TD Ameritrade Or E*TRADE: Which Stock Is A Better Pick?

Zacks Investment Research | Dec 04, 2018 03:37AM ET

Benefits from an improving economy and higher interest rates have positioned the .

Though both investment brokers have similar business trends, an insight into the financials will help decide which investment option is better.

Price Performance

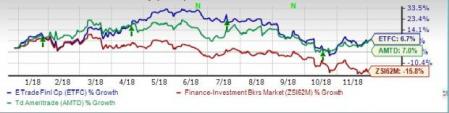

Both banks have outperformed the industry (down 15.8%) year to date, witnessing stellar growth. While shares of TD Ameritrade have rallied 7%, E*TRADE has risen 6.7%. So, TD Ameritrade has performed better than E*TRADE.

Year-To-Date Price Performance

Dividend Yield

Both the companies have been deploying capital in terms of dividend payments and share purchases to enhance shareholder value.

TD Ameritrade announced 43% dividend hike in October. Further, the company has a share buyback authorization in place. It has a dividend yield of 2.23%.

Dividend Yield: AMTD

Recently, E*TRADE initiated dividend payment. Further, the company has a share repurchase authorization in place. It has a dividend yield of 1.07%.

Dividend Yield: ETFC

As visible in the above charts, TD Ameritrade has an edge over E*TRADE. Not only is TD Ameritrade’s dividend yield better than E*TRADE but is also above the industry average of 0.89%.

Return on Equity (ROE)

ROE is a measure of a company’s efficiency in utilizing shareholders’ funds. TD Ameritrade’s ROE for the trailing 12-month period is 24.54% while that for E*TRADE is 15.45% compared with the industry’s level of 11.89%. Therefore, TD Ameritrade reinvests its earnings more efficiently.

Earnings Estimate Revisions & Growth Projections

The Zacks Consensus Estimate for fiscal 2019 earnings of TD Ameritrade has moved up 1% over the past 30 days. Meanwhile, the same for E*TRADE has jumped 1.3% for this year during the same time frame.

Moreover, fiscal 2019 earnings for TD Ameritrade are projected to jump 18.9% year over year. For E*TRADE, the Zacks Consensus Estimate is pegged at $3.85 for 2018, reflecting a year-over-year increase of a massive 75.8%.

Hence, E*TRADE reflects better earnings growth prospects.

Sales Growth

Sales for TD Ameritrade for fiscal 2019 are projected to increase 8.1% year over year to $5.9 billion. For E*TRADE, the Zacks Consensus Estimate is pegged at $2.9 billion for 2018, indicating year-over-year growth of 22.1%.

Therefore, E*TRADE has an edge here as well.

Valuation

TD Ameritrade has a Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.