Speculators Added Foreign Currency Exposure Before Trump Talk

Marc Chandler | Apr 16, 2017 12:29AM ET

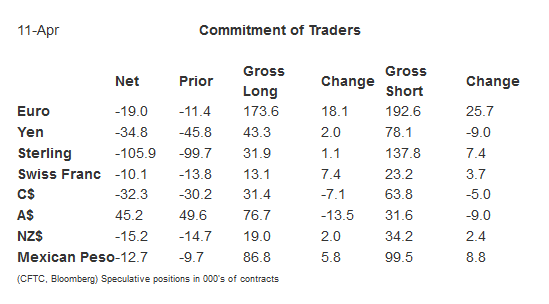

In the days before US President Trump expressed concern about the dollar's exchange value, speculators in the futures market mostly added to the gross long foreign currency positions. There were two exceptions, the Canadian and Australian dollars, which supports our suspicions of a change in sentiment toward the dollar-bloc currencies.

The bulls liquidated 13.5k long Australian dollar futures contracts bringing their holdings down to 76.7k contracts. The bears covered 9.0k previously sold contracts, leaving 31.6k. The net position fell for the second consecutive week. The net short Canadian dollar position grew for the fourth consecutive week, and now at 32.3k contracts,it is the largest in a year.

Besides the gross long Australian dollar position, there were two other gross position adjustments in excess of the 10k contract threshold and they were both in the euro. The gross long speculative position increased by 18.1k contracts and the gross shorts increased by 25.7k contracts to 173.6k contracts and 192.6k contracts respectively. The net short position increased to 19.0k, the second weekly increase.

Even though the gross position adjustments in the yen were minor, it is worth reviewing. It lends support to our hypothesis that the yen's gains have been more a function of short-covering than safe haven buying. In the most recent reporting period 9k short contracts were covered and 2k contracts were added to the gross long position. The net short position was reduced by 11k contracts to 34.8. The four-week decline brought the net short position to its smallest since early December.

Look at what has happened this year. The gross speculative long position increased by 2.7k contracts. The gross short position has fallen by 46k contracts since the end of last year and 28k since the middle of March.

Bulls and bears saw opportunity in the 10-year note futures, though in the two days after the reporting period ended, the yield fell 10 bp to new lows since last November. The bulls added 68.6k to the gross long position that now stands at 682.3k contracts. It has grown by 210k contracts since the end of February. The bears tried picking a top and added 77.4k contract to the gross short position, which stands at 746.8k contracts. This snapped a five-week short-covering phase that had seen the gross shorts fall from a record 882k contracts to 669k contracts.

While speculators added to gross long and short 10-year Treasury note futures, they reduced exposure to the light sweet crude oil futures. The shorts capitulated and covered 32.7k contracts, reducing the gross short position to 208.9k contracts. The longs were trimmed by 4k contracts to 646k These gross adjustments led to a 28.7k-contract increase in the net long position to 437k.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.