Tech Stocks Snatch Center Stage As Market Awaits The Fed

Dr. Duru | May 03, 2017 06:03AM ET

AT40 = 58.3% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 61.1% of stocks are trading above their respective 200DMAs

VIX = 10.6 (volatility index)

Short-term Trading Call: bullish

Commentary

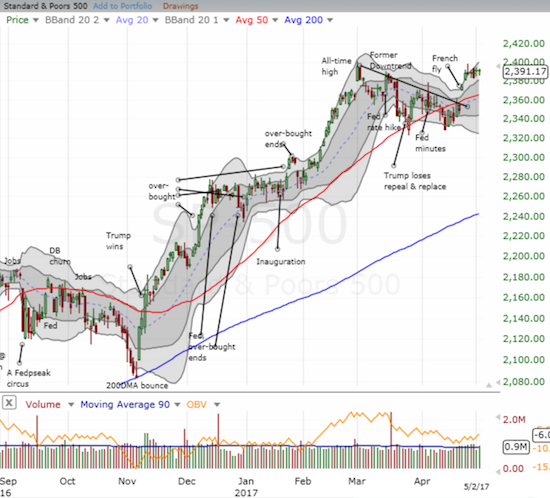

At the end of April, I noted how the stock market headed into May trading with a mix of alerts. AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), faded from intraday overbought conditions in a move that I typically interpret as bearish. Yet, the S&P 500 (SPDR S&P 500 (NYSE:SPY)) displayed no reason for concern beyond an eventual retest of support at its 50DMA. Moreover, the volatility index was as sluggish as ever. The start of trading for May followed through on the mixed alerts.

Tech stocks led the way with a tremendous move by the NASDAQ (PowerShares QQQ Trust Series 1 (NASDAQ:QQQ))* to a new all-time high. The NASDAQ gapped up and gained 0.7% on the day. The tech-laden index reconfirmed the dominance of bulls and buyers by once again closing on or above its upper-Bollinger Band (BB).

Since its big breakout on April 24th, the NASDAQ (QQQ) has been on an incredible roll.

While the NASDAQ was showing off on Monday, the S&P 500 (SPY) barely held onto its gain for the day. Add in Tuesday’s slight gain, and the index is still stuck in the muck of a tight 6-day trading range.

The S&P 500 (SPY) sits stuck just below its all-time as the momentum from the “French Fly” quickly lost gas.

AT40 also failed to follow the NASDAQ’s lead. On Monday, my favorite technical indicator had to recover from an intraday loss. On Tuesday, AT40 closed even with the end of Friday’s plunge.

The biggest show-off on Monday was the volatility index, the VIX. The VIX closed at 10.1 and a 10-year low. Since 1990, there have only been 14 other trading days that delivered lower closes. Thinking that the VIX would bounce back quickly given Wednesday’s Fed meeting, soon after the open I sold my put options on ProShares Ultra VIX Short-Term Futures (NYSE:UVXY). If I had just held into the close, I would have locked in good profits on my overall UVXY call/put hedge.

The volatility index, the VIX, is barely coming off an incredible 10-year closing low.

Taken together, I am still expecting a mild retest of 50DMA support for the S&P 500 at some point this month. Yet the coming results of the Federal Reserve’s May meeting present a small wildcard. The latest economic data hardly justify an imminent rate hike, so it is very possible that the Fed may take this opportunity to lift its foot off the rate hike pedal. If so, I will be VERY interested to see whether the market interprets such a move as bullish because easier money hangs around for longer or bearish because economic weakness may loom larger. See “Gold and Silver Lag A Market Wavering On Two More Rate Hikes for 2017” for additional Fed-speculations.

Speaking of economic weakness, weak auto sales grabbed a lot of headlines on the day. From Reuters :

“Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down.

The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession’s end in 2010.”

CarMax Inc (NYSE:KMX) initially sold off on the news, and I took the opportunity to lock in profits on the short position I opened last week based on the technicals. The move turned out to be fortuitous (since my short-term trading call is bullish, I do not hold short positions for long). KMX needs to close at a new post-earnings low to confirm the current 200DMA breakdown and resistance at a sharply downtrending 50DMA.

Weak auto sales initially sent Carmax (KMX) plunging through its 20DMA. Even with the rebound, the chart still looks toppy and bearish.

Chipotle Mexican Grill (NYSE:CMG) has my full attention now. Previously, I made nearly weekly hedged plays on CMG. Following last month’s breakout, I strictly focus on bullish plays. I took advantage of last week’s post-earnings fade to open new positions. On Monday, I thought I got it all wrong as CMG finished reversing all its post-earnings gain and then some. On Tuesday, I was able to take profits on my call options. I am still sitting on a call spread that is now even. CMG may need a week or two more to stabilize into a new pattern.

Chipotle Mexican Grill (CMG) has swung widely through earnings, but it overall remains in a very bullish position.

Speaking of wild trading, Amazon.com (NASDAQ:AMZN) pulled off a post-earnings move I do not think I have seen in a very long time, maybe ever. As I discussed last week, I went back to my traditional post-earnings play on AMZN by buying soon after the post-earnings open. I stick to the rules even if AMZN is well above its upper-Bollinger Band (BB) as it was on Friday. I started with a low ball offer on a call spread and then added shares as the gap up kept closing. I eventually stopped out those shares.

I was completely unprepared to get back into AMZN the very next trading day. On Monday, AMZN rode the wave of big cap tech and managed to trade at a new intraday all-time high before closing just about where it opened post-earnings on Friday. On Tuesday, I rushed into the tiny dip to get back into a small amount of shares. I am absolutely astonished at the ability of such a big cap stock to come back so quickly after such a major fade above its upper-Bollinger Band.

Manic post-earnings trading in Amazon.com (AMZN) – are the trading robots in control?

Intel (NASDAQ:INTC) has also traded in a manic fashion post-earnings. Last week, I pointed out how INTC gapped down post-earnings but managed to close right on top of support. I took advantage of the sell-off to execute my “between earnings” INTC trade. INTC rode the big cap tech wave on Monday with a decent confirmation of support. Tuesday’s 1.9% surge took my position of call options to a double. I typically follow an options trading rule to take profits on a quick double. However, in this case, I decided to hold a little longer given the exceptionally strong comeback that looks to completely close the post-earnings gap. However, I will have to close out at the first sign of weakness in order to protect the majority of profits.

Traders quickly change their minds on post-earnings Intel (INTC). Converged support at the 50/200DMAs held in picture-perfect style.

I am watching Wix.Com Ltd (NASDAQ:WIX) like a hawk. This stock turned into an epic miss as

Trading volume has surged on Wix.com (WIX) yet the overall result so far is churn. Is this distribution ahead of a big disappointment or are intrepid traders positioning ahead of some freshly positive catalyst?

While hanging out with the bulls has been rewarding, I am still looking out the corner of my eye at the lagging and non-confirming financials and small caps. As I pointed out in the last Above the 40 post , these laggards are contributing to mixed signals for May. The message is not lost on me…

The Financial Select Sector SPDR ETF (NYSE:XLF) peaked at a 9+ year high in March and has effectively traded sideways for 5 months.

The iShares Russell 2000 (NYSE:IWM) barely participated in Monday’s celebration. On Tuesday, it gave those gains right back.

Be careful out there!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by T2108 Resource Page . AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #301 over 20%, Day #121 over 30%, Day #11 over 40%, Day #8 over 50% (overperiod), Day #3 under 60% (underperiod), Day #73 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

Be careful out there!

Full disclosure: long INTC call options, long AMZN call spread and shares, long CMG call spread, long UVXY call options

*Note QQQ is used as a proxy for a NASDAQ-related ETF

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.