Gold Miner Technicals Remain Weak Though Gold, Silver Rise

Jordan Roy-Byrne, CMT | Mar 26, 2017 12:46AM ET

Last week we wrote that precious metals should see upside follow-through but to be wary of the 200-day moving averages and February highs before becoming excited. The metals did follow through as Gold gained 1.5% and Silver gained 1.9% (for the week) but the miners disappointed. VanEck Vectors Gold Miners (NYSE:GDX) gained only 1.1% while VanEck Vectors Junior Gold Miners (NYSE:GDXJ) finished in the red as did junior silver companies (PureFunds ISE Junior Silver (NYSE:SILJ)). As spring beckons, the gold stocks are showing relative and internal weakness.

Two signs of weakness in the miners are visible in the weekly candle charts below. First, while Gold has already rallied back to its high the first week of February, GDX and GDXJ are down 11% and 15% respectively. The miners and the metals will not always be perfectly aligned but that is a rather stark divergence. Secondly, although Gold closed at the highs of the week in each of the past two weeks the miners failed to hold their gains. This is not exactly the type of price action that inspires more gains in the short term.

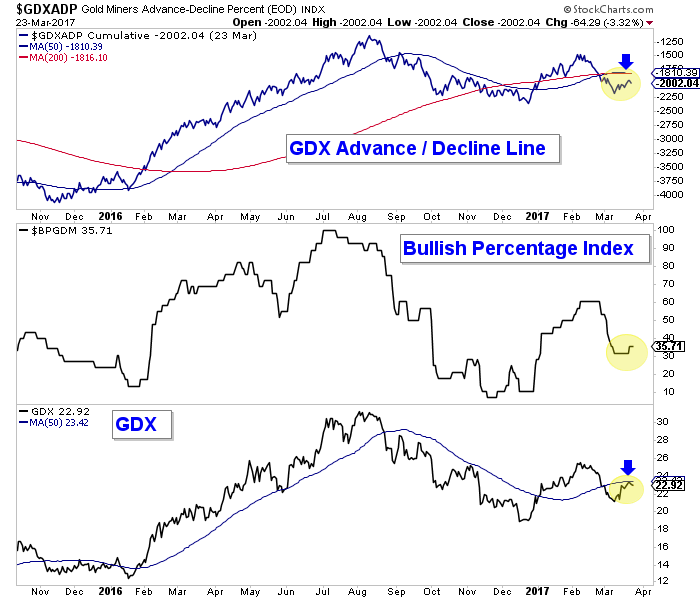

Gold stocks are also showing some internal weakness. In the chart below we plot the advance/decline (A/D) line for GDX and its bullish percentage index (BPI). Both are breadth indicators. The A/D line is the holy grail of leading indicators while I have found the BPI to be more of a confirmation or overbought/oversold indicator.

At present, the A/D line is below both its 50 and 200-day moving averages which are flattening and soon to slope lower. That is ominous if the A/D line can’t regain those moving averages. Meanwhile, the BPI is only at 36%. This means it has room to move up but it also shows weakness as it has barely changed despite gains in recent weeks.

Part of the cause of weakness in the gold stocks (and relative strength in Gold) is the weakness in the stock market which is actually a welcome and positive development for precious metals. As we discussed in a recent video , precious metals are currently set up to benefit from weakness in the stock market as they were in the 1970s and early 2000s. Patience is needed though as stock market weakness is not necessarily an instant or immediate catalyst for the gold stocks.

The current weak technical action in the gold stocks is further evidence that precious metals are unlikely to see a blast-off anytime soon. Gold could continue to rally on the back of stock market weakness but don’t expect that to pull miners much higher.

I reiterate that at present it’s not wise to chase strength in the miners. Instead, traders and investors should be patient and wait for (presumably) lower prices and a better entry point. We continue to look for high quality juniors that we can buy on weakness and hold into 2018.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.