Stocks Slide; Dollar Inches Higher Market Update

AvaTrade | Dec 15, 2017 01:49AM ET

Overview

- Dollar finds support after the dovish Fed drove the currency lower

- Chinese stocks sell-off after the PBoC hike rates

- Brent oil dropped 1.4% on Wednesday

The Federal Reserve left interest rate expectations for 2018 and 2019 unchanged. Lagging inflation remains to be the centre of conversation for policymakers. Despite the lack of price stimulation, members decided to raise the cost of borrowing by 25 basis points as expected.

The dollar is 0.03% higher after the Fed raised interest rates for the third time this year. The greenback dropped by 0.7% overnight as investors digested the Fed’s dovish tone.

European stocks are slipping, taking ques from the lacklustre Asian trading session.

Germany’s DAX 30 is 0.22% lower, while France’s CAC 40 is down 0.11%. London’s FTSE 100 has fallen by 0.06% and Spain’s IBEX 35 is 0.33% weaker.

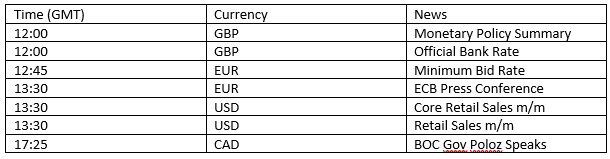

Later today it’s the European Central Bank’s and the Bank of England’s turn to announce their interest rate decision. The central banks are expected to keep interest rates on hold.

Leading up to the interest rate decisions; the euro is 0.05% stronger against the dollar. Sterling is 0.14% higher against the greenback and has gained 0.2% against the euro.

The People’s Bank of China increased rates by 5 basis points for its medium-term lending facility and reserve repos. China’s stocks declined as a result of the rate hike. Hong Kong’s Hang Seng fell 0.68%, while the China A50 slipped by 0.77%.

Commodities

Oil prices are subdued after Brent oil gave up 1.4% on Wednesday and Crude oil lost 1% in the previous session.

Brent oil is 0.27% lower today, trading at $62.50 per barrel. Crude oil is 0.22% weaker, trading at $56.85.

Gold got a boost from the sell-off in equity markets, gaining 0.09%, trading at $1256.35.

Coming up

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.