In this past weekend’s missive “Trump Infects Markets Bounce,” we discussed how even though the market had bounced off support, we still consider it a “sellable rally,” for now. The comment generated quite a few emails, mainly since we also discussed that markets are generally positive in election years. To wit:

“Lance, I am confused. On one hand you say that investors should use any near-term rally to rebalance risks. But then discuss how markets tend to be positive the majority of the time during election years. I am not sure what to do.” – KC

It’s a great question that drives to the heart of our risk management process.

Let’s start with our comment from the newsletter:

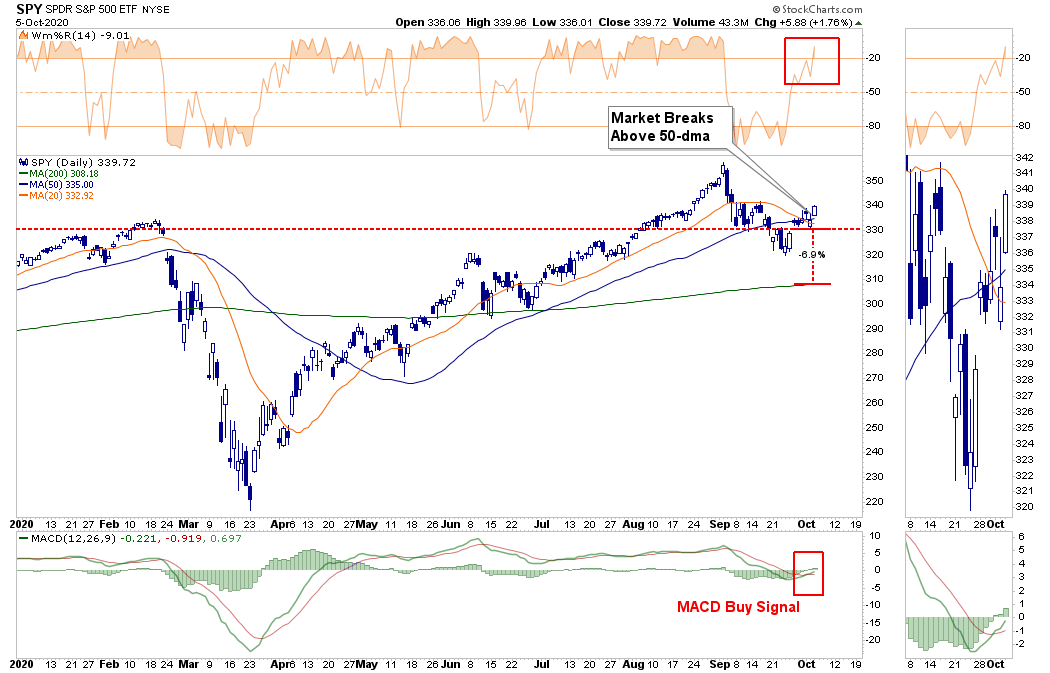

“Notably, while the rally that we have witnessed from the recent lows has eaten up a fair bit of the previous oversold condition, the MACD “buy signal” was triggered on Friday.

Such suggests that we could see some additional buying next week. However, again, with the failure at the 50-dma, such means continuing to use rallies to rebalance risks accordingly.”

Chart updated through Monday’s close.

The good news is that we did indeed see a spurt of “additional buying” on Monday, which allowed the market to clear the 50-dma. Such puts the previous September highs back within the context of the rally that started two weeks ago.

The bad news is that investors chased the market on “hopes” for further stimulus and a “Biden” victory during the upcoming election. There is a reasonable probability that one or both of those outcomes will not occur.

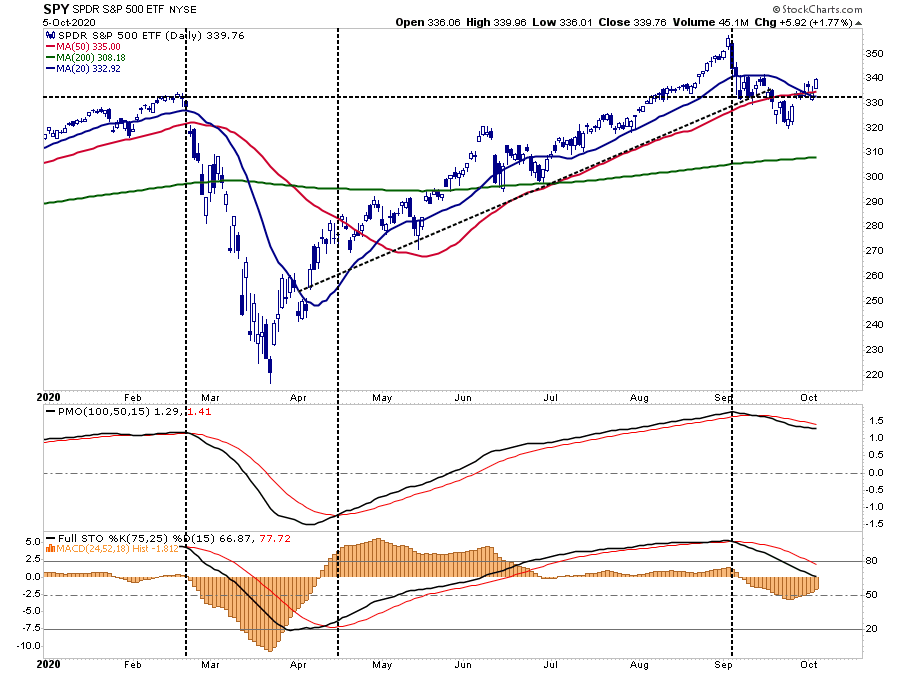

Lastly, as shown below, while the very short-term technicals are bullish, the intermediate-term measures have not reversed yet. Such could limit upside potential from current levels.

Conflicting Information

Get The News You Want

Get The News You Want

Read market moving news with a personalized feed of stocks you care about.

Get The App

If we break down the commentary and charts into critical points, we can gain some clarity.

- The market broke above resistance (bullish)

- MACD has crossed positively, issuing a “buy signal.” (bullish)

- The market broke above the 50-dma. (bullish)

- The overall trend from the September highs is negative (bearish)

- MACD is back to overbought (neutral to bearish)

- Intermediate-term “sell-signals” still firm (bearish)

Notably, the markets have returned to more neutral territory, and as noted previously, the correction has been orderly.

“Over the last couple of weeks, we have been discussing the ongoing market correction. As shown below, the sell-off has been orderly and not one of a ‘panic’ induced decline.“ – The Selloff Is Overdone,

So, Why Do We Think This Is Still A “Sellable Rally?”

In the short-term, we remain “bullish-biased” in portfolios. However, there are several significant concerns we have over the intermediate to long-term.

Psychology

Despite the recent correction, volatility remains hugely suppressed. “Over-confidence” by investors in the market is a “contrarian” indicator we watch closely. As noted above, the recent decline has shown no signs of investors “panic selling,” instead they appear to have become even more complacent.

Notably, while the recent correction did reduce our fear-greed index somewhat, it remains elevated. Again, like volatility, overall investment positioning doesn’t show “fear” of a deeper correction. While the indicator is currently in more “neutral” territory, it suggests gains are likely limited short-term.

The same goes for positioning by professional investors. With positioning back to more neutral territory, any rally in the market is likely limited.

The current psychological conditions suggest the short-term bottom in the market remains intact. However, given that much of the more “bullish” exuberance was not displaced, the upside may get confined to previous highs.

As noted, much of the impetus for the rally was “hope” of more stimulus. However, currently, there is little evidence of another CARES Act occurring before the election, particularly with the Senate in recess. Such could wind up disappointing investors in the short-term, particularly as economic growth continues to wane.

Fundamental

In “Earnings Don’t Support The Bullish Thesis,” I noted that while estimates were lowered by Standard & Poors (latest update was September 30), the earnings revisions continue to fall despite media commentary about a strongly recovering economy.

Let me point out some critical points:

- In January and February, investors were bidding up stocks to all-time highs based on REPORTED earnings of $171/share by the end of 2021.

- Today investors are paying roughly the same price for 2021 earnings that are near $30/share lower.

- While earnings revisions did tick HIGHER at the beginning of August, estimates through the end of 2020 hit a new low just 2-weeks later.

A Simple Message

- In January of 2020, investors bought stocks because valuations were cheap based on 2021 estimates.

- In September of 2020, investors are buying on the same media spin, but are paying more for less.

But this isn’t a new story, but one that existed over the last two years as shown by the S&P 500 total return attribution analysis.

Investors have been consistently “betting” on the promise of “stronger economic growth.” However, such has not been the case as corporate profits have weakened, economic growth has slowed, and valuations have only continued to expand.

GAAP Earnings (actual real earnings), as compared to GDP, explains the problem. Not surprisingly, since “stocks are a function of the economy,” there is a decent correlation between economic growth and corporate earnings. Such is because, without economic growth, consumers don’t have paychecks with which to consume, which is where corporate profits come from.

Such is also reason to remain concerned about the persistent gap between “the stock market” and “corporate profits.”

Eventually, the two will reconnect either by:

- Stock prices fall sharply as in 2008,

- The market stagnates while profits catch up, or

- A combination of both as in 2002-2003.

Technical Concerns

From a purely technical perspective, the market remains in a long-term deviation from historical trends. The problem with long-term trend analysis, much like valuations, is that markets can “remain irrational longer than logic would predict.” It is during these periods of “irrationality” where investors begin to believe “this time is different,” or “such and such” doesn’t matter any longer due to Central Bank interventions.

Those beliefs have, without exception, wound up costing investors more than they ever thought possible.

As noted above, on a short-term basis, if the market can clear the 50-dma, a subsequent rally back to all-time highs is certainly not out of the question.

However, when viewing longer-term time frames, the risks become more evident. As shown in the “weekly” chart below, the deviation from long-term means remains at extreme levels. Historically, these deviations correct themselves. Such a “mean-reverting” event can occur over a drawn-out period, as seen in 2015-2016. Or, it occurs rapidly, as seen in both 2018 and 2020.

What is essential to understand is that while the short-term bullish “meme” is hard to resist, these “mean-reverting” events occur regularly. They also tend to happen when the media least expects them too.

If we take a long-term view, the “monthly” chart confirms the same. Relative-strength continues to diverge negatively, participation remains weak, and markets remain well deviated from long-term means.

Navigating The Dichotomy

For many, it is hard to understand how there can be two simultaneous but opposing views. In the short-term, markets are “bullishly” biased, which keeps portfolio allocations weighted toward equity risk. However, longer-term, there is a clear “bearish” backdrop to consider.

That dichotomy is what makes investing difficult for most investors. Since they become so focused on the “short-term” view, as that is where all the “action” is, they dismiss the long-term view entirely. Unfortunately, such repeatedly leads to poor outcomes.

For now, and for all of the reasons stated herein, our portfolio management processes change from “buying dips” to “selling rallies.”

Let me be clear. Such does not mean we are “selling everything and going to cash.”

The Rules

Instead, we will use rallies to:

- Re-evaluate overall portfolio exposures. Are equity exposures aligned with current market dynamics and related risks?

- Raise cash as needed. (Cash is a risk-free portfolio hedge when clear opportunities are not available.)

- Review all positions (Sell losers/trim winners)

- Look for opportunities in other markets and assets. (There is no rule you can only buy stocks. Bonds, commodities, currencies, alternative investments, annuities, etc. can all have places.)

- Add hedges to portfolios.

- Trade opportunistically. (There are always rotations which can be taken advantage of)

- Drastically tighten up stop losses. (Tighter stop-losses reduce unexpected downside exposures.)

As we have discussed previously, momentum-driven markets are a tough thing to kill. However, when they do turn, the momentum works equally well in reverse.

If the bulls are right, then it is a simple process to remove hedges and reallocate back to equity risk accordingly.

However, if there is a risk to the bull market, a more conservative portfolio will protect capital in the short-term. The reduced volatility allows for a logical approach to making adjustments as the correction becomes more apparent. (The goal is not to get forced into a “panic selling” situation.)

It also allows you to buy at deeply discounted values.

For all of these reasons, we continue to use rallies as opportunities to rebalance risk, follow our portfolio management rules, and protect capital as needed.

Written By:

Lance Roberts