Stock Sentiment Has Been This Bullish Just Twice In Past 2 Decades

Jesse Felder | Dec 18, 2019 07:40PM ET

Warren Buffett’s most famous quote has to be: “Be fearful when others are greedy and greedy when others are fearful.” But how do we know when others are fearful or greedy?

I’ve written about margin debt as the Index Of The Volume Of Speculation, but there’s another indicator that can be useful in this regard and, like margin debt, it’s another real money indicator rather than just a survey of investor opinion. That is the Rydex Ratio, or the measure of Rydex traders’ assets in bear funds and money-market funds relative to their assets in bull funds and sector funds.

Just Watch

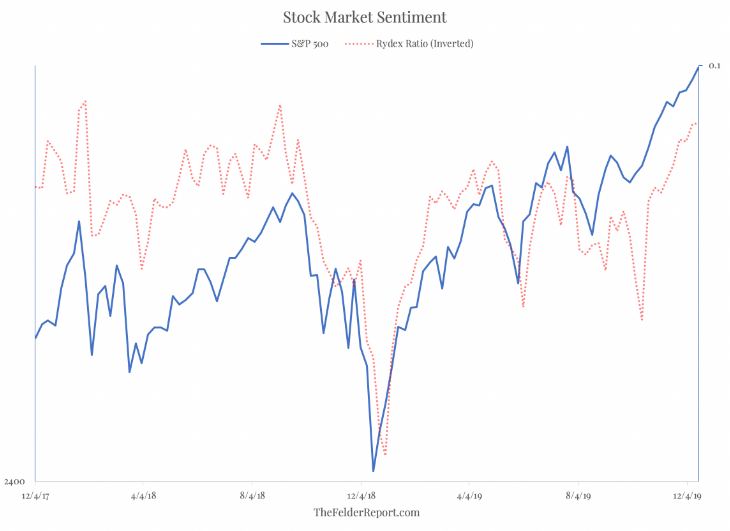

There are a few different ways to use this ratio but the simplest is to just observe the overall level of the ratio. In the chart below, the ratio is inverted so that it corresponds better with the level of the S&P 500 Index. Currently, Rydex traders are about as bullish as they were in early 2018 – just prior to the Volmageddon selloff – and again in the fall of 2018, which preceded that year's fourth quarter waterfall decline.

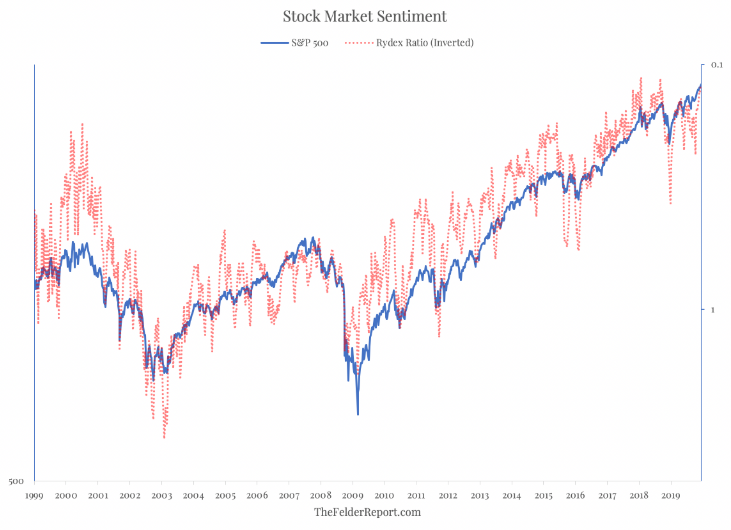

But when you zoom out even further it becomes apparent just how greedy these traders have now become. Even at the peak of the dot-com mania, from late-1999 into early-2000, they weren’t as aggressively positioned as they are today.

So, from both a short-term and long-term perspective, it’s pretty clear investors have become greedy – and to a fairly rare degree. For this reason, it may be wise to “be fearful” right now when it comes to overall equity exposure.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.