Equities Investor Confidence Pushing Extremes

Lance Roberts | Sep 08, 2020 07:05AM ET

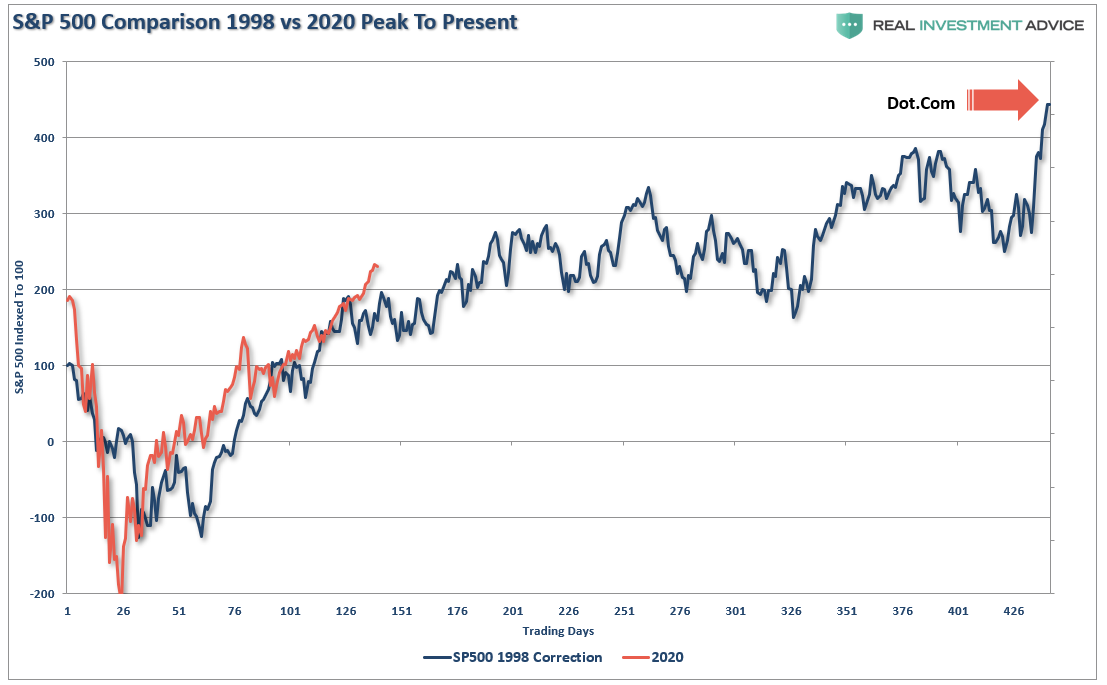

Over the last few months, the markets have become engulfed by a palpable feeling of exuberance. I remember the last time investors were engulfed in a near “panic” to invest. It was 1998, where following a correction, the market began a seemingly endless run to the peak in 2000.

I’m not too fond of market analogs as no two market environments are ever the same. However, there are many comparisons currently to the late 90s to explain the current bull market. The chart is below.

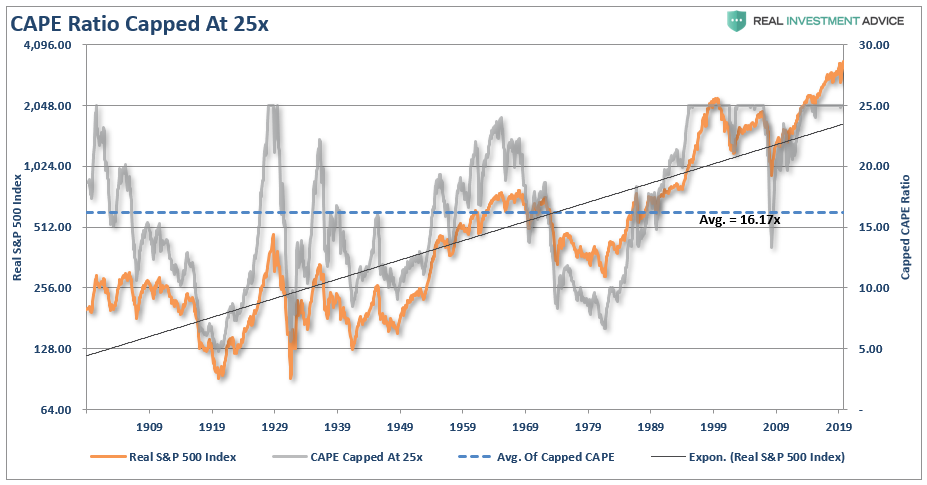

Another comparison is valuations.

Currently, the S&P 500 is trading at 31x trailing CAPE earnings. For comparative purposes, I have capped CAPE at 25x in the chart above, which aligns it with every valuation peak throughout history.

The deviation in valuations above the long-term average also only occurred in the late 90s.

Late 90’s Type Speculation

In the late 90s, there was also rampant speculation in unprofitable companies simply because they were associated with the rise of the internet. Stocks like JDS Uniphase, Lucent Technologies, Global Crossing, Enron, SDLI, and a host of others would rise each trading day by 50 points or more.

Making money was so easy in the market that people quit their jobs to become day traders. Everyone from grocery clerks to barbers became stock market gurus, and making money was so easy, why not lever up?

Or even better, use buy call options to increase the buying power of your money. Today, there are more call options on stocks than we saw then.

Value Is For Boomers

Previously, I discussed the disparity in value and the deviation

Part of those discussions related to similarities seen at previous market peaks where investors threw “caution to the wind” and paid astronomical prices to own the “hot stocks.”

While most young investors today assume “buying value” is for “boomers,” it is worth remembering what Scott McNealy, then CEO of Sun Microsystems, told investors who were paying 10x Price-to-Sales for his company in a 1999 Bloomberg interview.

“At 10-times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10-straight years in dividends. That assumes I can get that by my shareholders. It also assumes I have zero cost of goods sold, which is very hard for a computer company.

That assumes zero expenses, which is hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that expects you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10-years, I can maintain the current revenue run rate.

Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those underlying assumptions are? You don’t need any transparency. You don’t need any footnotes.

What were you thinking?”

How Many Do You Own?

Currently, there are hundreds of companies trading well beyond 10x price-to-sales. Below is a list of some of the “hot stocks” young investors are piling into trading at 10x or more.

Of course, much of this is “forgotten history” as many investors today were either a) not alive in 1999, or b) still too young to invest. For the newer generation of investors, the lack of “experience” provides no basis for the importance of “valuations” to future outcomes. That is something only learned through experience.

Bubbles Are About Psychology

Just as was the case in 1999, investors believe that stocks are essentially a “one-decision” investment. You buy them, and they only go up in price. In 1999, a large majority of these companies were financially unstable or grossly overvalued at best. Today, as shown above, it isn’t much different.

Notably, In 1999, as it is today, there was “no one,” saying there was a “Tech Bubble.” As Mark Hulbert noted earlier this year , it was quite the opposite. It also smacks of current sentiment as well:

“After reading through my newsletter archives from January 2000, I was struck by the similarities between now and then. For example, one newsletter editor in mid-January 2000 said he was encouraged that the Fed was signaling that it wouldn’t be raising rates as aggressively as previously thought. Another said, “inflation is dead.” A third celebrated the strength of the economy, as evidenced by robust consumer spending in the Christmas season that had just ended.

Sound familiar? To be sure, these similarities don’t mean the U.S. market is at or near a top. It does illustrate the false comfort we gain when telling ourselves a bear market can’t happen since the economy is strong, inflation is moribund, and the Fed is accommodative.”

As Mark goes on to note, the extension of valuations is concerning. However, valuations are a poor measure of market “bubbles.” Why? Because “bubbles” are a “psychological phenomenon” where investor “greed” completely overrides “logic” and “restraint.”

More Similarities Than You Think

The current bull market is by far and away one of the longest bull markets in history. Currently running 137 months and 2783 points from the March 2009 lows, it is one for the record books. However, it is also important to remember that it is only the first half of a full-market cycle.

Here are some similarities:

In 1999:

- Fed was providing liquidity in anticipation of Y2k problems.

- Economic growth was beginning to deteriorate.

- Interest rates were falling.

- Earnings were rising through the use of “new metrics,” share buybacks, and an M&A spree. (Who can forget the market greats of Enron, Worldcom & Global Crossing)

- Margin-debt / leverage was at the highest level on record.

- The stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

- The speculative asset of choice: Dot.com stocks

In 2007:

- Fed was discussing that subprime was “contained.”

- Economic growth was beginning to deteriorate.

- Interest rates were falling.

- Debt and leverage provided a massive “buying” binge in real estate, creating a “wealth effect” for consumers, and high-valuations were justified because of the “Goldilocks economy.”

- Margin-debt / leverage was at the highest level on record.

- The stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

- The speculative asset of choice: Real Estate

In 2020:

- Fed continues to “jawbone” markets with accommodative policies.

- Economic growth has deteriorated.

- Interest rates continue to decline.

- Earnings are rising through the use of “new metrics,” share buybacks, and an M&A spree.

- Margin-debt / leverage is pushing back toward the highest level on record.

- The stock market is beginning to go parabolic as exuberance explodes in a “can’t lose market.”

- The speculative asset of choice: Work-At-Home Stocks

Of course, those are just some of the similarities.

As noted above, valuations in all three cases exceeded the long-term market peaks of 23x reported earnings. Furthermore, just as we saw each time previously, investor confidence is pushing extremes.

Seen This Before

Again, none of this suggests the market is going to crash tomorrow.

History suggests the markets can, and will likely continue to rise in the short-term. As I stated, momentum is a tough thing to kill.

However, I have played this game before, and as the old saying goes:

“The more things change, the more they remain the same.”

If you have been around the markets for any length of time, you can quickly spot the “pigeons at the poker table.”

These are the ones that continually rationalize why prices can only go higher, why this time is different than the last, and solely focus on the bullish supports. Trying to “draw to an inside straight” is not impossible; it just leads to losses more often than not.

Gambling in the stock market may be fun in the short-term. However, it would be best if you always remembered why Las Vegas makes billions in profits every year.

If you play long enough, “the house always wins.”

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.