Speculators In The British Pound Unmoved By The Heightened Stakes

Dr. Duru | Feb 28, 2016 04:55AM ET

As I wrote in “

Speculators continue their retreat from net short positions against the British pound (FXB) after the UK government sets a date for a Brexit referendum.

I am a bit surprised that the response was so muted. I expected a significant response one way or the other. Given this mild response, I will assume for now that the pace of losses for the British pound will continue to abate in line with the cooling in interest in Brexit.

Interest in Brexit is waning in the immediate aftermath of the UK government setting a date for the referendum. It is still very possible interest will bottom out at a very high level.

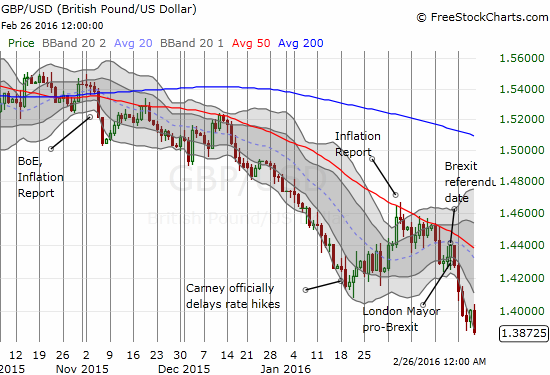

The forex picture for the British pound was mixed on the week. From Sunday to Tuesday, the pound definitely weakened across the board as the fall-out cascaded from the Mayor of London coming out in favor of leaving the European Union (EU). After that point, the pound strengthened against the Japanese yen (Guggenheim CurrencyShares Japanese Yen (N:FXY)) while it continued to slip against the U.S. dollar (DXY0). The U.S. dollar index strengthened most notably on Friday on the heels of a strong GDP.

The British pound hurtling ever lower against the U.S. dollar at a rapid pace.

The Japanese yen shows that the British pound was able to stabilize a bit in the last half the week.

The battle of words through op-eds on the Daily Telegraph continued. This time Prime Minister David Cameron wrote to convince voters to embrace the EU given a vote for Brexit would plunge the UK into uncertainty and pariah status on the world stage.

“…when the people campaigning for ‘out’ are asked to set out a vision outside the European Union, they become extremely vague. It’s simply not good enough to assert everything will be all right when jobs and our country’s future are at stake. That’s why today I want to set out some of the specific questions those who would leave the European Union must answer. They don’t owe it to me; they owe it to us all, because at the moment what they are offering is a leap in the dark…

There is no doubt in my mind that the only certainty of exit is uncertainty; that leaving Europe is fraught with risk. Risk to our economy, because the dislocation could put pressure on the pound, on interest rates and on growth. Risk to our cooperation on crime and security matters. And risk to our reputation as a strong country at the heart of the world’s most important institutions. With so many gaps in the “out” case, the decision is clearly one between the great unknown and a greater Britain. A vote to leave is the gamble of the century. And it would be our children’s futures on the table if we were to roll the dice.”

I am now waiting for the moment when currency traders realize the peril the European Union faces upon Brexit…and accordingly price the euro (FXE) down.

Be careful out there!

Full disclosure: net short the British pound and euro

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.