assume big losses at other companies that could offset Big 5 earnings, just net zero profits in the remaining companies in the S&P 500. We arrive at an insane price to earnings multiple there. We are talking 120 PE. Crazy!

There is a huge disconnect between the money that is floating around in the stock market and the earnings power of the Big Tech companies. There is too much love for Big Tech and too much money crowded in just a few names. This is something we have never seen before. Unfortunately, the more crowding you see in the index, the more volatile the SPX will be as it moves only on the fundamental developments of a few companies. Single stock risk becomes ever more important for the SPX index. That means its volatility will increase. Effectively, the SPX is turning into the FNGS ETF here which only invests in the Top 10 tech names (FANG+). That means VIX levels will remain very elevated going forward, certainly much higher than the levels we saw in 2019. 30 is not going to be a ceiling for the VIX in 2020. More like a floor.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.