This T-Bill ETF And Yield Look Higher

Mike Paulenoff | Oct 09, 2017 11:37AM ET

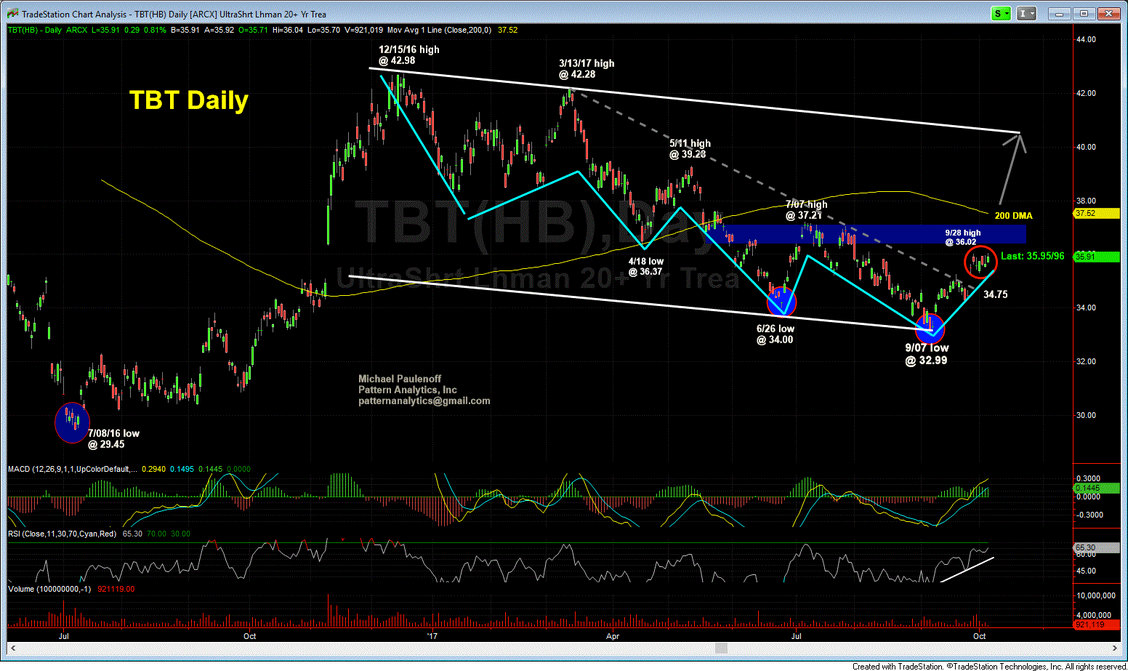

Ahead of last Friday's jobs report, we noted that our technical set-ups in both the ProShares UltraShort 20+ Year Treasury ETF (NYSE:TBT) and 10-year Treasury yield anticipated a positive reaction to the employment data.

While investors were expecting fewer additions to payrolls (compromised by hurricanes and seasonal bias), we anticipated that any positive data could spur yield and the TBT.

Apart from the employment report's headline, indicating a loss of 33,000 jobs, the other data-points showed a new low in the Unemployment Rate of 4.2% (vs. 4.4% in August), as well as a bump in Average Hourly Earnings of 0.05%, which on a 12-month basis, aggregates to +2.9%, up from 2.5%, recorded in the August report and a drop from 8.6% to 8.0% in the widest jobs classification, the U6 Unemployment Rate.

The TBT responded as expected on Friday, closing up 0.72%, or 26 cents to 36.14, the highest level in 9 weeks.

We've been bullish the TBT since its low of 32.99 on September 7 and have been anticipating the completion of the May-October bottom on the chart.

Our technical work indicates that a new bull market in yield, which is bullish for the TBT, started at the July 2016 low at 1.32%, which ended the 35-year bear market, and now is entering a new upleg after a December 2016 to September 2017 correction.

In the days just prior to employment report, the TBT price structure had been digesting its prior upleg from 32.99 to 36.02 within a high-level consolidation-continuation pattern. Friday's strength has the right look of a pattern entering upside acceleration toward a forthcoming test of the down-sloping 200 DMA, now at 37.52.

That said, my sense is that the current technical set-up is so combustible that if the TBT crosses and sustains above 37.27 it will trigger upside potential derived from all of the accumulation action from May into the first week of October and, as such, will project to 39-40.

In other words, if TBT surges above 37.27, the modestly down-sloping 200 DMA is unlikely to pose meaningful resistance on the road to 40.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.