Dow, SPX Finally Turn Positive

Double Dividend Stocks | Apr 03, 2016 02:18AM ET

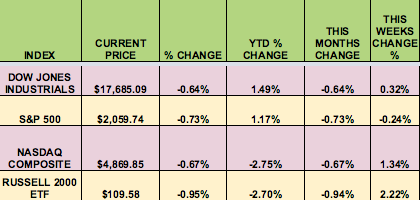

Markets: Even though all 4 indexes were negative in March, the Dow and the S&P 500 finally turned positive for 2016. However, the NASDAQ and the Russell 2000 small caps are still in the red. As you’ll see in the Sectors section below, all sectors were positive in March, with Tech, Energy, and Utilities leading the way.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Manhattan Bridge Capital Inc (NASDAQ:LOAN), Pearson PLC (NYSE:PSO), RAIT Financial Trust (NYSE:RAS), Verizon Communications Inc (NYSE:VZ).

Volatility: The VIX fell 11% % this week, finishing at $13.10, its lowest close since August 17th.

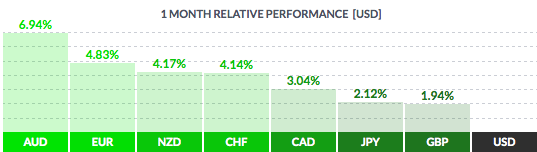

Currency: The US dollar fell vs. most major currencies in March.

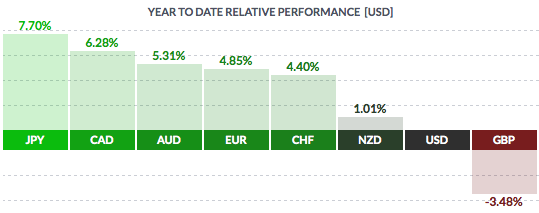

Year-to-date, the USD has fallen vs. most major currencies, except the British pound.

Market Breadth: 29 of the Dow 30 stocks rose in March, and 65% of the S&P 500 also rose in March.

US Economic News: Nonfarm Payrolls fell to 215K in March, less than the 245K created in February, but better than the forecast. Gains occurred in Retail, Construction,and Health Care, while losses happened in Manufacturing and Mining.

The Unemployment Rate went to 5% from 4.9%,

Week Ahead Highlights: Fed minutes from last month’s meeting will be released on Wed., Fed Chief Yellen a talk with former Fed chiefs Ben Bernanke, Alan Greenspan, and Paul Volcker in New York. Creditors resume talks with Greece about its latest bailout.

Next Week’s US Economic Reports:

Sectors and Futures:

Tech led in March, with Health Care trailing. Year to date, Utilities lead by a wide margin, with Financials turning in the worst performance by far, down -9.38%, followed by Health Care, which is down -5.90%.

OJ and Lumber futures led in March, with Rough Rice and the USD trailing:

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.