The Barbell Approach To ETF Portfolio Allocation Continues To Shine

Pacific Park Financial Inc. | Oct 08, 2014 01:02AM ET

I did not invent the long-term rates would fall, not rise . The contrarian call had been met with ridicule at the time. Allocate a percentage of portfolio assets to long-term investment grade debt? “Ludicrous!” cried fans of ProShares Ultra-Short 20+ Year Treasury (ARCA:TBT). “Rates can only go one direction. Up!”

However, there were thousands of folks who did appreciate my premise. Specifically, foreign governments and institutional money would be clamoring for a dwindling supply of intermediate- and longer-term U.S. bonds. Then, mix in the uncertainty of the Federal Reserve’s exit from quantitative easing (QE) during a period of extraordinary weakness in the global economy. Suddenly, safety seekers would be contributing to the demand side of the equation. Last, but certainly not least, U.S. Treasuries were (and still are) relatively attractive when compared to the yield on the debt of less stable countries.

My prescription in 2014? Exchange-traded trackers like Vanguard Long-Term Bond (ARCA:BLV), Vanguard Extended Duration (NYSE:EDV) and PIMCO 25+ Year Zero Coupon (NYSE:ZROZ). Those who valued my analysis expressed gratitude in comments, e-mails and hypertext links back to my articles. In contrast, when bonds pulled back sharply two weeks ago, a belligerent stalker of financial authors sarcastically admonished my choice of extended duration treasury bonds.

It is important to note that the long-term bond holdings were not my solitary conviction. More accurately, they have always been a component of a barbell approach.

For example, a number of my clients have 60% in lower beta risk stock assets such as Vanguard High Dividend Yield (NYSE:VYM), iShares USA Minimum Volatility (NYSE:USMV), iShares S&P 100 (iShares S&P 100 (NYSE:OEF), First Trust Technology Dividend (NASDAQ:TDIV) and/or SPDR Select Sector Health Care (ARCA:XLV). I even incorporated emerging market Asia via iShares MSCI All Country Asia Ex Japan (NASDAQ:AAXJ) into many portfolios. The 40% allocated to intermediate- and longer-term bond funds include those ETFs mentioned in the above-mentioned paragraph, as well as funds like SPDR Nuveen Muni (NYSE:TFI), iShares Intermediate Term Credit (NYSE:CIU) and Market Vectors Long Muni (NYSE:MLN).

What’s noticeably missing from the barbell is a significant allocation to the “middle-of-the-risk-spectrum” assets along the handle. This includes assets like higher yielding bonds, preferreds and REITs. (Note: Another antagonistic commenter who hides under the cloak of his anonymity believes that I missed the REIT boat, failing to understand the risk-reducing goals for a barbell-oriented portfolio.)

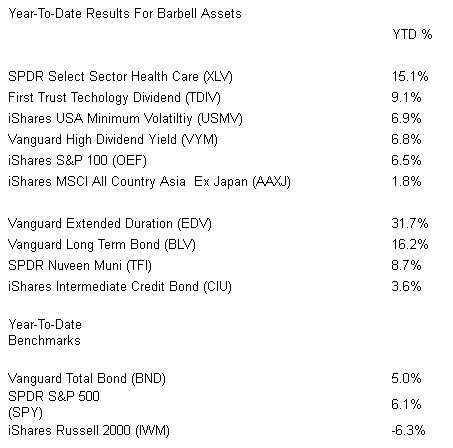

My clients have a variety of different risk profiles – income, conservative growth and income, moderate growth, moderately aggressive growth, etc. It follows that not every family has the same assets, let alone a mix of 60/40 growth-to-income. Nevertheless, it is instructive to view how the assets that I have been using throughout 2014 have performed year-to-date:

Clearly, the S&P 500 SPDR Trust (ARCA:SPY) performed remarkably well in 2014. For improved risk-adjusted rewards, it could easily have been paired with Vanguard Total Bond (NYSE:BND). That said, is it advisable to eschew diversifying with small-caps, foreign stocks, high yield bonds and other asset classes? Year-to-date, yes… avoiding small-cap U.S. stocks and foreign developed stocks has been sensible. Yet the best combination of assets at this moment continues to be barbell assets – longer-term bond ETFs, large-cap stock ETFs and low beta stock ETFs.

The barbell approach is not perfect nor is it intended for everyone. It is not a buy-n-hold recipe for success either. Instead, as bull markets mature, I tend to sell small-caps, riskier stock sectors and a variety of struggling assets in the middle of the risk spectrum. This is not to suggest that they cannot perform. I am suggesting that they are less worthy of the risk. It follows that my stock allocation shifts primarily to the largest-cap corporations, while my bond allocation shifts toward safety over income potential.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.