Technically Speaking: Slowly At First, Then All At Once

Lance Roberts | Jun 15, 2021 06:29AM ET

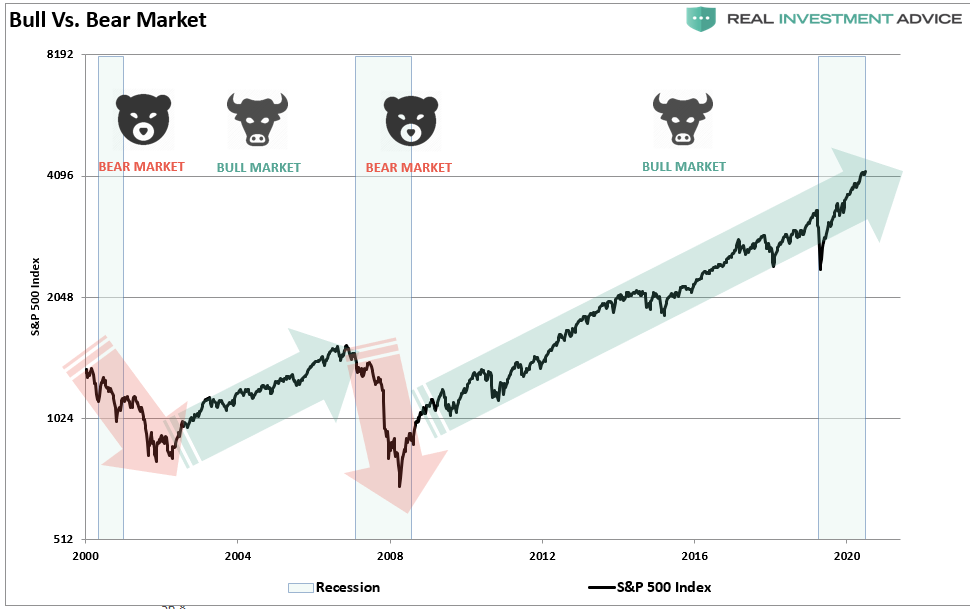

Bull markets always seem to end the same—slowly at first, then all at once.

My recent discussion on why March 2020 was a “correction” and not a “bear market” sparked much debate over the somewhat arbitrary 20% rule.

“Price is nothing more than a reflection of the ‘psychology’ of market participants. A potential mistake in evaluating ‘bull’ or ‘bear’ markets is using a ‘20% advance or decline’ to distinguish between them.”

Wall Street loves to label stuff. When markets are rising, it’s a “bull market.” Conversely, falling prices are a “bear market.”

Interestingly, while there are some for falling prices such as:

- A “correction” gets defined as a decline of more than 10% in the market.

- A “bear market” is a decline of more than 20%.

There are no such definitions for rising prices. Instead, rising prices are always “bullish.”

It’s all a bit arbitrary and rather pointless.

The Reason We Invest

It is essential to understand what a “bull” or “bear” market is as investors.

- A “bull market” is when prices are generally rising over an extended period.

- A “bear market” is when prices are generally falling over an extended period.

Here is another significant definition for you.

Investing is the process of placing “savings” at “risk” with the expectation of a future return greater than the rate of inflation over a given time frame.

Read that again.

Investing is NOT about beating some random benchmark index that requires taking on an excessive amount of capital risk to achieve. Instead, our goal should be to grow our hard-earned savings at a rate sufficient to protect the purchasing power of those savings in the future as “safely” as possible.

As pension funds have found out, counting on 7% annualized returns to make up for a shortfall in savings leaves individuals in a vastly underfunded retirement situation. Moreover, making up lost savings is not the same as increasing savings towards a future required goal.

Nonetheless, when it comes to investing, Bob Farrell’s Rule #10 is the most relevant:

“Bull markets are more fun than bear markets.”

Of this, there is no argument.

However, understanding the difference between a “bull” and a “bear” market is critical to capital preservation and appreciation when the change occurs.

Defining Bull And Bear Markets

So, what defines a “bull” versus a “bear” market.

Let’s start by looking at the S&P 500.

Bull And Bear Markets Are Evident With The Benefit Of Hindsight

The problem, for individuals, always comes back to “psychology” concerning our investing practices. During rising or “bullish,” markets, the psychology of “greed” keeps individuals invested longer and entices them into taking on substantially more risk than realized. “Bearish,” or declining, markets do precisely the opposite as “fear” overtakes the investment process.

Most importantly, it is difficult to know “when” the markets have changed from bullish to bearish. Over the last decade, several significant corrections have certainly looked like the beginning of turning from a “bull” to a “bear” market. Yet, after a short-term corrective process, the upward trend of the market resumed.

So, while it is evident that missing a bear market is incredibly important to long-term investing success, it is impossible to know when the markets have changed.

Or is it?

The next couple of charts will build off of the weekly price chart above.

Identifying The Trend

“In the short run, the market is a voting machine but in the long run it is a weighing machine” – Benjamin Graham

In the short term, which is from a few weeks to a couple of years, the market is simply a “voting machine” as investors scramble to chase what is “popular.” Then, as prices rise, they “panic buy” everything due to the “Fear Of Missing Out or F.O.M.O.” Then, they “panic sell” everything when prices fall. However, these are just the wiggles along the longer-term path.

In the long-term, the markets “weigh” the substance of the underlying cash flows and value. Thus, during bull market trends, investors become overly optimistic about the future bid-up prices beyond the practical aspects of the underlying value. The opposite is also true, as “nothing has value” during bear markets. Such is why markets “trend” over time. Eventually, excesses in valuations, in both directions, get reverted to, and beyond, the long-term means.

While the long-term picture is relatively straightforward, valuations still don’t do much in terms of telling us “when” the change is occurring.

Change Starts Slowly, Then All At Once

“Tops are a process and bottoms are an event” – Doug Kass

During a bull market, prices trade above the long-term moving average. However, when the trend changes to a bear market, prices trade below that moving average.

The keyword is TREND.

The chart below compares the market to the 75-week moving average. During “bullish trends,” the market tends to trade above the long-term moving average and below it during “bearish trends.”

Since 2009, there have been four occasions where the long-term moving average was violated, but did not lead to a longer-term change in the trend.

- The first was in 2011, as the U.S. was dealing with a potential debt-ceiling default and a downgrade of the U.S. debt rating. Fed Chairman Ben Bernanke started the second round of quantitative easing (QE), flooding the markets with liquidity.

- The second came in late-2015 and early-2016 as the Federal Reserve started lifting interest rates combined with the threat of Britain leaving the European Union (Brexit). Given the U.S. Federal Reserve had already committed to tightening monetary policy, the ECB stepped in with their version of QE.

- The third came at the end of 2018 as the Fed again tapered its balance sheet and hiked rates. The market decline quickly reversed the Fed’s stance.

- Finally, the “pandemic shut-down” of the economy led to a price reversion in the market. The Fed intervened with massive liquidity injections and the start of QE-4.

Each of these declines only gets classified as “corrections.” The market did not sustain the break of the long-term trend, valuations did not revert, and psychology remained bullish.

Still A Bull Market

Today, Central Banks globally continue their monetary injection programs, rate policies remain at zero, and global economic growth is weak. Moreover, with stock valuations at historically extreme levels, the value currently ascribed to future earnings growth almost guarantees low future returns.

As discussed previously:

:“Like a rubber band stretched too far—it must get relaxed in order to stretch again. The same applies to stock prices that are anchored to their moving averages. Trends that get overextended in one direction, or the other, always return to their long-term average. Even during a strong uptrend or strong downtrend, prices often move back (revert) to a long-term moving average.”

Historically, as prices approach 200-points above the long-term moving average, corrections ensued. Thus, the difference between a “bull market” and a “bear market” is when the deviations occur BELOW the long-term moving average consistently.

Since 2017, with the globally coordinated interventions of Central Banks, those deviations have started exceeding levels not seen previously. As of the end of May, the index was nearly 800 points above the long-term average or 4x the normal warning level.

We can see the magnitude of the current deviation by switching to percentage deviations. Historically, 10% deviations have preceded corrections and bear markets. Currently, that deviation is 22.5% above the long-term mean.

Notably, the decline below the long-term average reversed quickly, keeping the “bull market” trend intact.

Conclusion

Understanding that change is occurring is what is essential. But, unfortunately, the reason investors “get trapped” in bear markets is that when they realize what is happening, it is far too late to do anything about it.

Bull markets lure investors into believing “this time is different.” When the topping process begins, that slow, arduous affair gets met with continued reasons why the “bull market will continue.” The problem comes when it eventually doesn’t. As noted, “bear markets” are swift and brutal attacks on investor capital.

As Ben Graham wrote in 1959:

“‘The more it changes, the more it’s the same thing.’ I have always thought this motto applied to the stock market better than anywhere else. Now the really important part of the proverb is the phrase, ‘the more it changes.’

The economic world has changed radically and will change even more. Most people think now that the essential nature of the stock market has been undergoing a corresponding change. But if my cliché is sound, then the stock market will continue to be essentially what it always was in the past, a place where a big bull market is inevitably followed by a big bear market.

In other words, a place where today’s free lunches are paid for doubly tomorrow. In the light of recent experience, I think the present level of the stock market is an extremely dangerous one.”

Pay attention to the market. The action this year is very reminiscent of previous market topping processes. Tops are hard to identify during the process as “change happens slowly.” The mainstream media, economists, and Wall Street will dismiss pickup in volatility as simply a corrective process. But when the topping process completes, it will seem as if the change occurred “all at once.”

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.