Wednesday's Technical Analysis: AUD/USD, EUR/JPY, EUR/USD, GBP/JPY

Panayiotis Miltiadous | Mar 18, 2015 07:48AM ET

*All the charts are 30M charts with daily pivot points.

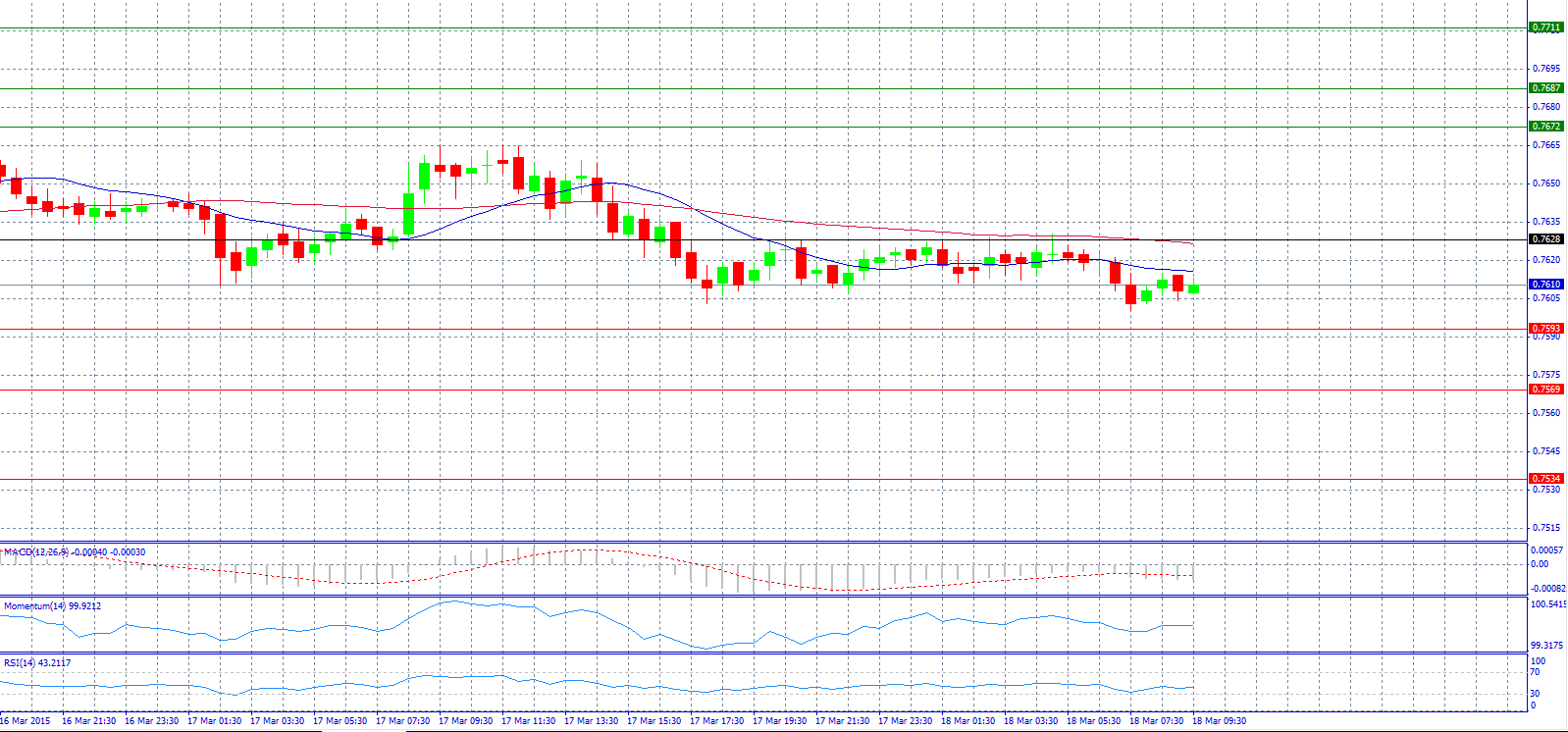

AUD/USD

Market Scenario 1: Long positions above 0.7628 with target @ 0.7672.

Market Scenario 2: Short positions below 0.7628 with target @ 0.7569.

Comment: The pair erased previous gains and fell near to 0.7600 level ahead of Europe open.

Supports and Resistances:

R3 0.7711

R2 0.7687

R1 0.7672

PP 0.7628

S1 0.7593

S2 0.7569

S3 0.7534

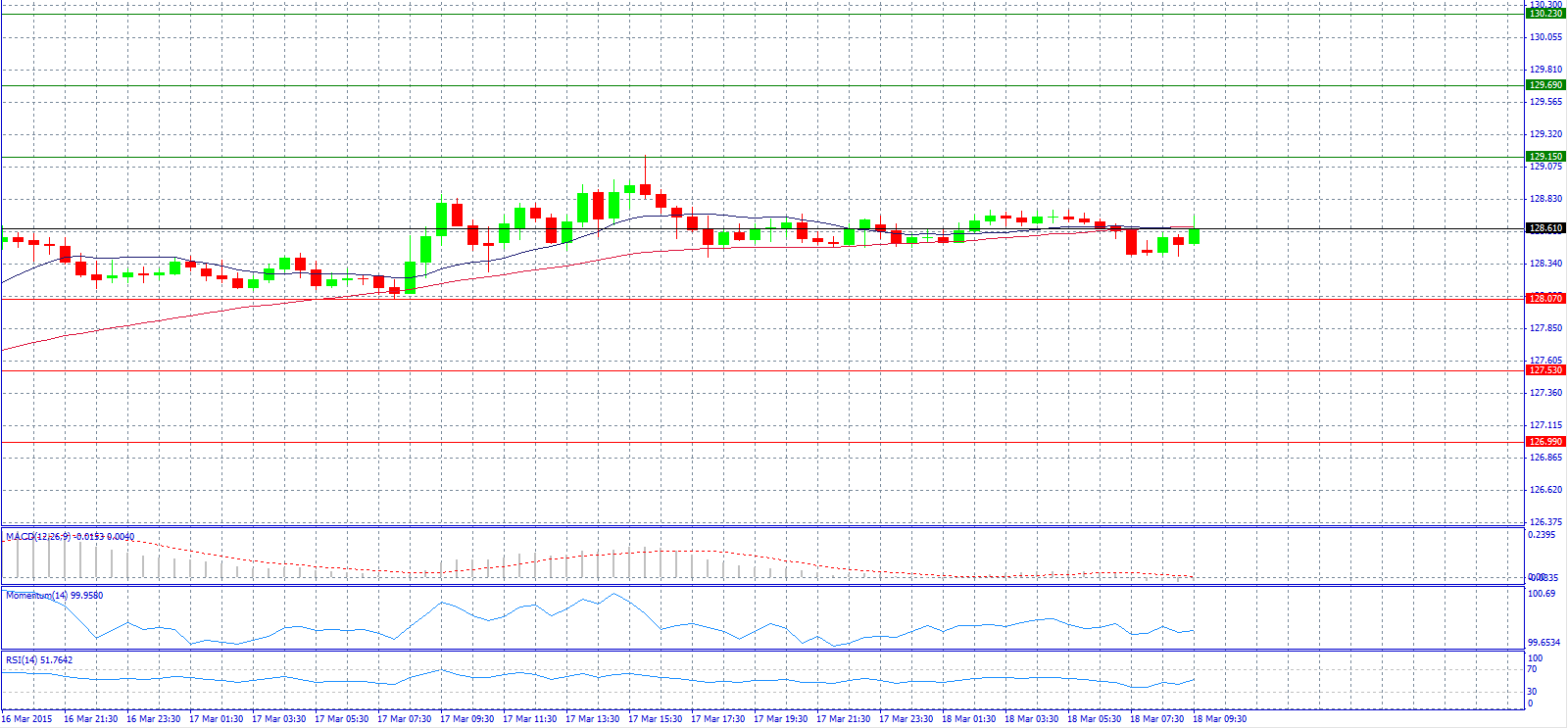

EUR/JPY

Market Scenario 1: Long positions above 128.61 with target @ 129.15.

Market Scenario 2: Short positions below 128.61 with target @ 128.07.

Comment: The pair continues to gain some momentum ahead of the Fed meeting today.

Supports and Resistances:

R3 130.23

R2 129.69

R1 129.15

PP 128.61

S1 128.07

S2 127.53

S3 126.99

EUR/USD

Market Scenario 1: Long positions above 1.0599 with target @ 1.0647.

Market Scenario 2: Short positions below 1.0599 with target @ 1.0548.

Comment: The pair rose above 1.0600 level but now fell below it again.

Supports and Resistances:

R3 1.0746

R2 1.0698

R1 1.0647

PP 1.0599

S1 1.0548

S2 1.0500

S3 1.0449

GBP/JPY

Market Scenario 1: Long positions above 179.22 with target @ 179.91.

Market Scenario 2: Short positions below 179.22 with target @ 177.62.

Comment: The pair trades below 179.00 level.

Supports and Resistances:

R3 181.51

R2 180.82

R1 179.91

PP 179.22

S1 178.31

S2 177.62

S3 176.71

GBP/USD

Market Scenario 1: Long positions above 1.4772 with target @ 1.4820.

Market Scenario 2: Short positions below 1.4772 with target @ 1.4699.

Comment: The pair fails to gain a foothold above 2013 low.

Supports and Resistances:

R3 1.4941

R2 1.4893

R1 1.4820

PP 1.4772

S1 1.4699

S2 1.4651

S3 1.4578

USD/JPY

Market Scenario 1: Long positions above 121.33 with target @ 121.54.

Market Scenario 2: Short positions below 121.33 with target @ 120.93.

Comment: The pair stays dead flat ahead of the Fed.

Supports and Resistances:

R3 121.94

R2 121.73

R1 121.54

PP 121.33

S1 121.14

S2 120.93

S3 120.74

GOLD

Market Scenario 1: Long positions above 1149.70 with target @ 1157.70.

Market Scenario 2: Short positions below 1149.70 with target @ 1140.00.

Comment: Gold prices slip to near four-month low as Fed seen readying rate hike path.

Supports and Resistances:

R3 1175.40

R2 1167.40

R1 1157.70

PP 1149.70

S1 1140.00

S2 1132.00

S3 1122.30

CRUDE OIL

Market Scenario 1: Long positions above 43.01 with target @ 43.62.

Market Scenario 2: Short positions below 43.01 with target @ 41.22.

Comment: Crude oil nearing its final target of 32.54 level.

Supports and Resistances:

R3 45.41

R2 44.80

R1 43.62

PP 43.01

S1 41.83

S2 41.22

S3 40.04

USD/RUB

Market Scenario 1: Long positions above 60.618 with target @ 60.970

Market Scenario 2: Short positions below 60.618 with target @ 59.579.

Comment: The pair trades ranged given the limited RUB transactions overseas.

Supports and Resistances:

R3 62.696

R2 61.657

R1 60.970

PP 60.618

S1 59.931

S2 59.579

S3 58.540

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.