FX Technicals: 30-Minute Charts

Panayiotis Miltiadous | Mar 17, 2015 07:32AM ET

*All charts are 30-M charts with daily pivot points.

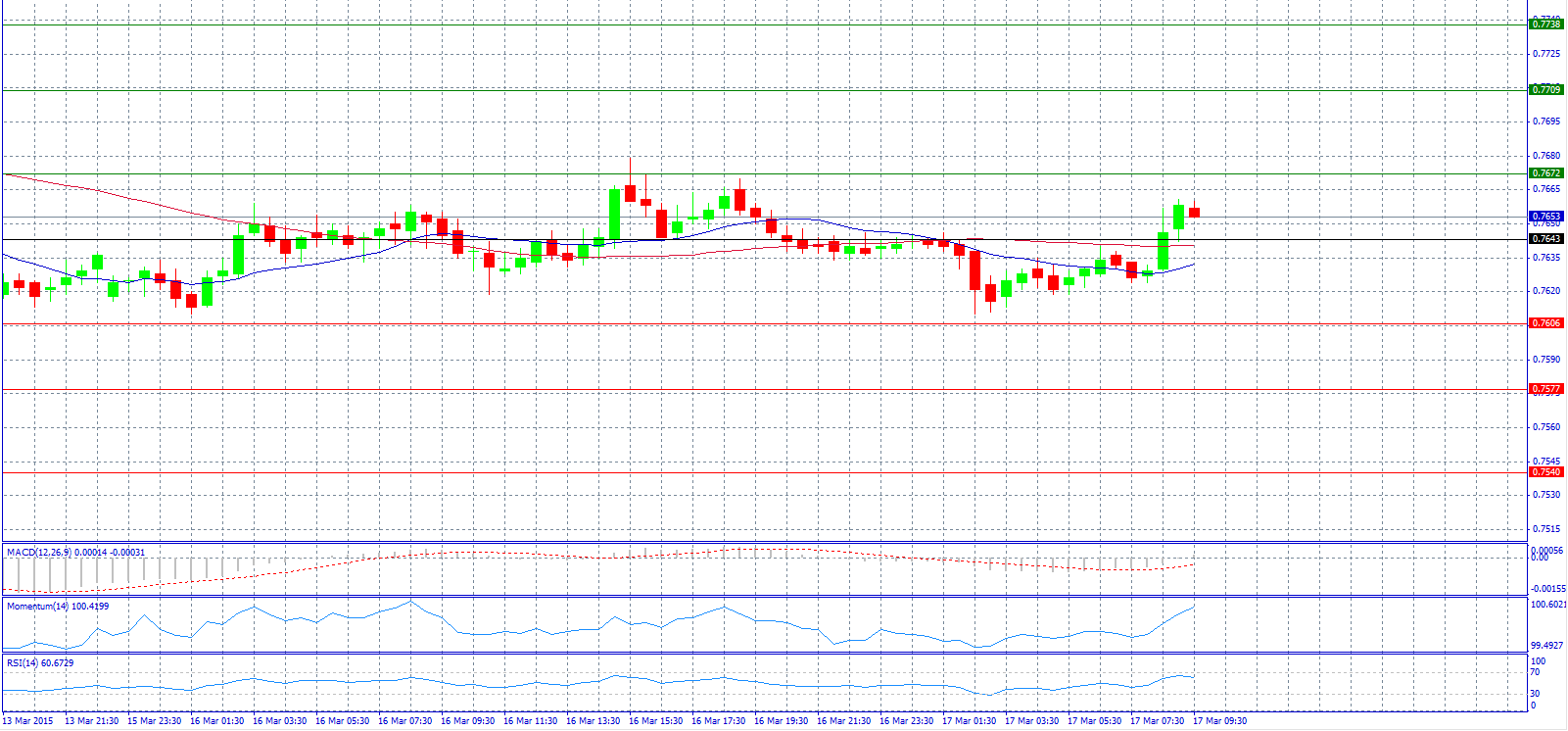

AUD/USD

Market Scenario 1: Long positions above 0.7643 with target @ 0.7709.

Market Scenario 2: Short positions below 0.7643 with target @ 0.7606.

Comment: The pair after it showed weakness in the early European morning and had losses, now it’s advancing again above 0.7650 level.

Supports and Resistances:

R3 0.7738

R2 0.7709

R1 0.7672

PP 0.7643

S1 0.7606

S2 0.7577

S3 0.7540

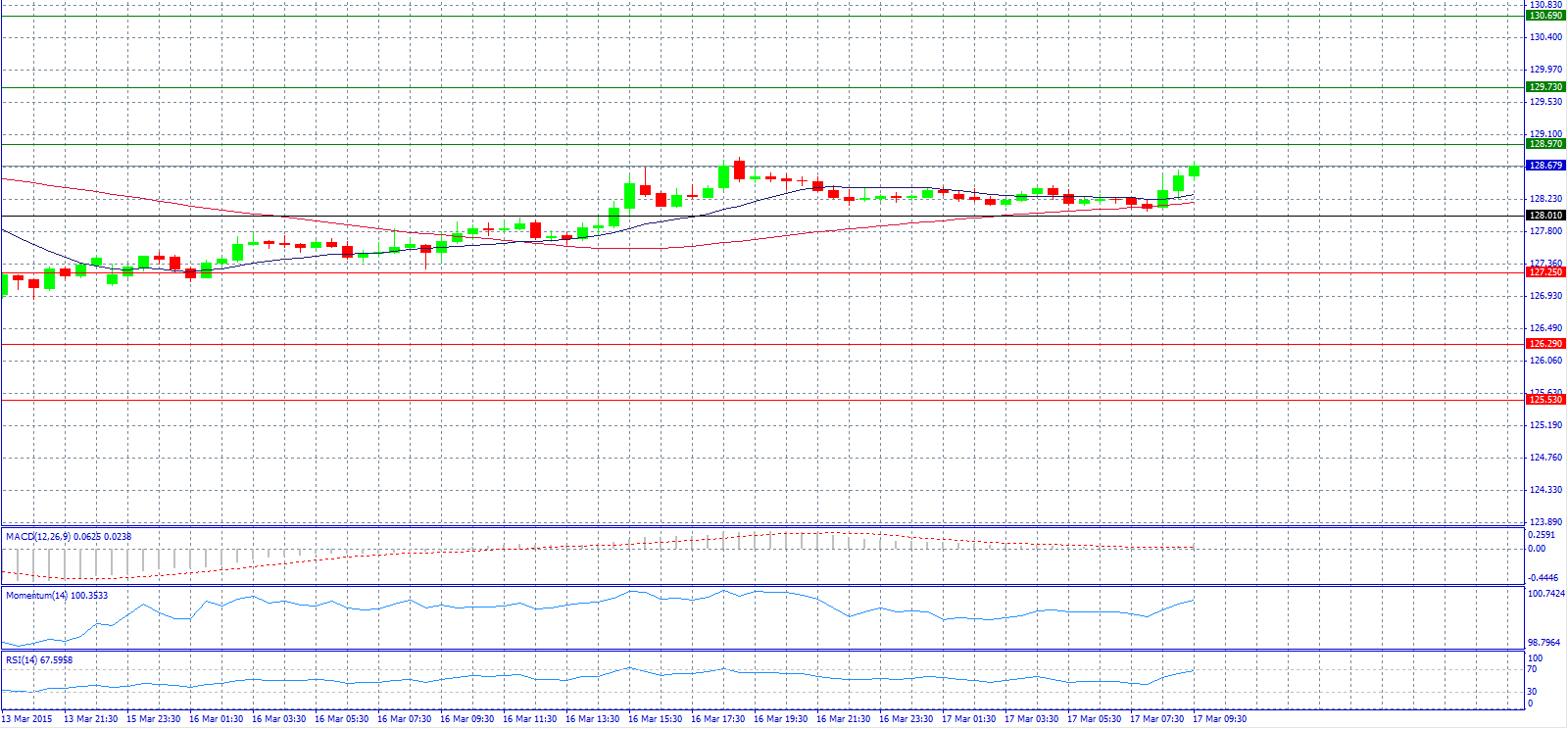

EUR/JPY

Market Scenario 1: Long positions above 128.01 with target @ 129.73.

Market Scenario 2: Short positions below 128.01 with target @ 127.25.

Comment: The pair traded almost steady in mid-Asia and now it’s advancing 128.60 level.

Supports and Resistances:

R3 130.69

R2 129.73

R1 128.97

PP 128.01

S1 127.25

S2 126.29

S3 125.53

EUR/USD

Market Scenario 1: Long positions above 1.0552 with target @ 1.0700.

Market Scenario 2: Short positions below 1.0552 with target @ 1.0484.

Comment: The pair advances higher with German data ahead.

Supports and Resistances:

R3 1.0780

R2 1.0700

R1 1.0632

PP 1.0552

S1 1.0484

S2 1.0404

S3 1.0336

GBP/JPY

Market Scenario 1: Long positions above 179.63 with target @ 180.47.

Market Scenario 2: Short positions below 179.63 with target @ 179.07.

Comment: The pair is currently trading below pivot point 179.63.

Supports and Resistances:

R3 181.87

R2 181.03

R1 180.47

PP 179.63

S1 179.07

S2 178.23

S3 177.67

GBP/USD

Market Scenario 1: Long positions above 1.4804 with target @ 1.4876.

Market Scenario 2: Short positions below 1.4804 with target @ 1.4755.

Comment: The pair rallied during the session on Monday, jumping back above the 1.48 level and now trading below it again.

Supports and Resistances:

R3 1.4997

R2 1.4925

R1 1.4876

PP 1.4804

S1 1.4755

S2 1.4683

S3 1.4634

USD/JPY

Market Scenario 1: Long positions above 121.29 with target @ 121.49.

Market Scenario 2: Short positions below 121.29 with target @ 121.12.

Comment: The pair fall below 121.37 level.

Supports and Resistances:

R3 121.86

R2 121.66

R1 121.49

PP 121.29

S1 121.12

S2 120.92

S3 120.75

Gold

Market Scenario 1: Long positions above 1155.50 with target @ 1161.60.

Market Scenario 2: Short positions below 1155.50 with target @ 1147.60.

Comment: Gold prices trade steady at 1154.00 level and traders remain on the sidelines ahead of the start of the two-day Federal Reserve meeting later in the day.

Supports and Resistances:

R3 1175.60

R2 1169.50

R1 1161.60

PP 1155.50

S1 1147.60

S2 1141.50

S3 1133.60

Crude Oil

Market Scenario 1: Long positions above 43.88 with target @ 44.91.

Market Scenario 2: Short positions below 43.88 with target @ 42.76.

Comment: Crude oil prices continue to fall and currently trading at $43/barrel.

Supports and Resistances:

R3 47.06

R2 46.03

R1 44.91

PP 43.88

S1 42.76

S2 41.73

S3 40.61

USD/RUB

Market Scenario 1: Long positions above 61.169 with target @ 61.538.

Market Scenario 2: Short positions below 61.169 with target @ 60.249.

Comment: The ruble stabilized in recent weeks as the pace of inflation slowed, alongside steadying government benchmark rates.

Supports and Resistances:

R3 63.009

R2 62.089

R1 61.538

PP 61.169

S1 60.618

S2 60.249

S3 59.329

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.