S&P 500 - Outlook For The Week Of July 15th, 2018

Satendra Singh | Jul 15, 2018 05:12AM ET

Despite the fact that the trade war between China and the US is claiming commodity markets as one of its first victims, equity markets look to ignore the aftermath impacts of trade war which has resulted in globally worsen economic conditions. China, the biggest consumer of everything from copper to coal, has warned the proliferation of tariffs could cause a global recession. On the other hand, the US import prices fell the most in more than two years in June.

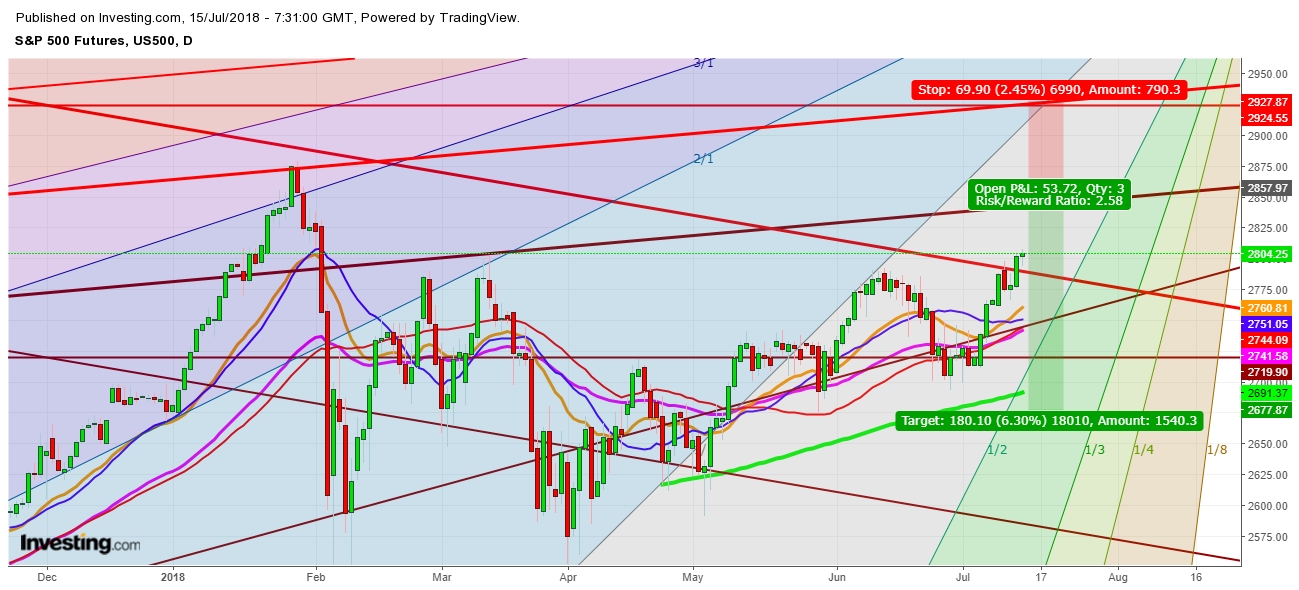

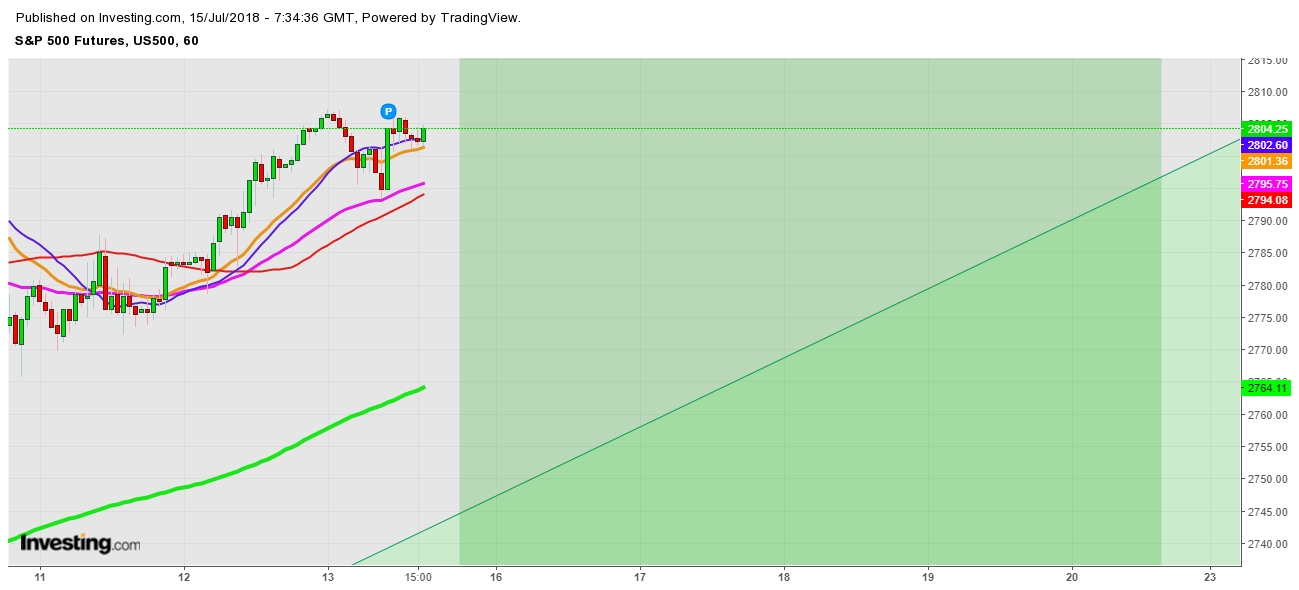

On analysis of the movement of S&P 500 Futures amid currently prevailing recessionary scenario, I find that S&P 500 futures are ready for a rally which is likely to continue during the upcoming week. No doubt that the quantum of volatility will be too high due to sudden tilt in geopolitical moves after the US President Donald Trump and Russian President Vladimir Putin will hold a summit on July 16 in Helsinki where they are likely to discuss issues on relations between the United States and Russia and other national security issues. No doubt that this meeting may bring some positive developments on the tariff-trade-war front, but I find that any change in expected development will be liable to create tremors in global equity markets this time. Traders around the World will have a vigilant eye over the developments at Helsinki on July 16th, 018. I’ve found the following expected trading zones for S&P 500 futures for the Week of July 15th, 2017. To understand the following analysis in detail subscribe my YouTube channel .

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.