Stock Exchange: How Do You Filter Out Noisy Trade Signals?

Jeff Miller | Apr 20, 2018 02:20AM ET

The Stock Exchange is all about trading. Each week we do the following:

- Discuss an important issue for traders;

- highlight several technical trading methods, including current ideas;

- feature advice from top traders and writers; and,

- provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review:

Our previous Stock Exchange asked the question: How Do You Allocate Your Trade Risk Budget? We noted that trading results depend, in part, on other market participant actions that are out of your control. And therefore, budgeting your risk exposures can be critically important. For example, asset class diversification, process diversification, timing luck, “internal dialogue,” stop orders, and position sizing are just some risk budgeting concepts to consider. A glance at your news feed will show that the key points remain relevant.

This Week: How Do You Filter Out Noisy Trade Signals?

With an ever growing amount of market data and news, it’s easy for traders to feel overwhelmed and distracted. However, as Dr. Brett Steenbarger shares in yet another exceptional article , it’s not information overload, it’s filter failure.

We couldn’t agree more, and this is exactly why it’s so important to have a disciplined repeatable trading process. This can quickly help you drown out the noise and focus on what matters. As we’ll see later in this article, each of our trading models adheres to its own strict and objective trading strategy. And filtering out noise has been a key to our model building process. For example, as we’ve written in this article , disciplined entry and exit points are one example of what can separate successful traders from the rest of the pack. And without discipline, you could end up chasing (or running from) every noisy news story or unrelated data point you come across.

In relation to the ever increasing complexity and information available to traders, Michael Harris notes the growth of quant within the world of technical analysis in this article . Specifically, he explains how the Chartered Market Technician program is increasingly shifting its focus to quant, a move that may not be palatable for all technicians. He shares an interesting quote attributed to John Bollinger:

Quants are not gonna make it. They carry too much baggage. Technicians are going to be the ones to make the next big opportunities

Quantitative strategies can be extremely complex, a characteristic that puts them out of reach for many traders, and makes them error-prone for others.

Also interesting, this article by Mark Rzepczynski notes that:

There has been an explosion of alternative measures and methods to access market betas and risk premiums, yet it is not always easy to explain what this added complexity should give investors.

And while the added complexity creates challenges, the article notes there are some benefits, for example:

The decomposition of risk into different factors or risk premium has allowed for more reordering of the risk within a portfolio. The reordering of risk premium should result in smoother return to risk trade-offs.

In our view, even matching the market is good if you can smooth out returns, as Mark describes. Beating the market is even better.

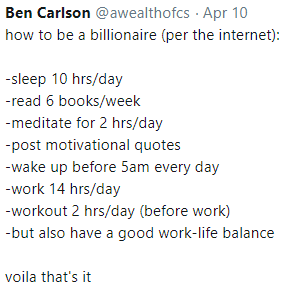

And for some lighthearted humor on the concept of information overload, here is a post from Ben Carlson on how to become a billionaire:

…If there were only 28+ hours per day.

Model Performance:

Per reader feedback, we’re continuing to share the performance of our trading models.

We find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

And for these reasons, I am changing the “Trade with Jeff” offer at Seeking Alpha to include a 50-50 split between Holmes and Athena. Current participants have already agreed to this. Since our costs on Athena are lower, we have also lowered the fees for the combination.

If you have been thinking about giving it a try, click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

This week’s Stock Exchange is being edited by Blue Harbinger (a source for independent investment ideas).

Road Runner: This week I sold my Amazon (NASDAQ:AMZN) position. I originally purchased the shares on 3/19, which is consistent with my typical holding period of four weeks. How do you feel about that one, Blue Harbinger?

Blue Harbinger: I feel that was a bumpy ride, based on your buy and sell charts (above). If you’d have just bought a year ago and held, you’d be up big time, Road Runner.

RR: I am a trend follower, and I hold my positions for four 4-weeks. This is not the first time I’ve done a round-trip Amazon trade, and in aggregate I have been very profitable with my strategy over the long-term. Besides, my strategy also works well when blended with the other trading models because that provides a strong return stream that is differentiated from the market. This lower correlation is far more attractive to some market participants than is Amazon’s high volatility and high beta. Amazon’s beta is closer to two than it is to the market average of one.

BH: Wow, listen to you, Road Runner—talking about beta. And as I’m sure you are aware, a lot of investors believe Amazon’s market cap of $750 billion is ridiculous considering it pays no dividend and its trailing P/E is over 250! Here is a look at Amazon’s Fast Graph.

RR: Thanks for those stats, Blue Harbinger. However, I am a technical trader not a fundamental analyst. That information you are providing is basically noise to me, and I’m not going to let you distract my focus with it.

BH: I appreciate that you stick to your process, and you are filtering out my noise. However, to me it’s not noise, my selection process is different than yours. And I also realize Amazon’s revenues are growing dramatically, not only from Prime and its online marketplace, but also from Amazon Web Services, which is the clear market leader in the cloud space—easily beating the likes of Microsoft (NASDAQ:MSFT) (the second biggest cloud company).

RR: One model’s trash is another man’s treasure.

BH: Okay. Thanks. How about you, Felix—any trades this week?

Felix: Yes. I purchased Macquarie Infrastructure (MIC) on 4/16. Ever heard of it?

BH: Yes—it’s a company that invests in infrastructure companies. It targets companies operating in the fields of airport services, bulk liquid terminals, gas production, and distribution. Why do you like this stock, Felix?

Felix: I like it because I am a momentum trader, and I typically hold my positions for 66 weeks, on average. And based on the following chart, you can see it has attractive upside.

BH: Based on the chart, I am not exactly seeing the momentum you’re talking about, Felix. Macquarie Infrastructure’s share price was falling for months, and then it cratered in February after an ugly earnings release in which it essentially forecast a dividend cut. Here is a look at this company’s Fast Graph.

Felix: This company is in better shape than you’re realizing from a technical standpoint. Check back with me down the road, and you’ll see what I am talking about.

BH: Okay, thanks, I guess. A little vague, but I realize your 6 and 12-month track record (as shown earlier) is very strong. I also know there is a lot more to your methodology that I am not privy to. Do you have anything else you want to share?

Felix: Yes, I ran the Russell 1000 (large cap stocks) through my model, and the top 20 results are included in the following list.

BH: Interesting list, Felix. Some of the names on your list (e.g. Square (NYSE:SQ) and Netflix (NASDAQ:NFLX)) seem to have a lot more momentum that your Macquarie pick, but I know your process continues to be highly successful. Thanks for sharing. And how about you, Athena—any trades this week?

Athena: Yes—I sold my Abercrombie & Fitch (ANF) shares this week for $28.23. If you recall, I bought them on 2/5 for $20.25.

BH: Not a bad trade, Athena. Why’d you buy and then sell.

Athena: As a momentum trader, with an average holding period of about 17-weeks, I buy into the momentum, and then sell when my price target is reached.

BH: And I assume you’re not interested in knowing that ANF’s EPS has been trending lower for years. ANF is a retail store, and retail stores have been getting trounced by internet companies as consumer shopping habits evolve. Here is a look at the Fast Graph.

Athena: Thanks for that information, but it’s all just noise to me. I am a technical trader, and I don’t allow myself to get overloaded with unnecessary data.

BH: Okay then, Athena—thanks. And how about you, Oscar—do you have anything for us this week?

Oscar: Yes. This week I ran the high volume ETF universe through my model, and the top 20 are ranked in the following list.

BH: Interesting list, Oscar. I see oil USO ranked near the top of your list. This makes sense considering you are a momentum/trend-follower. I also know you typically hold for about 6-weeks before you rotate into a new sector—which is helpful context as I look through the names on your list. I also think it is interesting to see the Ultra Short VIX (UVXY) at the top of your list. Seems like you believe market fear and uncertainty will diminish, at least over the next 6-weeks.

Conclusion:

Information overload is a real risk for traders, unless they can focus their efforts and drown out the unnecessary noise. One good way to do this is to have a disciplined trading strategy, such as each of our trading models, and then stick to it (often easier said than done). Nonetheless, if you want to be a successful trader (also easier said than done) you need to focus on a strategy that works for you and that allows you to stay focused.

Background On The Stock Exchange:

Each week, Felix and Oscar host a poker game for some of their friends. Since they are all traders, they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check out Background on the Stock Exchange for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am usually the only human present and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities.

Stock Exchange Character Guide:

| Character | Universe | Style | Average Holding Period | Exit Method | Risk Control |

| Felix | NewArc Stocks | Momentum | 66 weeks | Price target | Macro and stops |

| Oscar | “Empirical” Sectors | Momentum | Six weeks | Rotation | Stops |

| Athena | NewArc Stocks | Momentum | 17 weeks | Price target | Stops |

| Holmes | NewArc Stocks | Dip-buying Mean reversion | Six weeks | Price target | Macro and stops |

| RoadRunner | NewArc Stocks | Stocks at bottom of rising range | Four weeks | Time | Time |

| Jeff | Everything | Value | Long term | Risk signals | Recession risk, financial stress, Macro |

Getting Updates:

Readers are welcome to suggest individual stocks and/or ETFs to be added to our model lists. We keep a running list of all securities our readers recommend, and we share the results within this weekly “Stock Exchange” series when feasible. Send your ideas to “etf at newarc dot com.” Also, we will share additional information about the models, including test data, with those interested in investing. Suggestions and comments about this weekly “Stock Exchange” report are welcome.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.