Stock Market Is Good News Bad News Joke

Wall Street Sector Selector | Jun 10, 2013 02:01AM ET

Major U.S. stock market indexes rallied on Friday after the monthly Non Farm Payroll Report showed modest employment gains while unemployment climbed from 7.5% to 7.6%.

The last few weeks in the stock market have been all about good news/bad news. Is good news “good” or is bad news “good” as investors try to determine the next moves by the Federal Reserve in regards to its quantitative easing program?

For the week, the Dow Jones Industrial Average (DIA) added 0.9%, the S&P 500 (SPY) climbed 0.8% and the Nasdaq (QQQ) climbed o.4%.

On My ETF Radar

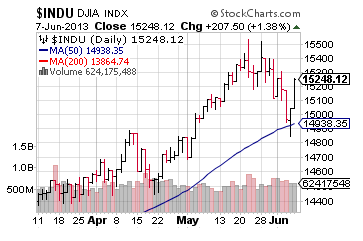

While major U.S. stock market indexes rallied, the overall action remains tepid on mediocre volume, flattening momentum and within the confines of the recent trading range. A glance at the chart of the Dow Jones Industrial Average (DIA) tells the story.

In this simple chart, we can see how the Dow Jones Industrial Average (NYSEARCA:DIA) has been correcting since reaching its recent high in late May and now has bounced off its 50 day moving average (blue line) which is always seen as significant support.

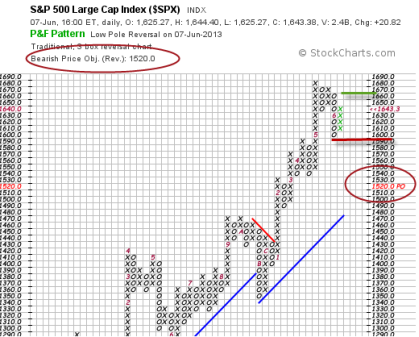

Nevertheless, in the chart of the S&P 500 (NYSEARCA:SPY) below, we can see what the bigger picture has to say.

Recent stock market action has generated a “sell” signal in the S&P 500 (NYSEARCA:SPY) with a downside price objective of 1520, 7.5% below Friday’s closing price. Strong support is at 1600 while a break above 1660 would mark the resumption of the recent uptrend.

All of this will depend upon the stock market’s reaction to the Federal Reserve’s impending withdrawal of its easy money programs and if “good” news is good or “good” news is bad as the stock market’s good news/bad news joke continues.

Since today’s stock market is all about the Fed, all the time, recent developments point to the end of quantitative easing coming into view.

Fed Chairman Bernanke started the discussion during his recent testimony before Congress and on Friday, famed Fed reporter, Wall Street Journal’s John Hilsenrath, penned an article headlined,”Fed On Track To Ease Up On Bond Buying Later This Year” in which he said that “Federal Reserve officials are likely to signal at their June policy meeting that they’re on track to begin pulling back their $85-billion-a-month bond-buying program later this year, as long as the economy doesn’t disappoint.” Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.