ECB Easing Speculation On The Rise

MarketPulse | Sep 23, 2015 06:57AM ET

The “steroids” of monetary policy from G10 central bankers has provided the global investor with what seems “unlimited” leverage to push regional indices to previously unseen levels. However as the Fed and BoE contemplate beginning their own rate-normalization policy, investors are now more exposed than ever to another major selloff in equities. The uncertainty over the timing of a first U.S rate increase in a decade continues to promote massive swings amongst the various asset classes. The Fed’s inaction, and reasons last week, has put the pressure back on the ECB and BoJ. With dealers now pricing in further QE, expect forex-trading ranges to come under scrutiny. Investors are looking for confirmation. Will they get it from Draghi this morning?

Global equities closed sharply lower Tuesday and are again under pressure this morning. Regional deceleration has been on diverging reasons. Australasia bourses have plunged after Chinese PMI came in below expectations and fell to a new six-and-a-half year low (47.0 vs. 47.5E). There had been some speculation that the China figures would show a bounce, especially given the current high profile visit of President Xi to the U.S. Due to the commodity sensitive nature, the Kiwi (N$0.6275) and Aussie (A$0.7041) currency pairs have been the G10 underperformers in forex.

In Europe, data this morning has been less gloomy and has gone someway to offset Chinas growth concerns. The eurozone has seen only a slight slowdown in its own business activity for this month, which would suggest that the spillover from China has been somewhat limited. German PMI’s for September came in a tad weaker than forecasted (manufacturing – 52.5 vs. 52.8 and services – 54.3 vs. 54.5). This has pushed down the composite to 54.3 from 55.0 in August. The data is not considered as weak as the headline would suggest. Germany’s private sector continues to expand at a healthy clip along with new orders and job growth. Certainly a plus was the preliminary PMI’s for France coming in stronger than expected (manufacturing – 50.4 vs. 48.5 and services – 51.2 vs. 51). The composite rose to 51.4 from 50.2 in August. All healthy numbers that would suggest that France’s economy is growing. Unlike Germany, investors need to look below the hood. Even a modest rise in new orders did not prevent France from cutting jobs again, and at the fastest pace in 10 months. This would suggest that Europeans second-largest economy continues to have its problems.

Data stateside yesterday showed that manufacturing activity in the Richmond Fed District weakened in September (53.1 to 51.6). This continues a string of disappointing regional factory reports. The weakness seen in the Empire State survey, the Philadelphia Fed index and now the Richmond Fed gauge would suggest that this September's ISM factory index is also likely to come under pressure.

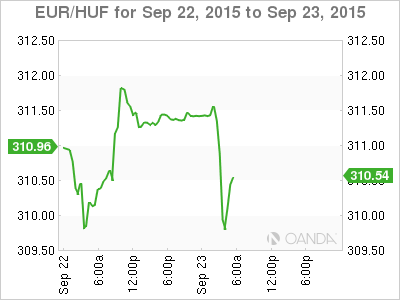

As expected the Hungarian National Bank (MNB) kept rates on hold yesterday and backed up the move with further “dovish” commentary. The CB has indicated that current levels of the base rate is in line with their achievement of their CPI goal and that inflation pressures are likely to remain moderate. Expect policy makers to continue to put the forint and domestic bond yields under pressure by pushing additional liquidity onto the financial markets (€311.00).

Scandi foreign exchange markets are expected to remain relatively quite ahead of Norges Bank (Norway) rate decision tomorrow. There are strong arguments for the central bank to cut -25bps and maintain an easing bias. Currently, fixed income traders are only pricing in -10bps worth of cuts for Thursday. If Norwegian policy makers do surprise and go deep, EUR/NOK (€9.2268) will be very active. But a “no” cut and an easing bias may only have a minor positive effect for the NOK. Perhaps Norges bank needs to be more proactive than the under pressure ECB head.

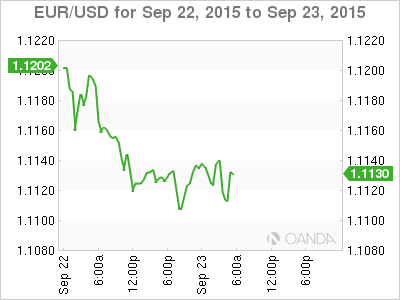

Investors are waiting for a speech by ECB president Draghi this morning (0.900am EDT). He is due to testify on monetary policy before the European Parliament’s Economic and Monetary Committee, in Brussels. Investors are looking for clues into whether the ECB is contemplating expanding its bond-buying program (€1.1133)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.