Speculators Raised USD Index Bullish Bets As Euro Bets Rising

Zachary Storella | Apr 05, 2020 02:19AM ET

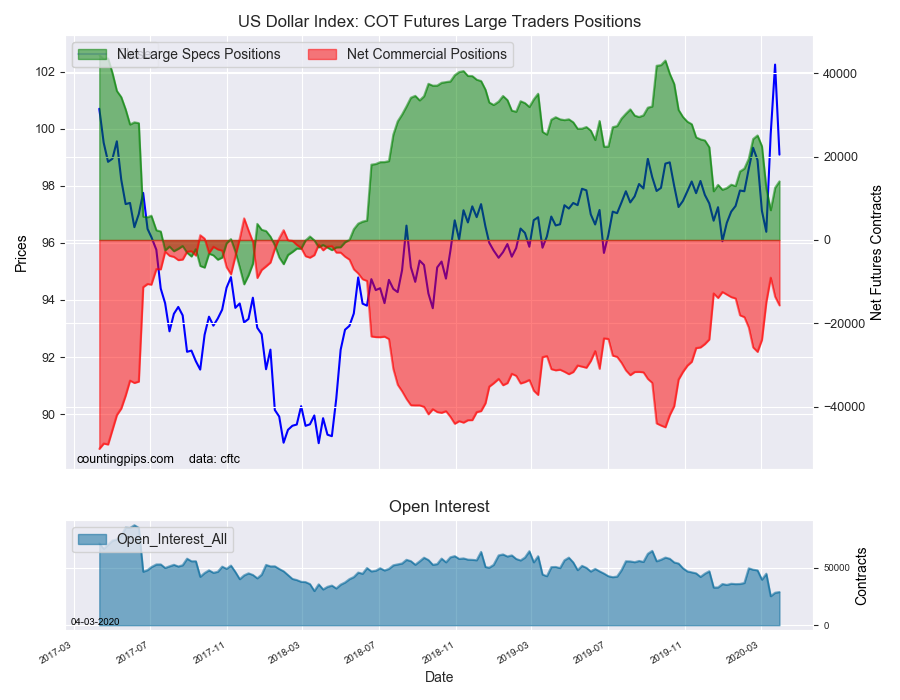

US Dollar Index Speculator Positions

Large currency speculators increased their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 14,065 contracts in the data reported through Tuesday March 31st. This was a weekly gain of 1,545 contracts from the previous week which had a total of 12,520 net contracts.

This week’s net position was the result of the gross bullish position (longs) increasing by 496 contracts (to a weekly total of 22,952 contracts) compared to the gross bearish position (shorts) which saw a decline by -1,049 contracts on the week (to a total of 8,887 contracts).

US Dollar Index speculators increased their bullish bets for a second straight week following declines in the previous three weeks. Dollar bullish bets have now risen to the highest level of the past four weeks as trader sentiment and safe haven flows have helped keep the dollar bid in the currency markets. The dollar index price bounced this week (by about 2.50 percent) to back above the 100 level after a sharp decline (by over 3.50 percent) last week that had pushed the index to right around 98.

Individual Currencies Data this week: Euro bets jump, Peso bets continue to decline

In the other major currency contracts data, we saw two substantial changes (+ or – 10,000 contracts) in the speculators' category this week.

Euro speculators positions gained for a fifth straight week and by a total of +188,268 contracts over that time-frame. Euro bets have now risen by at least +10,000 contracts in each of these five weeks and the current positional standing resides at the most bullish level since June 12th of 2018 (a span of 94 weeks). Despite these bullish bets for the euro, the EUR/USD currency pair has been selling off and currently sits under the important 1.10 level.

Mexican peso positions were dumped once again this week by speculators for the ninth straight week. Speculative bets have now dropped by -162,701 contracts over the last nine weeks and the overall standing has landed at a small bullish position of just +7,665 contracts. This selloff in speculator bets has come fast and furious as the total speculator position was at a record high of +170,366 contracts as recently as January 28th.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (1,545 weekly change in contracts), euro (12,957 weekly change in contracts), Swiss franc (56 contracts) and the Canadian dollar (7,316 contracts).

The currencies whose speculative bets declined this week were the British pound sterling (-5,891 contracts), Japanese yen (-5,581 contracts), Australian dollar (-6,457 contracts), New Zealand dollar (-90 contracts) and the Mexican peso (-14,314 contracts).

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The Euro large speculator standing this week totaled a net position of 74,247 contracts in the data reported through Tuesday. This was a weekly lift of 12,957 contracts from the previous week which had a total of 61,290 net contracts.

British Pound Sterling:

The large British pound sterling speculator level totaled a net position of 4,993 contracts in the data reported this week. This was a weekly decrease of -5,891 contracts from the previous week which had a total of 10,884 net contracts.

Japanese Yen:

Large Japanese yen speculators came in at a net position of 18,282 contracts in this week’s data. This was a weekly decline of -5,581 contracts from the previous week which had a total of 23,863 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week totaled a net position of 4,947 contracts in the data through Tuesday. This was a weekly advance of 56 contracts from the previous week which had a total of 4,891 net contracts.

Canadian Dollar:

Canadian dollar speculators were a net position of -21,929 contracts this week. This was a gain of 7,316 contracts from the previous week which had a total of -29,245 net contracts.

Australian Dollar:

The large speculator positions in Australian dollar futures recorded a net position of -31,664 contracts this week in the data ending Tuesday. This was a weekly lowering of -6,457 contracts from the previous week which had a total of -25,207 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing reached a net position of -16,106 contracts this week in the latest COT data. This was a weekly reduction of -90 contracts from the previous week which had a total of -16,016 net contracts.

Mexican Peso:

Mexican peso speculators totaled a net position of 7,665 contracts this week. This was a weekly decrease of -14,314 contracts from the previous week which had a total of 21,979 net contracts.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.