Tail Risks Lurk In The Shadows. Fiscal Cliff Is Out In The Open

Sober Look | Nov 08, 2012 04:44AM ET

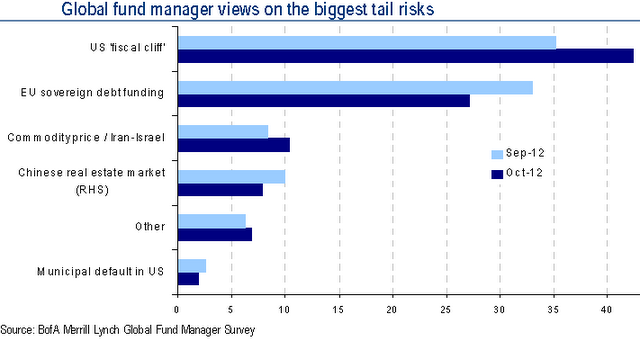

Merrill conducts a periodic survey of US institutional money managers. One area the survey focuses on is a set of questions on the so-called "tail risks," the less probable but potentially devastating events that negatively impact financial asset valuations. Here are the survey results from September and October of this year.

The US fiscal cliff is clearly on people's minds and is quickly becoming the dominant concern in the financial community. If this survey were conducted today, the percentage of participants who would view the upcoming budget cuts and tax increases as the main risk to their portfolios would increase sharply. In fact, based on Google Trends, the public's concerns about the US fiscal cliff have spiked recently.

But once certain risks become this widely "respected," they can no longer be called "tail risks." In fact as we saw in today's equity markets, these risks are already being priced into the markets.

Tail risks are usually those events that are not fully priced, risks that are ignored, sometimes leading to formations of asset bubbles. What would be an example of such a risk these days? One potential candidate may be some of the US bond markets, for example credit (see post ), possibly even earlier. Instead one should look at the less probable events that most investors are now simply ignoring.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.