S&P 500 to Keep Shining? These March Patterns Forecast More Positive Returns Ahead

Investing.com | Mar 04, 2024 07:48AM ET

- In this piece, we will look at two historically reliable indicators for the S&P 500 that are predicting positive performance.

- Alongside that, we will also take a look at recent developments in the Dow Jones challenge a widely accepted belief among investors.

- Also, we will discover the stocks with the greatest potential to drive the Dow Jones higher this year.

- Subscribe now and take advantage of up to a 38% discount for a limited time on your 1-year plan!

- Firstly, when the S&P 500 increased in November, December, January, and February, it never went down in the next 12 months. In March, the average return has been +2.1%. Over the next 10 months, the average return has been +14.9%, and for the following 12 months, it has been +17.4%.

- Additionally, when the S&P 500 went up in January and February, it has risen 27 out of 28 times since 1950 in the following 12 months. In March, the average return has been +1.40%. Over the next 10 months, the average return has been +12.2%, and for the following 12 months, it has been +14.80%.

- UnitedHealth (NYSE:UNH) +16%

- Microsoft (NASDAQ:MSFT) +14%

- Boeing (NYSE:BA) +28%

- McDonald's (NYSE:MCD) +11%

- Amazon +17.5% Chevron (NYSE: Chevron)

- Chevron (NYSE:CVX) +17% +17%

- Goldman Sachs (NYSE:GS) +6.5%

- Amgen (NASDAQ:AMGN) +9%

- Itochu (OTC:ITOCY)

- Mitsubishi Corp. (TYO:8058)

- Mitsui (TYO:8031)

- Sumitomo (TYO:8053)

- Marubeni (OTC:MARUY)

- Japanese Nikkei +19.26%

- Nasdaq +8,42%

- FTSE MIB +8.51% +8.51

- Euro Stoxx 50 +8,26%

- S&P 500 +7.70%

- Dax German +5.87% +5.87

- Cac French +5.18

- Dow Jones +3.71%.

- Ibex 35 Spanish -0.37%

- FTSE 100 British -0.66

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add shortly.

March could see the S&P 500 continue to post gains, historical patterns suggest. These trends have been proven right many times in the past, but only time will tell if they will continue to be reliable indicators.

The two historical patterns are as follows:

Meanwhile, Dow Jones Is Undergoing Some Changes

The Dow Jones is making some changes. Amazon (NASDAQ:AMZN) is stepping in for Walgreens (NASDAQ:WBA), and Uber (NYSE:UBER) is taking over from JetBlue (NASDAQ:JBLU).

Walgreens is getting the boot due to its poor profitability, plummeting by -58.22% since joining the index. In contrast, Amazon has soared by +178,602% since its stock market debut and inclusion in the index.

There's a common belief that entering an index benefits stocks, while exiting harms them. The logic is that when a stock enters a major index, passive management funds replicating the index must buy its shares to maintain accurate performance replication. Conversely, when a stock exits, funds are no longer obligated to hold its shares.

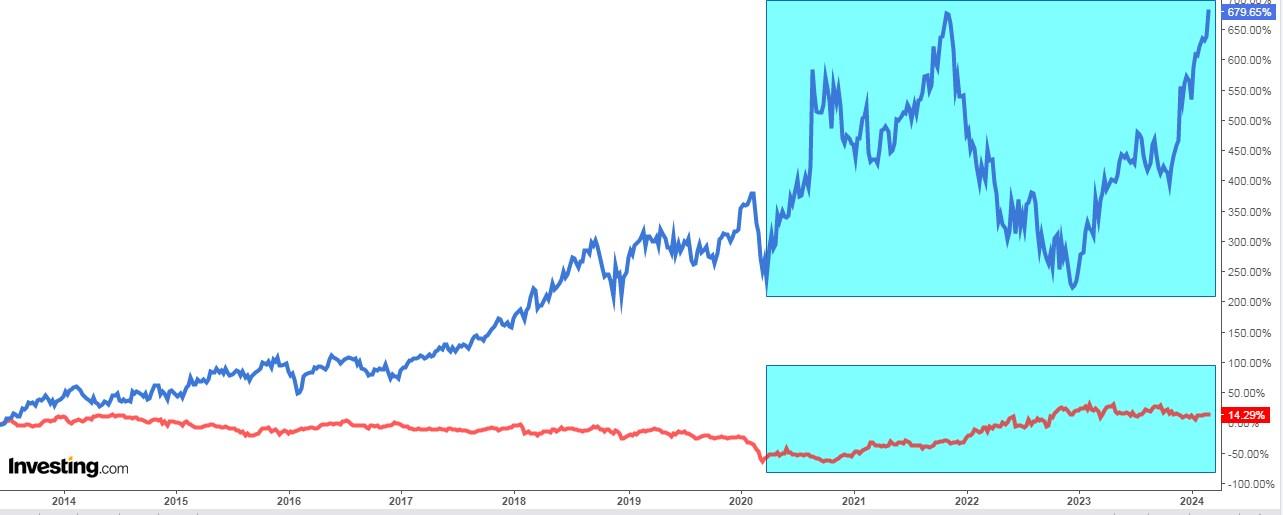

However, this belief isn't always proven right. For instance, the last time the Dow Jones saw changes was almost four years ago, with Salesforce (NYSE:CRM) replacing Exxon Mobil (NYSE:XOM). Since then, Exxon Mobil shares have seen an annualized return of +36%, compared to +9% for Salesforce.

Examining a study by Jeremy Siegel and Jeremy Schwartz, companies exiting the S&P 500 (1957-2003) outperformed, on average, the companies that entered the index. Similar trends were observed with stocks exiting the Russell 2000 (1979-2004) compared to those entering.

In reality, the logic behind index changes doesn't always hold. So, we should be cautious about assuming this rule always applies.

Which Dow Jones Stock Can Lead Gains This Year?

Wall Street has a list of stocks that could lift the Dow Jones this year.

Here are the stocks that would contribute the most to the rise of the Dow Jones this year along with the weightage in the index:

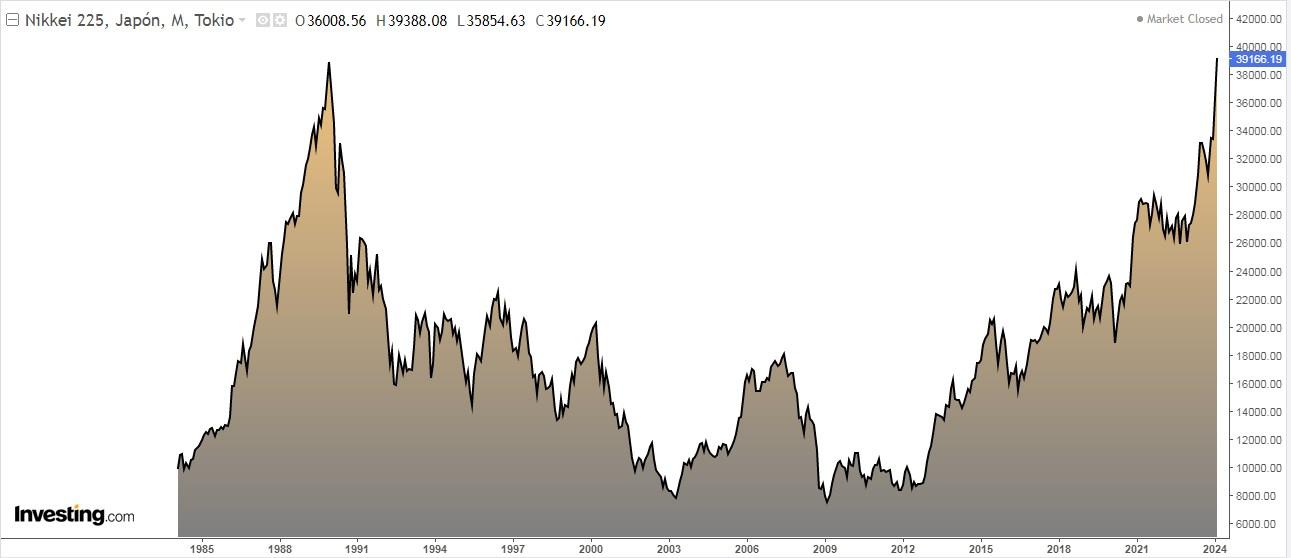

Nikkei 225: Can Index Continue Historic Climb?

It took more than three decades, but the Nikkei 225 finally managed to set all-time highs and break above the record highs set back in December 1989. The index breached the 40,000 point mark for the first time ever.

Note that at its peak in 1989, Japan had a CAPE index of 78, making it a bubble, compared to a CAPE of 18 for the U.S. stock market at the time.

Months ago, Warren Buffett already expressed his interest in the Japanese stock market as he increased his stake by 5% in these five companies:

Stock Market Ranking So Far in 2024:

Here's how the world's major stock exchanges are ranking so far in 2024:

Investor sentiment (AAII)

Bullish sentiment, i.e. expectations that stock prices will rise over the next six months, rose to 46.5% and remains above its historical average of 37.5%.

Bearish sentiment, i.e. expectations that stock prices will fall over the next six months, fell to 21.3% and remains below its historical average of 31%.

***

Do you invest in the stock market? Set up your most profitable portfolio . With it, you will get:

Act fast and join the investment revolution - get your OFFER

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.