Technically Speaking: Bears Gain Control As Market Fails Resistance

Lance Roberts | Oct 05, 2021 04:42PM ET

With yesterday’s rout, the “bears” gained control of the narrative as the market failed at resistance.

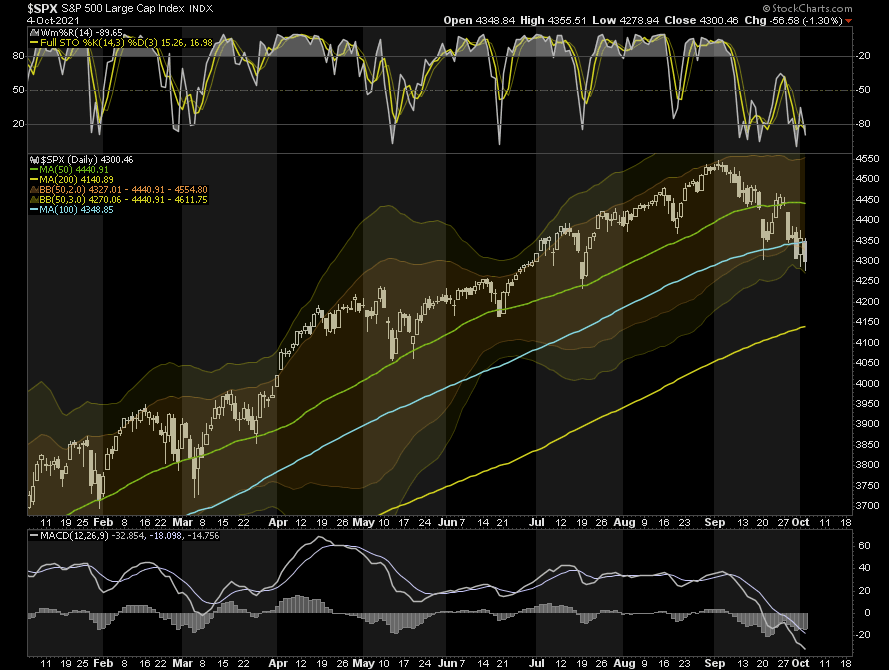

In this past weekend’s article, we discussed the market reclaiming the 100-dma on Friday. To wit:

“It is worth noting there are two primary support levels for the S&P. The previous July lows (red dashed line) and the 200-dma. Therefore, any meaningful decline occurring in October will most likely be an excellent buying opportunity particularly when the MACD buy signal gets triggered.

"The rally back above the 100-dma on Friday was strong and sets up a retest of the 50-dma. If the market can cross that barrier, we will trigger the seasonal MACD buy signal suggesting the bull market remains intact for now.“

Chart updated through Monday’s close.

The failure to hold the 100-dma is concerning. With the “bears” continuing to maintain control over the market, risks are mounting. With the market pushing well into 2-standard deviations below the 50-dma, we expect a counter-trend rally.

However, for now, those rallies should likely get used to “sell into,” rather than trying to “buy the dip.”

Numerous Headwinds To The Bullish Outlook

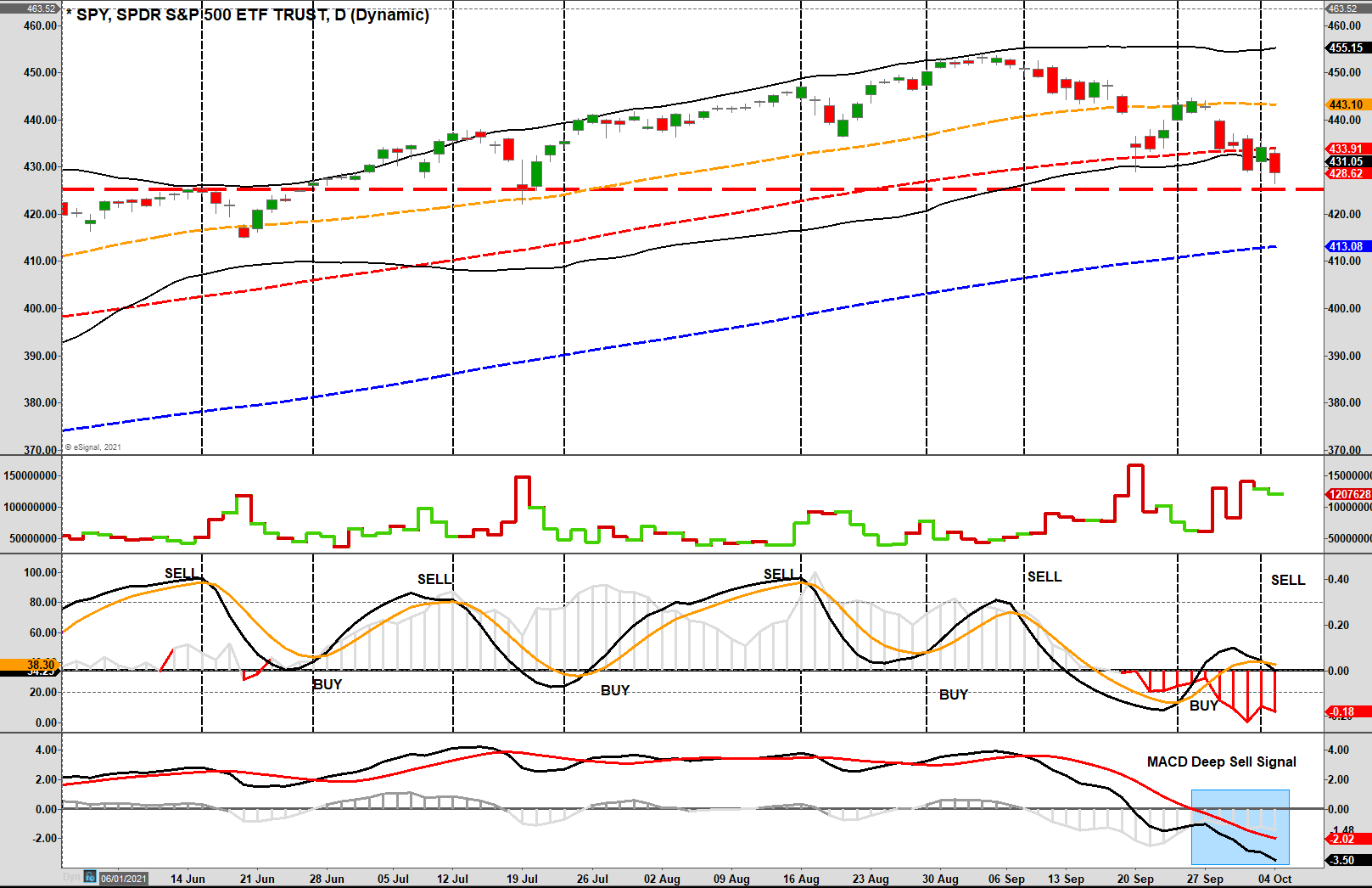

The selloff in September took our short-term indicators into oversold territory. Such suggests selling pressure is getting exhausted near term.

While short-term indicators got oversold, longer-term indicators did not. The dichotomy of these different indicators supports the idea of a rally short-term (days to a couple of weeks) but a more significant correction ahead.

On RIAPRO, we provide the sentiment and technical measures we follow. The number of oversold stocks is back towards extremes, which supports the idea of a short-term rally.

However, the overall “breadth” and “participation” of the market remains highly bearish. Thus, to avoid a deeper correction, breadth must improve.

There are reasons to be hopeful for a short-term rally with markets oversold, and the sentiment very negative. Furthermore, we are entering into the “seasonally strong” period of the year. The month of October has a spotty record, but November and December trend stronger.

However, don’t ignore the risks. Much like a patient with a weak immune system, the weak market internals leave investors at risk of numerous headwinds.

- Valuations remain elevated.

- Inflation is proving to be sticker than expected.

- The Fed will likely move forward with “tapering” their balance sheet purchases in November.

- Economic growth continues to wane.

- Corporate profit margins will shrink due to inflationary pressures.

- Earnings estimates will get downwardly revised keeping valuations elevated.

- Liquidity continues to contract on a global scale.

- Consumer confidence continues to slide.

While none of these independently suggest a significant correction is imminent, they will make justifying valuations difficult. Moreover, with market liquidity already very thin, a reversal in market confidence could lead to a more significant decline than currently expected.

Longer-Term Signals Suggest Caution

Given the broader macro issues facing the market, and not dismissing the possibility of a near-term reflexive rally, the weekly and monthly signals suggest caution.

Important Note: Weekly and monthly signals are only valid at the end of the period.

On a weekly basis, the market has triggered sell signals for the first time since April. However, despite the sell signal, the market continues to hold above its weekly moving average support. Furthermore, the market is as oversold today as it was during the selloff earlier this year.

The monthly picture is more concerning. Monthly “sell signals” are rarer and tend to align with more extensive market corrections and bear markets. But, as shown below, it is the first time since March 2020 that this signal has gotten triggered.

While the longer-term MACD has not yet confirmed that monthly signal, it is worth paying close attention to. Historically, the monthly signals have proven useful in navigating correction periods and bear markets.

Let me reiterate these longer-term signals do not negate the possibility of a counter-trend bull rally. As noted, in the short-term the market is oversold enough for such to occur. However, these longer-term signals suggest that investors should be using such rallies to rebalance portfolio risks, raising some cash, adding hedges, and reducing overall portfolio volatility.

My best guess is that we are still in the midst of seasonal weakness and could decline a bit further before sellers get exhausted. Such should lead to a stronger rally into the end of the year, however, new highs may be in the rearview mirror for now.

15-Portfolio Management Rules

There is a substantial risk of a bigger correction as we move into 2022. Such does not imply selling everything and moving to cash. However, being aware of the possibility allows for a logical approach to risk management.

- Cut losers short and let winner’s run.

- Set goals and be actionable.

- Emotionally driven decisions void the investment process.

- Follow the trend.

- Never let a “trading opportunity” turn into a long-term investment.

- An investment discipline does not work if it is not applied.

- “Losing money” is part of the investment process.

- The odds of success improve significantly when the technical price action confirms the fundamental analysis.

- Never, under any circumstances, add to a losing position.

- Markets are either “bullish” or “bearish.” During a “bull market” be only long or neutral. During a “bear market” be only neutral or short.

- When markets are trading at, or near, extremes do the opposite of the “herd.”

- Do more of what works and less of what doesn’t.

- “Buy” and “Sell” signals are only useful if they get implemented.

- Strive to be a .700 “at bat” player. (No strategy works 100% of the time.)

- Manage risk and volatility.

For now, it appears the “bears” have regained control of the market. However, the bullish trend remains intact which suggests we remain long our equity exposure. When there is a dichotomy of conditions, sometimes the best action is “no action” at all.

The “need to do something” is emotionally driven and tends to lead to worse outcomes.

For now, please pay attention, make small changes as needed, reduce risk on rallies, and wait for the market to tell you where its headed next.

Things are getting interesting.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.