Sterling Rises On Get Out Of Jail Card

MarketPulse | Dec 04, 2018 06:43AM ET

Tuesday December 4: Five things the markets are talking about

Stocks fell in Asia, are on the back foot in Europe, and looking to open in the red in North America as the market reins in its optimism over any breakthrough in the Sino-U.S trade war. U.S Treasury prices remain better bid, while the ‘mighty’ U.S dollar again underperforms across the board.

The optimism that drove gains for riskier assets yesterday is disintegrating as investors struggle to figure out exactly what was agreed between the U.S and China on trade at the weekend.

Lack of specifics from the Trump administration again has the market worried and unless there is clarity, investors can expect more of the same as we approach the year-end.

Note: China statement said nothing about its commitment to remove U.S auto tariffs, nor was there any mention of a three-month deadline.

In the Treasury market, U.S 3-year yields have backed up above U.S 5’s – an inverted curve – potentially suggesting an end of the Fed’s tightening cycle.

Note: U.S 2/10’s curve remains upwardly sloped.

Elsewhere, crude oil remains better bid ahead of this week’s OPEC+ meeting (Dec 6).

On tap: U.S financial markets will close tomorrow for a national day of mourning to honour former President George Bush. Fed Chair Powell’s testimony to Congress scheduled has been cancelled.

1. Stocks see red

In Japan, the Nikkei dropped overnight with investors selling off exporters and financials, while profit taking continued on cyclical stocks that rallied on Monday. Both the Nikkei and broader Topix fell -2.3%. The index rallied to a two-week high on Monday.

Down-under, Aussie shares closed lower on growing concerns over whether the world’s two largest economies can resolve their trade differences before a three-month deadline. The S&P/ASX 200 index fell -1.01% at close of trade. In S. Korea, the Kospi fell -0.82%, weighed down mostly by the underperforming tech sector.

In China and Hong Kong, stocks lost steam overnight, as investors come to terms with the fact that the relationship between U.S and China has not improved, while China’s economy continues to face downward pressure. The blue-chip CSI300 index rose +0.2%, while the Shanghai Composite Index gained +0.4%. In Hong Kong, the Hang Seng index rallied +0.3%, while the China Enterprises Index gained +0.2%.

In Europe, regional bourses trade lower across the board, fading some of the sharp trade related gains seen yesterday, following declines in Asia and lower U.S index futures.

U.S stocks are set to open in the ‘red’ (-0.48%).

Indices: Stoxx600 -0.41% at 359.70, FTSE -0.44% at 7,031.79, DAX -0.71% at 11,384.51, CAC-40 -0.66% at 5,020.71, IBEX-35 -0.74% at 9,109.00, FTSE MIB -0.41% at 19,541.50, SMI -0.22% at 9,084.50, S&P 500 Futures -0.48%

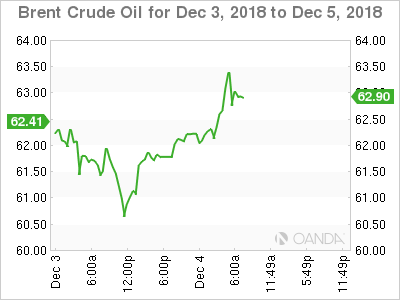

2. Oil bid on expectations of OPEC-led output cuts

For now, oil prices remain better bid, extending Monday’s gains ahead of expected output cuts by OPEC and a mandated reduction in Canadian supply.

Brent crude oil is up +75c, or +1.2%, at +$62.44 per barrel, while U.S light crude (WTI) is up +65c at +$53.60.

Note: Both benchmarks rallied +4% yesterday after the U.S and China pledged to pause an escalating trade dispute.

OPEC and Russia will meet on Thursday to agree future output. The group is expected to announce production cuts of more than -1M bpd.

Oil also received support from Canada, where Alberta indicated that it would force producers to cut output by -8.7%, or -325Kbpd, to deal with a pipeline bottleneck that has led to crude building up in storage.

Note: Qatar has indicated that they would leave OPEC in January – their oil production is only around +600K bpd, but it is the world’s biggest exporter of liquefied natural gas.

Ahead of the U.S open, gold prices have rallied to a one-month high earlier this morning, supported by a weaker U.S dollar. Spot gold has rallied +0.6% to +$1,238.36 per ounce. Prices touched a peak of +$1,238.83 earlier in the session. U.S gold futures are up +0.3% at +$1,243.4 per ounce.

3. U.S 3/5’s yield curve inverts as appetite for risk increases

A strong appetite for risky assets after last weekend’s Sino-U.S Trade truce has led to a yield-curve inversion in the 3/5’s curve and a weaker U.S dollar.

The 3/5’s spread fell to negative -1.4 bps Monday – the first inversion in a decade.

A better measure for a possible recession, the U.S 2/10’s spread, has fallen to +13 bps, the lowest in years.

There are a couple of way’s to interpret this, first, the underperformance of the longer dated U.S paper vs. the shorter-dated ones shows the shift of money into U.S equities now that trade disputes are put on hold. Second, it also shows that investors are pricing in a less bullish Fed.

Down-under, the Reserve Bank of Australia (RBA) left the Cash Rate Target (NYSE:TGT) unchanged at +1.50% as expected – it’s the 24th consecutive pause in the current easing cycle.

Governor Lowe reiterated the central banks stance, that low rates were supporting the economy and that progress on unemployment and inflation to be gradual. He also saw Australian GDP growth averaging ~3.5% over the coming years.

4. Sterling rises on get out of jail card

The pound (£1.2823) has rallied after the European Court of Justice’s (ECJ) advocate general said that the U.K. could still cancel Brexit by revoking Article 50 without the consent of other E.U member states.

The recommendation is significant because it could be a way for the U.K. to avoid a no-deal Brexit, even though such a move would add further uncertainty for the pound.

EUR/USD (€1.1404) has edged back above the psychological €1.14 handle as U.S 10’s yields test below +3% at +2.95% for a three-month low.

Investors continue to speculate that the Fed would slow the pace of its rate hikes further out the curve. The U.S dollar has also been impacted by the ‘temporary’ truce in the Sino-U.S trade dispute as cash flowed into riskier currencies vs. the safe-haven USD.

The Japanese yen has rallied +0.8% to ¥112.78, its strongest increase in a fortnight on the biggest increase in more than five-months.

Elsewhere, South African Q3 GDP jumped +2.2% q/q vs. -0.7% in the comparable period – USD/ZAR has fallen -1% to a four-month low of $13.5419.

5. U.K construction PMI unexpectedly rises

U.K data this morning showed that the construction sector activity in the U.K economy grew at a faster pace than expected in November.

The final Purchasing Managers’ Index (PMI) came in at 53.4 in November, up from 53.2 seen in October – the market was expecting 52.5.

According to IHS Markit “November data indicates that the U.K construction sector remains in expansion mode, with resilient business activity trends seen for housing, commercial and civil engineering activity. The latest overall rise in construction output was the fastest since July, helped by a stronger contribution to growth from house building activity.”

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.