Teva: Investors Split On Outlook

The Non-Consensus | Jul 03, 2018 12:43AM ET

Fremanezumab Chronic Cluster Trial Failure Seen as Non-Issue, but Cluster Pathway Still Unclear

On June 15, Teva Pharma Industries Ltd ADR (NYSE:TEVA) announced that they would be discontinuing its fremanezumab clinical trial for chronic cluster headaches (CCH). Investors have largely noted that the discontinuation of the clinical trial for CCH does not materially impact their thesis or estimates. However, Teva still faces a number of obstacles before fremanezumab can be filed.

To provide some background, we should first talk about the size and scope of cluster and migraine headaches. The addressable market in the US for migraine headaches is about 10 million people (that qualify for migraine preventives), and it is among the top 10 causes of global disability. Cluster headache prevalence in the US is about 350,000 people. Within that 350,000 people experiencing cluster headaches, there are two kinds of cluster headaches: episodic and chronic. Episodic cluster headaches can last from 7 days to a year, and include 1+ months of pain-free remission periods. These make up about 80-90% of cluster headaches. The remaining 10-20% is chronic cluster headaches, which can last longer than a year, and either have no remission or a brief remission of less than a month.

Getting positive clinical trial data for both chronic and episodic cluster headaches would have been great for a couple reasons. First, there are currently no approved therapy options for cluster headaches. Second, it's an extremely debilitating illness for many people.

However, chronic cluster headaches impact the smallest number of people within the three types of headaches. Teva still is pursuing the larger indications - episodic cluster headaches and migraine headaches. Additionally, Eli Lilly's galcenezumab had already failed a phase 3 trial for the same CCH indication. Investors already knew that there was more risk around the cluster headache indication, and therefore had not actually baked in any cluster headache sales in their consensus estimates for fremanezumab. Consensus estimates remain largely unchanged.

This does not mean that Teva is in the clear on fremanezumab, though. In particular, the filing path for episodic cluster headaches remains unclear. Teva management noted that they could potentially receive results for the episodic cluster headaches in 1H19. Even if they receive approval, it is unclear if they would need to run an additional phase 3 trial before filing with the FDA. If they do need an additional trial, submission could be pushed out by several more years.

There is also risk around the migraine headache path. Recall that the company has a PDUFA action date on September 16. Some analysts and investors have expressed reservations around the company's ability to get all inspections and resubmissions ready by that date. However, should they be able to do so, and receive approval, the company could essentially be in line with Eli Lilly's galcanezumab to market, and closely behind Amgen (NASDAQ:AMGN)'s Aimovig.

The company recently announced that they will be presenting more fremanezumab clinical trial data at the American Headache Society, which is occurring right now as of this writing (June 28-July 1).

Copaxone Has Proven More Resilient than Expected, but Longer-Term Outlook Remains In Question

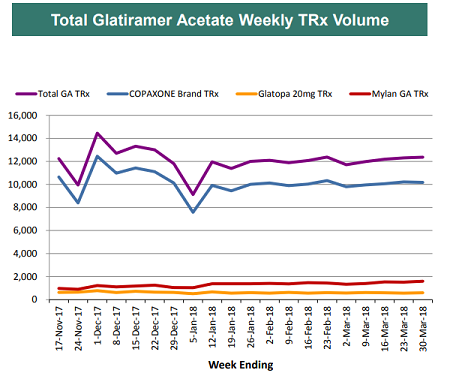

Copaxone and its rate of sales erosion remains a key topic among investors. Copaxone generated roughly 17% of total sales in 2017. Late last year, Mylan (NASDAQ:MYL) received approval for both its 20mg and 40mg Copaxone generic, which caught many investors by surprise. After the approval, investors widely expected significant sales erosion for Teva, especially after Mylan was able to capture roughly 10% of the market out of the gate. Expectations for Teva's Copaxone sales lowered even further after Momenta/Sandoz received approval for its 40mg generic in February this year.

However, since the beginning of the year, share gains by Mylan have slowed, as Teva notes that the generic Copaxone has only captured 15% of the market. Momenta/Sandoz also struggled to launch their generic despite receiving approval over 4 months ago.

As a result, investors have raised Teva's Copaxone sales expectations for the year as the drug has proven more resilient than expected. This has been a major reason for Teva's recent stock outperformance (the stock is now up over 100% since its bottom in November of last year). One reason cited by analysts for the resilience has been aggressive discounting by Teva, which has eliminated the financial incentive for physicians to recommend switching to the generic version. Additionally, physician feedback has suggested that Teva's patient support network was much stronger than generic companies', which was a major deciding factor. Momenta/Sandoz cited supply issues for its launch delay.

Moving forward, the outlook remains highly uncertain. Bulls would likely point to near-term strength in Copaxone sales and its potential to outperform vs. consensus expectations. Bears would point to upcoming generics - Momenta/Sandoz will likely address its supply issues, Amneal has guided to a generic Copaxone 20mg later this year and a 40mg potentially next year, and Dr. Reddy could have a generic Copaxone in 2020. In such an environment, bears believe it is inevitable that generic market share will rise more significantly.

ProAir Competition Delayed; Estimates Move Up

Similar to Copaxone, competition for Teva's ProAir has also been unexpectedly delayed. In early May, Perrigo announced a CRL for its generic ProAir. This would represent the third CRL for Perrigo's ProAir generic - the company received a CRL in 2016, and one in 2017. Perrigo management previously expected its ProAir generic to launch in 4Q18; investors are now expecting this to be a 2019 event. Lupin also has an upcoming action date this year, but given the issues in getting generic approval, investors do not expect an approval this year.

As a result of the delays, Teva's ProAir sales estimates, which previously factored in generic competition this year, are now being revised slightly upward. Should Perrigo or Lupin face any further headwinds, estimates could potentially move higher. In contrast, if they receive positive news or approval, Perrigo estimates may be revised downwards further. Consensus bakes in a more significant erosion in 2019.

Conclusion: Near-Term Outlook Brighter, but 2019 Concerns Remain

Teva stock is controversial on the street. Bulls focus on the resilience of Copaxone sales, the new CEO, positive Austedo traction, indications that fremanezumab is still on track, signs of a recovery in the generic pricing environment, and the near-term belief that consensus estimates will move higher.

Bears see the potential for continued weakness in the generic pricing environment, upcoming competition in Copaxone and ProAir that could lead to lower consensus estimates, uncertain details around the future of fremanezumab, and expensive valuation that leaves little room for error.

Copaxone's performance vs. consensus and the upcoming PDUFA date for fremanezumab on September 16 will be key factors for the stock.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.