Stocks In Asia Show Small Gains; Japanese PMI Drops in July

Danske Markets | Jul 31, 2012 08:56AM ET

- Very limited action overnight as markets await Fed and ECB meetings

- Stocks in Asia showing small gains on earnings – except China that still trades weak

- Japanese PMI drops further in July

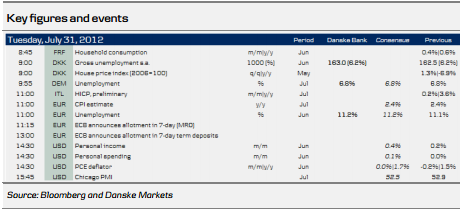

- Focus continues to be on central banks with only tier-2 data released today

Financial markets have been very quiet overnight with most markets trading broadly sideways ahead of the Fed and ECB meetings this week. While there is little expectation of action from the Fed tomorrow, markets are geared up for a decent response from the ECB following president Mario Draghi’s “Believe me, it will be enough” comment last week. Markets are a bit sidelined now, though, as it is unclear how much Draghi can persuade his fellow central bankers in Frankfurt to do. Der Spiegel yesterday wrote about

the divisions inside ECB.

The news flow has been quite limited overnight. Japanese PMI released took a dive to 47.9 in July from 49.9 in June providing yet more evidence that the global industrial cycle is in a downturn currently. At the same time, though, Japanese unemployment fell to 4.3% in June from 4.4% in July.

Equity markets closed broadly flat in the US yesterday and the S&P 500 future has seen small gains in Asian time. Asian stock markets are also higher on anticipation of ECB action and company-related news – see Bloomberg. Chinese stocks are still trading weak, though, as the Shanghai Composite Index hit the lowest level in three years on continued concern over the economy. The improvement seen in other markets has yet to reach China where stocks have kept a negative trend.

US bond yields are unchanged from yesterday when the 10-year yield fell to 1.51%. The 10-year Spanish yield fell another 10bp yesterday to 6.57%. In FX markets EUR/USD has climbed slightly higher overnight to trade just below 1.23. Scandi currencies have been stable overnight after especially SEK strengthened yesterday on very strong GDP data.

Global Daily

Focus today: With mostly tier-2 data on the agenda markets are likely to stay sidelined ahead of the Fed meeting tomorrow and the ECB meeting on Thursday. German and euro unemployment and Euro Flash CPI are set to be released before noon. German unemployment is expected to stay unchanged at 6.8%, the lowest rate in decades. Euro area unemployment should go a nudge higher to 11.2% in June from 11.1%, another high

in the lifetime of the euro. Inflation in the euro area is seen unchanged in July at 2.4%. This afternoon US data on personal spending and core PCE deflator for June will be released. There should be few surprises in the June data as it can be distilled from last week’s Q2 GDP data. The report painted a picture of sluggish consumption growth and limited inflation pressure. US will also release Chicago PMI which is expected to decline slightly to 52.5 in July from 52.9 in June.

Fixed income markets: Following last week’s sell-off safe-haven bond markets showed some tentative signs of stabilisation yesterday. Fixed income and rate markets are expected to continue to trade cautiously ahead of the Fed and ECB meetings. Following Draghi’s bold statements last week, the markets now have high expectations of an ECB intervention and the bar for a positive surprise from the ECB seems relatively high. After the German and Danish bond sell-off last week, even a slight disappointment from the ECB could give way to a new rally in core bond markets later this week. The joker is of course whether the Fed decides to go along with some monetary easing tomorrow, which could make life a bit easier for the ECB in terms of underpinning the recent positive market sentiment. With a light calendar today we do not expect any big moves in the rate markets – at least not until the US ISM and FOMC meeting tomorrow. In the fixed income market the EFSF is printing EUR1.5bn 1.125% 2015 bonds today.

FX markets are in waiting mode ahead of the big central bank events this week but in general we expect the positive sentiment to continue today and with room for new longs in cyclical and commodity currencies AUD, CAD and NZD are expected to continue to perform. If this level is tested strong support is not seen before 8.1750, the 15 June 2000 low. In respect of EUR/USD, German unemployment has the potential to move the cross. Overall we look for upside for EUR/USD ahead of the FOMC and ECB meetings. Even though some short speculative EUR positions were probably taken out last week when EUR/USD jumped 2.5 big figure, there is still a risk of further short-covering. For more on positions see the IMM Update that we published yesterday.

Scandi Daily

In Scandinavia all eyes are on SEK. EUR/SEK dropped 12 big figures yesterday after the much stronger than expected GDP numbers. The market is still able to price out rate cuts in Sweden and further downside for EUR/SEK is expected today. Next strong support for EUR/SEK is seen at 8.2960, the 9/14 August 2000 low.

Disclosure:

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst’s personal view about the financial instruments and issuers

covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of the Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. Employees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the

Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate

finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be

obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without

limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not

undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S.

Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors”.

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.