The Bears Try To Gain Control

Pepperstone | Jan 14, 2019 12:01AM ET

Another big week for financial markets, and after last week’s talkfest from a raft of Fed speakers, with Fed Chair Jerome Powell herding his troops to form a universally-held patient stance on rates. In my opinion, these should be the core debates in markets for the week ahead, and I assess four primary considerations:

- Whether traders can push the S&P 500 through 2600, or look to re-apply bearish exposures

- Price action in WTI and Brent crude, and the impact on inflation expectations and risk assets

- USD/CNH (offshore yuan) – further moves in the CNH should impact EUR and AUD

- Wednesday’s Brexit vote – To what extent the vote will fail?

- Moves in US equities and the spill over into regional markets

The S&P 500, along with the Russell 2000, Dow and NASDAQ will focus more intently on micro issues this week, with Q4 earnings playing a more significant role into investors mindsets. While macro considerations still loom large, the reporting season will give us a greater chance to mark-to-market where corporates are in relation to the sharp drawdown in financial markets through November and December. Technical conditions are short-term overbought, and it would not surprise to see the bears use this relief rally to re-establish bearish exposures, with stops through 2600, and while its early days, S&P 500 and Dow futures are finding better sellers in a downbeat Asian session.

That said, with a supportive Fed and the bar for earnings is set low, especially after so many have cleared the decks with profit guidance statements, so, an upside break of 2600 (in the S&P 500) could promote a greater fear of not being involved.

A move into $54.50 to $55.50 in WTI crude would also influence sentiment, predominantly, if inflation expectations move higher as a result and this, in turn, pushes ‘real’ (or inflation-adjusted) bond yields lower. Don’t underestimate the role crude is having on markets more broadly, as lower ‘real’ yields ease financial conditions as the cost of money is effectively falling. The fact US crude futures have found sellers on open, with futures 1.2% lower suggests this could be an early indicator on the near-term direction in wider markets.

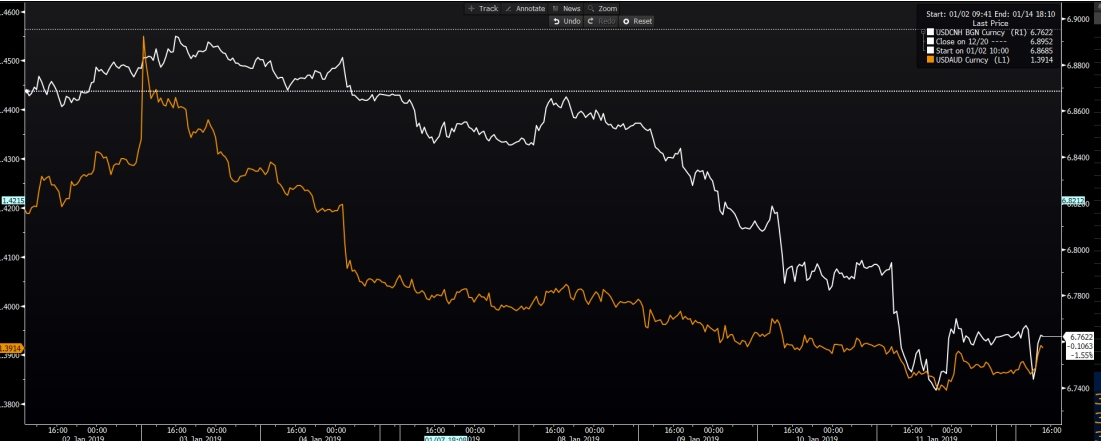

USD/CNH got plenty of attention on Thursday and Friday, with the cross trading to the lowest levels since July. It wasn’t just a case of USD weakness, as the trade-weighted yuan has broken the multi-month trading range, and while this could pose accelerate disinflationary forces in China, it does send a positive message to the US trade team and could be seen as another olive branch.

The correlation between the CNH and AUD, as well as the EUR, has been clear, so further weakness in USD/CNH should support AUD/USD and EUR/USD. That said, AUD/USD is overlooking CNH moves today and taking its variability from Chinese equity markets, which have taken a hit from poor China trade data.

Orange - AUD/USD (Inverted), White - USD/CNH

D Day for Brexit

As a short, sharp shock to the system, Wednesday’s vote on Theresa May’s Brexit 'deal' commands attention. The implied move priced into GBP/USD options pricing by the Wednesday expiry is currently 146-points, while the implied move through Wednesday in EUR/GBP resides at 94 points. So, traders can use this as a guide to assess correct position sizing, and how much risk they should expose each position too.

As traders, our primary job is to manage risk, so running GBP exposures into the vote require strong consideration, and whether one wants to be exposed to an event we can’t control and where the range of outcomes is fairly diverse.

That said, while no one expects Theresa May to gain the 320 ‘yea’ votes needed to get the necessary majority to progress her deal. If the vote fails by say far more than 100 votes, it will likely cause a negative reaction in GBP. The vote, itself, is expected to take place around 6 am AEDT, so again we need to consider liquidity at this time, and the potential for exaggerated moves as this comes at the twilight zone and the hours between the US close and Asia open. One would argue should the vote fail by less than 50 votes then GBP/USD should rally. This may sound bizarre, but with May having three sitting days to forge a Plan B, a small fail opens up the possibility that perhaps a re-worked deal can be salvaged. It’s a big ‘if’, as the EU is not going to offer the legal concessions to take this further.

The political will is certainly there to forge a deal before 29 March, and the betting sites see a mere 14% probability that the UK will not have a deal in place before this deadline. If I look at GBP/USD one-week risk reversals, we see this currently at 0.32x – risk reversals look at the skew of call volatility versus put volatility, so, this effectively tells us the demand for near-term upside structures in GBP/USD outweighs that of bearish optionality. Traders may feel the deal fails, however, on balance, there are more upside risks to the GBP than downside.

GBP/USD 1-Week Risk Reversals - The Skew Of Call Vols Versus Put Vol

Staying in the options market, and if I look at implied volatility and subsequently the implied move through to Wednesday, we can see this sit at 146 points. This suggests the market believes the upside (through to Wednesday) is capped into $1.3000, while even if the deal fails by a large extent, then $1.2700 should limit the downside. Of course, there are other factors at play, such as whether Jeremy Corbyn pulls a vote of no confidence on the Tory government, increasing the prospect of a general election. While the possibility of a second referendum looms large, which again has implications for the GBP, not to mention would be fodder for a UK Yellow Vest movement waiting for its catalyst.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.