Strong Finish On Friday For S&P And NASDAQ As Russell 2000 Struggles

Declan Fallon | Jun 01, 2020 12:03AM ET

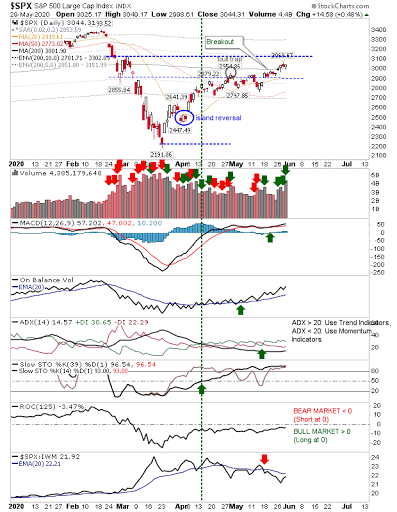

Last week closed strongly with volume rising in confirmed accumulation across indices.

The S&P 50 remained above its 200-day MA on increasing accumulation (rising On-Balance-Volume) as relative performance against the Russell 2000 and NASDAQ remained weak. The index remains on course to challenge the mini-swing high from February—a milestone already achieved by the NASDAQ.

The NASDAQ completed the closure of the February breakdown gap and is just left with February highs to beat before it has a chance to challenge 10,000.

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) is still playing catchup, and is struggling to reach the milestones achieved by the S&P and NASDAQ. On Friday it posted a slightly lower close after a big bearish engulfing pattern from Thursday—which itself came off a failed challenge on the 200-day MA. The one thing working in its favor is the relative performance advantage to the NASDAQ and S&P.

The NASDAQ is on course to reverse the entire COVID-19 decline, probably well before the virus disappears in relevance. If this does happen, it will give buyers confidence to do the same for the Russell 2000 or S&P. This coming week could be a big one for the index.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.