Tech Market Technicals Turn Net Positive

Declan Fallon | Jul 14, 2017 12:02AM ET

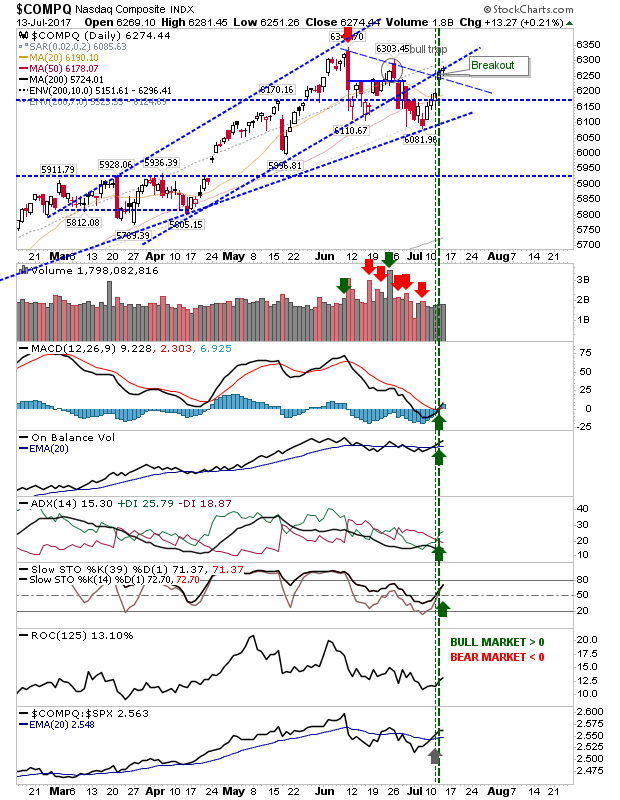

Two days of gains have helped re-establish the bullish technical picture for tech indices, NASDAQ and NASDAQ 100. While the improvement was welcomed it didn't come without a price.

The NASDAQ broke through declining resistance but also left itself wedged beneath the former rising channel. If there is a chance for shorts, then Friday could be it.

The NASDAQ 100 has also touched on former channel support – now resistance – offering a chance for shorts to launch an attack.

The Dow Jones continued its good form, albeit on a small gain as it shapes a bullish handle (off an earlier handle). While above the breakout resistance level of 21,550 it will need more volume to confirm whether the move is valid.

The Russell 2000 continues to be the index with the most potential energy to drive the next major market rally. Thursday's 'hammer' next to 1,430 sets the tone for a strong Friday. Momentum players should take note.

Friday will either prove to be a victory for shorts with channel resistance reversals for the NASDAQ or NASDAQ 100 or a win for the Russell 2000 and an opportunity for a solid 1%+ breakout style gain. Those are the indices and trades to watch.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.