Tap Into the Growing Beer Industry

Wall Street Daily | Jan 26, 2015 12:43AM ET

As you crack open your favorite brew just before Super Bowl XLIX kicks off next Sunday, you’ll probably be more focused on the Seahawks-Patriots spread than how much value got sucked out of your long-commodity portfolio last year.

But despite the pigskin distraction, the reality is, many of our commodity portfolios suffered over the last half of 2014.

However, the answer to gaining back some of your losses might just be in that fine brew that you’re sipping.

Beer isn’t a traditional commodity, as there are no futures markets associated with it, but it is considered an alternative investment.

And while there are likely to be some bad drives in the Super Bowl on Sunday, beer stocks are typically good plays, regardless of our economic condition.

Taking Inventory

Like wine, some beers benefit from extended aging. According to Wine Enthusiast, cellaring beer can mellow otherwise intense notes, meld commingling flavors, and ratchet up complexity, thus increasing the beer’s value.

The collective period for beer is actually longer than you may think – sometimes over two years!

The best bottles to store are the malty, full-bodied beers and those that have higher alcohol content over the more hop-heavy brews. Good bets include imperial stouts, lambics, Belgian strong ales, and barleywines.

Unfortunately, not everyone can be a craft brewer like Jim Koch – the Founder of Samuel Adams, which is now the Boston Beer Company Inc (NYSE:SAM) with sales exceeding over two million barrels annually.

In fact, it’s not all that simple to start and become a successful microbrewery as the competition continues to grow . Just 200 breweries were in operation in the 1980s; today, the number is around 1,600.

That’s a lot of competition if you want to start your own brewery, but a lot to choose from if you’re looking to invest.

Craft Brew Alliance Inc (NASDAQ:BREW) is a listed craft brewer. However, most names are unlisted, meaning your best bet on the microbrewery side is to go the venture-capital or private-equity route.

Investors would do well to stick to the lower-cost brands, such as InBev products like Budweiser and Stella Artois, which tend to do well during tough economic times. Other names to consider along with the “King of Beers” owner, Anheuser-Busch (OTC:AHBIF) , are SABMiller and Molson Coors Brewing Company (NYSE:TAP). Diageo is another good investment, as it has strong offerings in both North America and Europe with brands such as Guinness, Harp, Kilkenny, and Red Stripe.

But you don’t have to stay loyal to just one brew…

Make Your Own Six-Pack

If you would rather have a diversification of names, you can opt for an index.

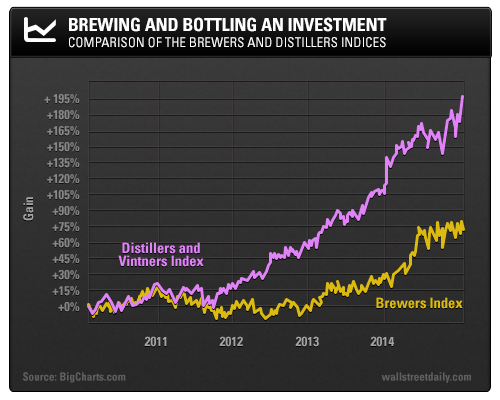

The Dow Jones Brewers and the Dow Jones Distillers & Vintners are two to watch. Here’s a five-year comparative chart.

Investing along the beer supply chain is another good option. Enthusiasts can buy into providers of ingredients and packaging through agriculture, aluminum, and distribution companies.

Furthermore, there are new innovations in beer technology that aim to improve the industry as a whole; however, these are typically far from pure-play investments.

So rather than crying over your beer if your team is losing, think about investing instead.

Cheers and good investing,

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.