Euro Stoxx 50 Technicals: 10-23-2017

IFC Markets | Oct 23, 2017 08:53AM ET

The European Central Bank may announce about tapering of its monetary stimulus program for the EU economy at its next meeting on October 26, 2017. Will EU50 prices fall?

The European economy shows growth for the 5th consecutive year. Most market participants expect that on Thursday ECB President Mario Draghi will announce a reduction in the volume of buyback of bonds from the current level of 60 billion euros to 40 billion euros per month. Changes may take effect from the beginning of the next year. At the same time, the ECB interest rate is not expected to rise, which is now 0%. The buyback program of bonds may last for 6 or 9 months of 2018. Note that the next meeting of the ECB will be held only on January 25, 2018, so the likelihood of any of its statements at the meeting on Thursday is quite high. Another factor for the possible correction of the Pan-European stock index is a relatively weak forecast of the aggregate profit of the largest EU companies. According to the results of the 3rd quarter of 2017, it is expected to grow by 4.5% compared to the same period of 2016, and excluding energy companies - only by 1.3%. Meanwhile, from the beginning of October 2016 to the beginning of October 2017, the EU50 grew by 20%.

On the daily timeframe, EU50: D1 is in a neutral trend. A full-fledged downward correction is possible in case of a reduction in the quarterly aggregate profit of European companies, as well as in case of tapering ECB programs to stimulate the EU economy.

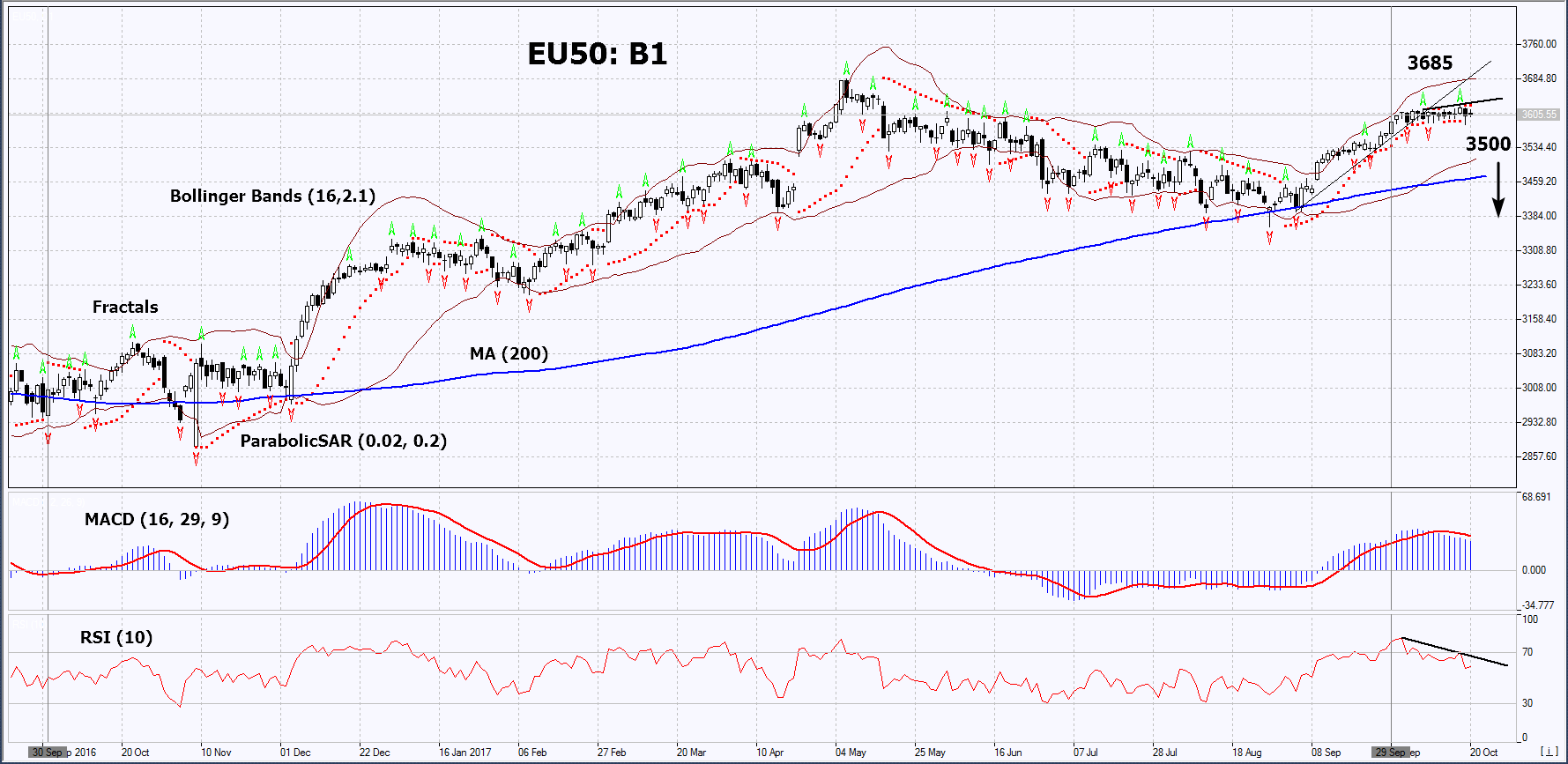

- The Parabolic indicator gives a bearish signal.

- The Bollinger bands have widened, which indicates high volatility.

- The RSI indicator is above 50. It has formed a negative divergence.

- The MACD indicator gives a bearish signal.

The bearish momentum may develop in case EU50 falls below the 4 fractal lows and the lower Bollinger® band at 3500. This level may serve as an entry point. The initial stop loss may be placed above the two-year high, the upper Bollinger band and the Parabolic signal at 3685. After opening the pending order, we shall move the stop to the next fractal high following the Bollinger and Parabolic signals.Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 3685 without reaching the order at 3500, we recommend cancelling the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

Position - Sell

Sell stop - Below 3500

Stop loss - Above 3685

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.