Technically Speaking: On The Cusp Of A Bear Market

Lance Roberts | Mar 10, 2020 06:46AM ET

Over the last couple of years, we have discussed the ongoing litany of issues that plagued the underbelly of the financial markets.

- The “corporate credit” markets are at risk of a wave of defaults.

- Earnings estimates for 2019 fell sharply, and 2020 estimates are now on the decline.

- Stock market targets for 2020 are still too high, along with 2021.

- Rising geopolitical tensions between Russia, Saudi Arabia, China, Iran, etc.

- The effect of the tax cut legislation has disappeared as year-over-year comparisons are reverting back to normalized growth rates.

- Economic growth is slowing.

- Chinese economic data has weakened further.

- The impact of the “coronavirus,” and the shutdown of the global supply chain, will impact exports (which make up 40-50% of corporate profits) and economic growth.

- The collapse in oil prices is deflationary and can spark a wave of credit defaults in the energy complex.

- European growth, already weak, continues to weaken, and most of the EU will likely be in recession in the next 2-quarters.

- Valuations remain at expensive levels.

- Long-term technical signals have become negative.

- The collapse in equity prices, and coronavirus fears, will weigh on consumer confidence.

- Rising loan delinquency rates.

- Auto sales are signaling economic stress.

- The yield curve is sending a clear message that something is wrong with the economy.

- Rising stress on the consumption side of the equation from retail sales and personal consumption.

I could go on, but you get the idea.

In that time, these issues have gone unaddressed, and worse dismissed, because of the ongoing interventions of Central Banks.

However, as we have stated many times in the past, there would eventually be an unexpected, exogenous event, or rather a “Black Swan,” which would “light the fuse” of a bear market reversion.

Over the last few weeks, the market was hit with not one, but two, “black swans” as the “coronavirus” shutdown the global supply chain, and Saudi Arabia pulled the plug on oil price support. Amazingly, we went from “no recession in sight”, to full-blown “recession fears,” in less than a month.

“Given that U.S. exporters have already been under pressure from the impact of the “trade war,” the current outbreak could lead to further deterioration of exports to and from China, South Korea, and Japan. This is not inconsequential as exports make up about 40% of corporate profits in the U.S. With economic growth already struggling to maintain 2% growth currently, the virus could shave between 1-1.5% off that number.

Get The News You Want

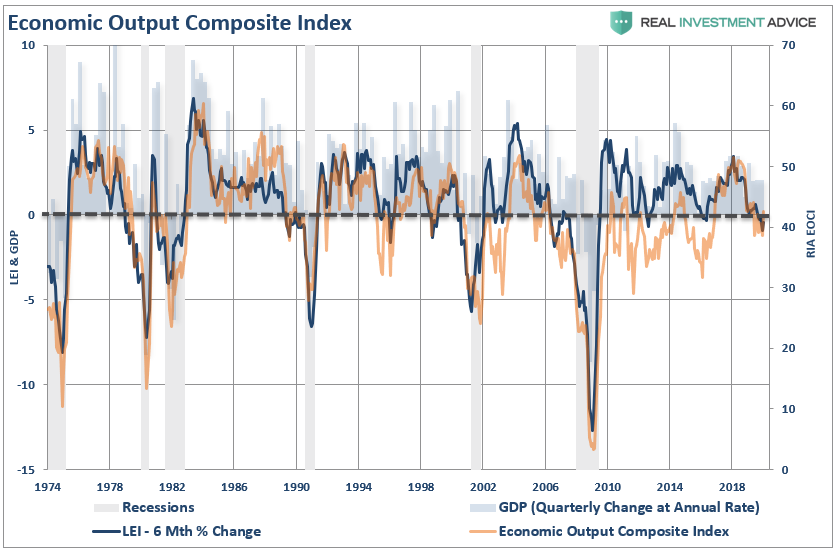

Read market moving news with a personalized feed of stocks you care about.Get The AppWith our Economic Output Composite Indicator (EOCI) already at levels which has previously denoted recessions, the “timing” of the virus could have more serious consequences than currently expected by overzealous market investors.”

On The Cusp Of A Bear Market

Let me start by making a point.

“Bull and bear markets are NOT defined by a 20% move. They are defined by a change of direction in the trend of prices.”

There was a point in history where a 20% move was significant enough to achieve that change in overall price trends. However, today that is no longer the case.

Bull and bear markets today are better defined as:

“During a bull market, prices trade above the long-term moving average. However, when the trend changes to a bear market prices trade below that moving average.”

This is shown in the chart below, which compares the market to the 75-week moving average. During “bullish trends,” the market tends to trade above the long-term moving average and below it during “bearish trends.”

In the last decade, there have been three previous occasions where the long-term moving average was violated but did not lead to a longer-term change in the trend.

- The first was in 2011, as the U.S. was dealing with a potential debt-ceiling and threat of a downgrade of the U.S. debt rating. Then Fed Chairman Ben Bernanke came to the rescue with the second round of quantitative easing (QE), which flooded the financial markets with liquidity.

- The second came in late-2015 and early-2016 as the market dealt with a Federal Reserve, which had started lifting interest rates combined with the threat of the economic fallout from Britain leaving the European Union (Brexit). Given the U.S. Federal Reserve had already committed to hiking interest rates, and a process to begin unwinding their $4-Trillion balance sheet, the ECB stepped in with their own version of QE to pick up the slack.

- The latest event was in December 2018 as the markets fell due to the Fed’s hiking of interest rates and reduction of their balance sheet. Of course, the decline was cut short by the Fed reversal of policy and subsequently, a reduction in interest rates and a re-expansion of their balance sheet.

Had it not been for these artificial influences, it is highly likely the markets would have experienced deeper corrections than what occurred.

On Monday, we have once again violated that long-term moving average. However, Central Banks globally have been mostly quiet. Yes, there have been promises of support, but as of yet, there have not been any substantive actions.

However, the good news is that the bullish trend support of the 3-Year moving average (orange line) remains intact for now. That line is the “last line of defense” of the bull market. The only two periods where that moving average was breached was during the “Dot.com Crash” and the “Financial Crisis.”

(One important note is that the “monthly sell trigger,” (lower panel) was initiated at the end of February which suggested there was more downside risk at the time.)

None of this should have been surprising, as I have written previously, prices can only move so far in one direction before the laws of physics take over. To wit”

“Like a rubber band that has been stretched too far – it must be relaxed before it can be stretched again. This is exactly the same for stock prices that are anchored to their moving averages. Trends that get overextended in one direction, or another, always return to their long-term average. Even during a strong uptrend or strong downtrend, prices often move back (revert) to a long-term moving average.”

With the markets previously more than 20% of their long-term mean, the correction was inevitable, it just lacked the right catalyst.

The difference between a “bull market” and a “bear market” is when the deviations begin to occur BELOW the long-term moving average on a consistent basis. With the market already trading below the 75-week moving average, a failure to recover in a fairly short period, will most likely facilitate a break below the 3-year average.

If that occurs, the “bear market” will be official and will require substantially lower levels of equity risk exposure in portfolios until a reversal occurs.

Currently, it is still too early to know for sure whether this is just a “correction” or a “change in the trend” of the market. As I noted previously, there are substantial differences, which suggest a more cautious outlook. To wit:

- Downside Risk Dwarfs Upside Reward.

- Global Growth Is Less Synchronized

- Market Structure Is One-Sided and Worrisome.

- COVID-19 Impacts To The Global Supply Chain Are Intensifying

- Any Semblance of Fiscal Responsibility Has Been Thrown Out the Window

- Peak Buybacks

- China, Europe, and the Emerging Market Economic Data All Signal a Slowdown

- The Democrats Control The House Which Effectively Nullifies Fiscal Policy Agenda.

- The Leadership Of The Market (FAANG) Has Faltered.

Most importantly, the collapse in interest rates, as well as the annual rate of change in rates, is screaming that something “has broken,” economically speaking.

Here is the important point.

Understanding that a change is occurring, and reacting to it, is what is important. The reason so many investors “get trapped” in bear markets is that by the time they realize what is happening, it has been far too late to do anything about it.

Let me leave you with some important points from the legendary Marty Zweig: (h/t Doug Kass.)

- Patience is one of the most valuable attributes in investing.

- Big money is made in the stock market by being on the right side of the major moves. The idea is to get in harmony with the market. It’s suicidal to fight trends. They have a higher probability of continuing than not.

- Success means making profits and avoiding losses.

- Monetary conditions exert an enormous influence on stock prices. Indeed, the monetary climate – primarily the trend in interest rates and Federal Reserve policy – is the dominant factor in determining the stock market’s major decision.

- The trend is your friend.

- The problem with most people who play the market is that they are not flexible.

- Near the top of the market, investors are extraordinarily optimistic because they’ve seen mostly higher prices for a year or two. The sell-offs witnessed during that span were usually brief. Even when they were severe, the market bounced back quickly and always rose to loftier levels. At the top, optimism is king; speculation is running wild, stocks carry high price/earnings ratios, and liquidity has evaporated.

- I measure what’s going on, and I adapt to it. I try to get my ego out of the way. The market is smarter than I am, so I bend.

- To me, the “tape” is the final arbiter of any investment decision. I have a cardinal rule: Never fight the tape!

- The idea is to buy when the probability is greatest that the market is going to advance.

Most importantly, and something that is most applicable to the current market:

“It’s okay to be wrong; it’s just unforgivable to stay wrong.” – Marty Zweig

There action this year is very reminiscent of previous market topping processes. Tops are hard to identify during the process as “change happens slowly.” The mainstream media, economists, and Wall Street will dismiss pickup in volatility as simply a corrective process. But when the topping process completes, it will seem as if the change occurred “all at once.”

The same media which told you “not to worry,” will now tell you, “no one could have seen it coming.”

The market may be telling you something important if you will only listen.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.