The AUD/USD Fell Sharply At The Beginning Of The Weekly Trades

Masterforex-V | Nov 04, 2014 12:11AM ET

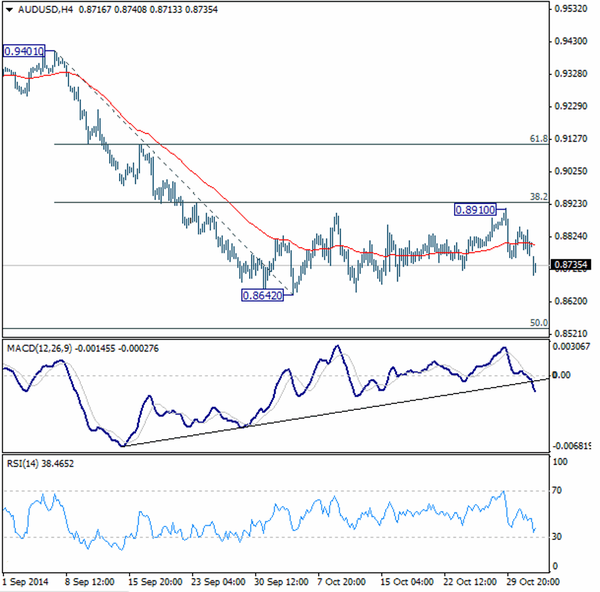

Quotes of the currency pair AUD/USD fell sharply in the first hours after the opening of trading on Monday. Even before the analysts determined that the intraday reversals will occur at points (S1) 0,8757; (P) 0,8805; (R1) 0,8846. However, this forecast has lost relevance.

A sharp drop in the pair AUD/USD exchange rate fluctuations led to above $ 0.8642. Inside the fluorescent offset currently become neutral. "It is possible the formation of consolidation," - noted the analysts of the Forex Broker Company .

In the case of recovery, experts predict that the quotes pair AUD/USD will fluctuate within the range of 0.9401 to 0.8642, where 0.8932 is becoming an important resistance level. Break of 0.8642 support will extend the drop pair AUD/USD to a long-term Fibonacci level 0.8544. The fall of the AUD/USD from 1.1079 is treated as the maximum mid-term correction. Since quotes are below the moving average for the 55 weeks, the bearish outlook remains valid. Confident breakdown support level 0.8659 is likely to continue to allow a drop in prices pair AUD/USD within the range from 0.6008 to 1.1079, where the following minimum is formed at the level of 0.8544, and becomes an important resistance level 0.7945 point .

Trading recommendations

In the case of recovery of quotations AUD/USD, breaking 0.9504 will signal to the formation of the medium-term reversal. While this level of resistance remains intact, bullish forecasts are not relevant, even if we will see a strong rebound from current levels. Asian stock indexes retreated from month highs on concern slowing growth in China, which intensified after the publication of weak data on the manufacturing sector and the service sector. Hang Seng fell 0.34% and NIFTY - fell to 0.187%. Asx dipped 0.36%, while Nzx 50 rose by 0.6%. The Kospi lost 0.6%. Meanwhile, Nikkei 225 gained 4.83%, following growth of USD/JPY. Futures on the S&P 500fell 0.12%, after Friday closed at record highs.

Recall that on Monday, the data on business activity in the US industry will be out. "And at the junction of Monday and Tuesday will be published rate of the Reserve Bank of Australia, which can also significantly affect the volatility in the pair AUD/USD", - reported experts of TraderGlobal (rated among the TOP Forex Brokers Masterforex-V World Academy http://www.masterforex-v.com/).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.