Taxable Total Return: First Quarter Review

Cumberland Advisors | Mar 24, 2017 01:48AM ET

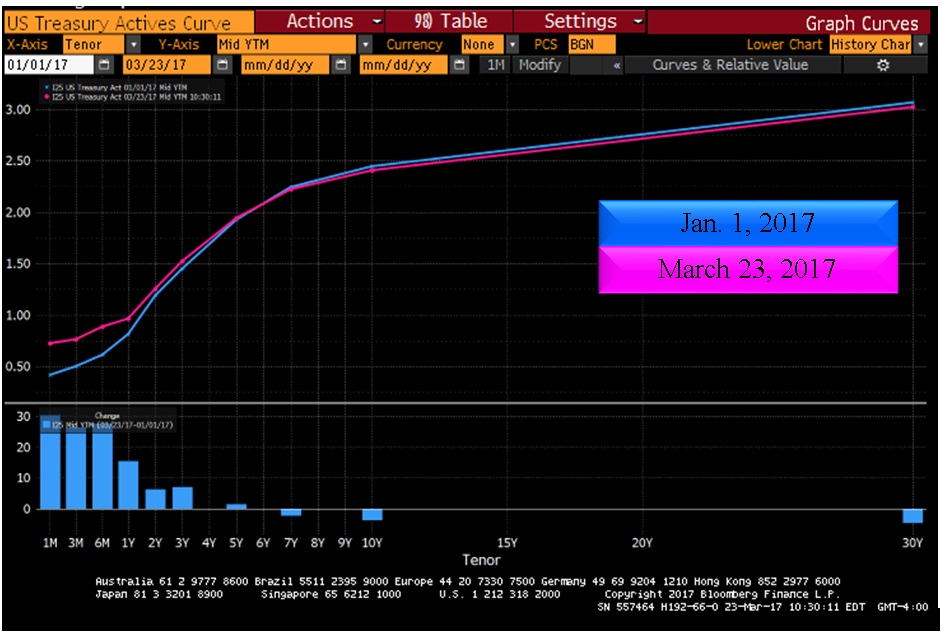

The first quarter of 2017 saw records being broken in the equity market, while yields in the fixed-income market have experience continued volatility. The largest movement in yield was on the short end, as we have begun to witness some flattening of the yield curve. As of March 23rd, the 1-year and 2-yearTreasury yields increased 15.4 and 6 basis points respectively to 0.947% and 1.25%. The 10-year and 30-year Treasury yields decreased 4.5 and 5.4 basis points to 2.401% and 3.012% respectively. This is due to the Federal Open Market Committee’s (FOMC) bias toward raising short-term interest rates and the expectation that the hikes will follow a more sequential pattern moving forward.

The following table shows the US Treasury actives curve, outlining the movement in yields across the Treasury market from the beginning of the year to 3/23/17.

For the first time in this hiking cycle, the FOMC decided to raise short-term rates in a month other than December. On March 15th the Committee raised the fed funds target range a quarter percentage point (25 basis points) to 0.75-1.00 percent, marking the third hike in the cycle and the second in the last three months. Accompanying the rate hike was an FOMC statement that carried a more hawkish tone than previous statements. The statement indicated that economic activity has continued to expand, job gains remain solid, inflation is closing in on the Committee’s 2 percent target, and the unemployment rate is little changed.

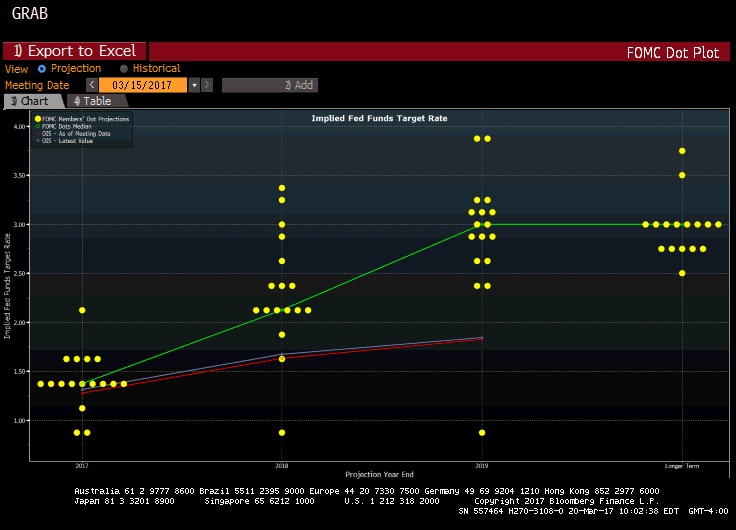

The more hawkish tone of the FOMC’s statement did not, however, lead to an increase in the number of hikes expected in 2017 (now projected at three). The Federal Reserve’s “dot plot,” which provides the central bank’s outlook for future short-term interest rates, remained unchanged for 2017 and 2018, based on median estimates. The graph below shows the Fed’s “dot plot,” and the green line is the median forecast going forward, including a projection for 2017 that has the fed funds rate between 1.25-1.50 percent, which corresponds to a total of three hikes for 2017.

During the first quarter of 2017, Cumberland’s taxable fixed-income portfolios benefited from the inclusion of long tax-free municipal bonds at yields greater than 4%, tightening spreads on corporate and taxable municipal bonds, and the inclusion of assets designed to defend against rising interest rates.

At the end of 2016, with the overselling in the Treasuries market, we began easing back into the long end of the curve and extending durations slightly by doing some crossover buying into the tax-free municipal market.That strategy continued throughout the first quarter of 2017. The election results provided an opportunity to purchase long tax-free municipal bonds at yields greater than 4%. At a ratio of 130–140% to the 30-year US Treasury, these bonds represent an attractive opportunity for our clients, so we continue to include a small weighting in our taxable portfolios. The historical average muni-to-Treasury ratio is 70–80%, and our expectation is that the ratio will work its way closer to that average going forward. You can read more about our expectations for the muni-to-Treasury ratio in John Mousseau’s commentary “The Muni Market Two Months After Trump ”.

As yields have risen in the Treasuries market, the spread over Treasuries has begun to compress in the taxable municipal and corporate markets. In the taxable municipal market we have seen spreads tighten between 5-10 basis points, while corporate market spreads have tightened 10-15 basis points. The tightening spreads have helped Cumberland portfolios over the first quarter due to the inclusion of taxable municipals and corporate bonds in our portfolios. One example of this is AAPL 1.90 2/7/20 (Apple (NASDAQ:AAPL)) that was issued on 2/2/2017 at a spread of 45 basis points over the 3-year Treasury. Since issuance we have seen that spread compress down to roughly 28 basis points, or 17 basis points tighter than at issuance. Spread compression is very common in times of rising interest rates and Fed hiking cycles, and this cycle is continuing that trend.

Cumberland’s taxable total-return portfolios have also benefited from the inclusion of defensive assets in the form of Treasury floating-rate notes. These notes protect against rising interest rates by adjusting the coupon weekly based on the 13-week T-bill auctions. The floaters are being positioned as a cash alternative that protects the principal investment while the coupon adjusts in lockstep with interest rates. We started purchasing Treasury floaters in the middle of 2016 when we began shifting portfolios to a more defensive structure, and we continue to add them to portfolios today.

As we enter the second quarter of 2017, Cumberland’s view is that rates will continue moving upward. At the start of the year our projection was for at least two and possibly three rate hikes in 2017, and this outlook has not changed. The FOMC will remain extremely judicious with regard to raising short-term interest rates and will focus on economic data and overall market conditions to determine whether to continue increasing rates. Our goal is to remain defensive in our approach to investing, with a focus on preservation of capital. We will continue making our investment decisions conservatively while extending durations and picking up additional yield as opportunities in the market become available.

by Cumberland Advisors

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.