Thanksgiving Turkey Giving Trouble To Global Equities

IG | Nov 25, 2015 02:12AM ET

Asian markets followed Europe’s lead downwards as concerns over Turkey’s downing of a Russian jet seemed to add to ongoing market concerns. While the dispute between Turkey and Russia is unlikely to escalate into a “hot” conflict, it does underline the unresolved tensions over how to put an end to the unrest in Syria and Iraq. This uncertainty around a further escalation of the conflict in the Middle East has hung heavily over Asian markets with all indices in the region seeing red.

Strong US Q3 GDP numbers and Case-Shiller House Prices served to push the WIRP bond market probability of a December Fed rate hike up to 74%. Despite this, the US dollar has been seeing a pullback. During the Asian session almost all Asia-Pacific currencies have gained during the session with the Malaysian ringgit, Korean won and Taiwanese dollar seeing the strongest performances.

The Aussie dollar gained 0.7% overnight. This was boosted by short-covering in the metals complex and Glenn Stevens arguing that he didn’t believe a further rate cut would help the economy much and he was loath to “smash savers over the head”.

China

Nervousness around China’s forthcoming PMI releases was heightened today with the release with the little-known Minxin PMI pointing to a decline in November from October. Were this result to be borne out in the Caixin and NBS PMIs next week, it could have a major repercussions in global equity and commodity markets as concerns that Chinese has not done enough to ease its slowdown continue to mount.

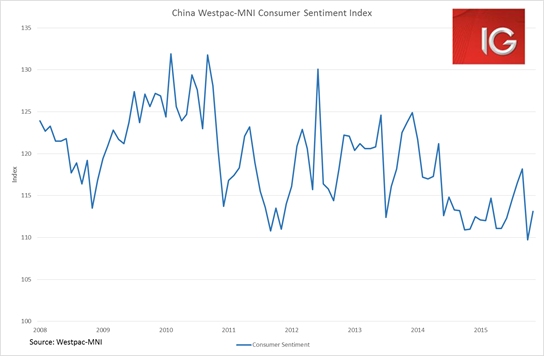

However, the key growth engine of the “New Normal” Chinese economy – consumption – was given a boost today as the Westpac-MNI consumer sentiment indicator bounced back in November. While China’s secondary sector continues to slow, a collapse in consumption or tertiary sector growth would really start to ring warning bells about a potential financial crisis.

Japan

The yen strengthened on safe-haven buying spurred by Middle East tension concerns. The JPY gained 0.4% against the USD. This provided some headwinds to the Nikkei 225, which was down 0.6%, led by the financials sector.

The Bank of Japan (BoJ) minutes further underlined the BoJ’s reluctance to further extend their QQE monetary easing policy. BoJ members were keen to emphasise positives around the economy, while little notice was paid to the fact that Japan entered a technical recession in Q3. Japanese services PPI held steady at 0.5% year-on-year expansion.

Australia

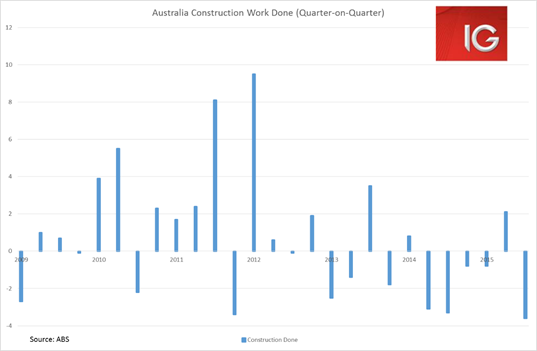

Australia Q3 construction activity came in below expectations for 2% quarter-on-quarter (QoQ) decline, falling 3.6%. This partly looks to have been driven by a drop back in Western Australia activity after the installation of Chevron's (N:CVX) 37,000 tonne gas-processing platform. Despite the poor number, the different accounting methodologies between the construction activity quarterly index and Australia’s GDP means this number is unlikely to materially alter expectations for Australian Q3 GDP due out next week.

While Australian internet-based skilled vacancies continued their four-month run of positive month-on-month expansion, rising 0.6% in October. Another data point supporting the steadily strengthening employment situation in Australia.

The ASX has followed regional markets down as concerns over the Middle East saw a pullback in global equities. The increased risk premium has been seeing a rise in global oil prices, but also expectations that OPEC may agree to come to an agreement on excess supply at their meeting on 4 December are rising.

This has supported energy stocks globally, but particularly on the ASX with the sector as a whole rising 0.7%. The buying in the sector did seem to be focussed on the more established players with Origin Energy Ltd (AX:ORG), Woodside Petroleum Ltd (AX:WPL) and Santos Ltd (AX:STO) all moving up on the day.

The short-covering seen in the London Metals Exchange overnight saw copper gain 3.3% and nickel rise 6.9%. This helped boost the materials sector in the FTSE 100 and the S&P 500 overnight. The materials sector has flipped between positive and negative territory throughout the session. But the buying seen in BHP Billiton Ltd (AX:BHP) and Rio Tinto Ltd (AX:RIO) looks to have pushed the sector back into the green through their sheer market cap weight.

Despite CBA’s ADR pointing to positive territory, the banks have seen pretty heavy selling today. The sector as whole was down 0.35%.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.