Table Set For An Economic Growth Spurt

Econintersect LLC | Nov 17, 2013 06:48AM ET

One can tell from my posts over the last few months that I have become more bullish on the economy. Are things great? [expletive deleted] no!

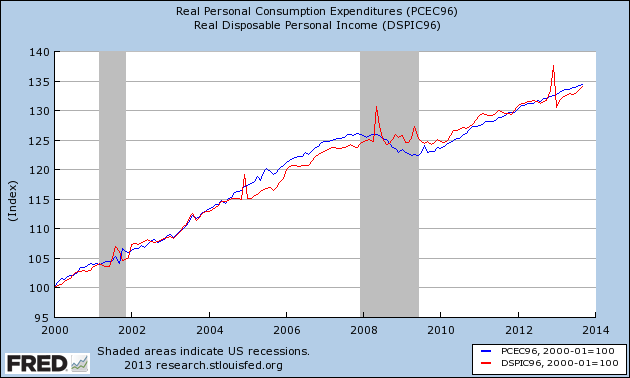

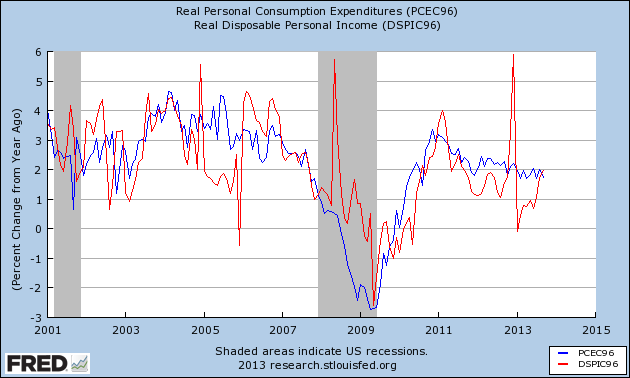

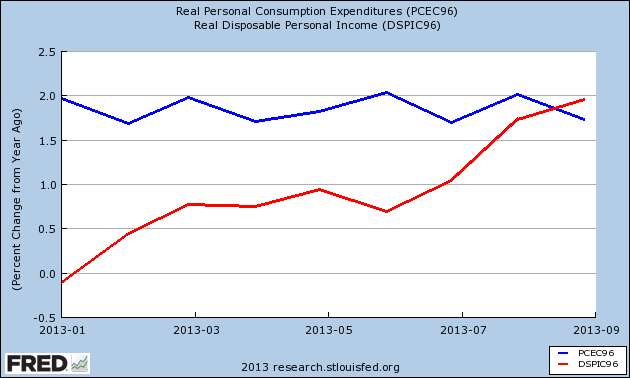

The year 2013 has been dogged by consumer expenditures (blue line in graphs below) outrunning consumer income (red line in graphs below). This balance has been restored.

The above graph has indexed expenditures and income to January 2000. To have another perspective – the graph below uses the same data set to show year-over-year change.

And the following graph provides a closeup on the year-over-year change for 2013. From this graph, one gets the feel why the USA consumer based economy has felt so sluggish this year – as income growth has lagged expenditures.

What you may be thinking is that the 0.1% causing this distortion. But listen to the message from Gordon Green of Sentier Research :

“Since August 2011, the low-point in our household income series, we have seen some improvement in the level of real median annual household income. While the trend in household income since August 2011 has been uneven, on balance we have seen an upward movement: by 1.0 percent since September 2012 and by 3.1 percent since August 2011. We still have a significant amount of ground to make up to get back to where we were before, but at least we now appear to be heading in the right direction.”

And here is the chart to back up this statement (red line in graph below):

Being real here, median household income is far from its pre-recession peak. All economic analysis is a process of looking at a glass half-full, and trying to extricate the elements which are the drivers. Many make a mistake to believe that drivers are static – I believe in a very dynamic set of economic forces driving a consumer based economy. For now, the good forces are marginally winning. My concern is the forces of evil (aka Obamacare unintended consequences and a housing recovery failure) could drag imagined wealth and suck disposable income from the economy.

For now, income is the important driver as it sets the stage for expenditures (and the USA economy is measured by spending). The economy will not turn a new page overnight but the trends are in the right direction.

Other Economic News this Week:

The Econintersect economic forecast for Rail movements growth trend is continuing to accelerate.

All other data released this week either does not have enough historical correlation to the economy to be considered intuitive, or is simply a coincident indicator to the economy.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.