S&P 500: New Medium-Term Low. Is Panic Over?

Sunshine Profits | Jun 14, 2022 10:27AM ET

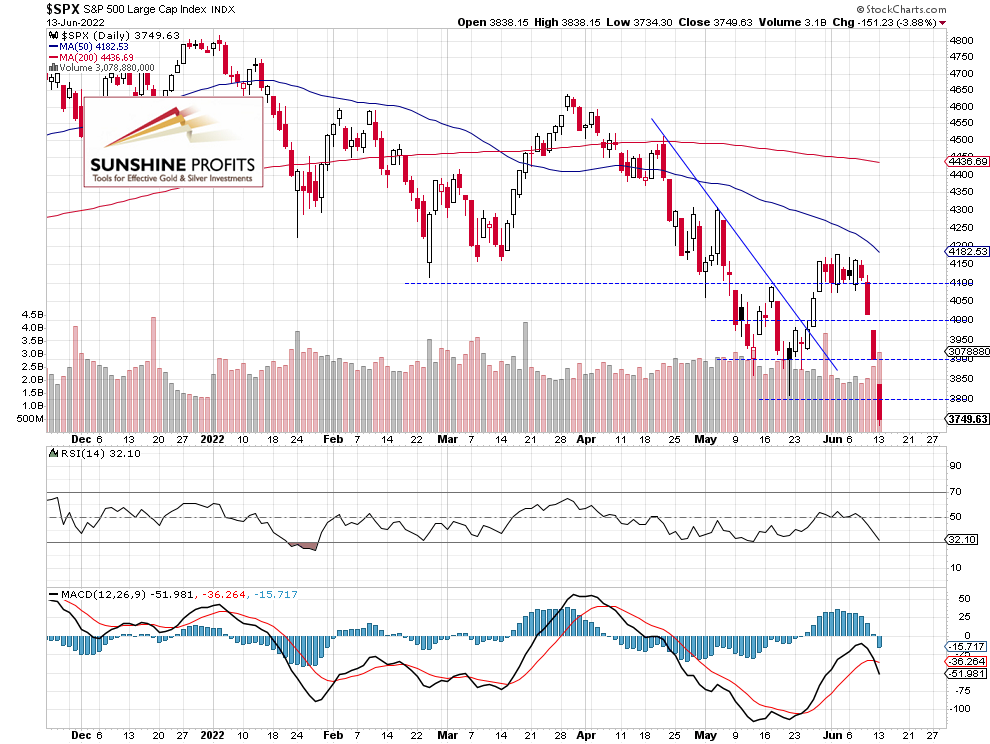

The S&P 500 index accelerated its sell-off, as it broke below the 3,800 level yesterday. The market is frightened by tomorrow’s FOMC Statement release. Is it getting closer to a bottom?

The broad stock market index lost 3.88% Monday, following its last Thursday’s and Friday’s sell-off of more than 5%. Yesterday’s daily low was at 3,734.30. The S&P 500 index was 1084.3 points or 22.5% below its Jan. 4 record high of 4,818.62.

There’s still a lot of uncertainty and worries about inflation data, tightening Fed monetary policy and the Russia-Ukraine conflict. The market will be now waiting for tomorrow’s FOMC Rate Decision announcement.

The nearest important ):

Futures Contract – Below Previous Lows

Let’s take a look at the hourly chart of the S&P 500 futures contract. It was trading within a consolidation above the 4,080 level last week, and on Thursday it broke lower. Yesterday, the market broke below its previous lows. However, we may see a short-term upward correction here.

Conclusion

We may finally see a rebound on the S&P 500 after a three-day-long sell-off.

Investors will be waiting for the Wednesday’s FOMC’s interest rate decision release.

Here’s the breakdown:

- The S&P 500 index accelerated its sell-off on Monday, as it lost almost 4%; we may see a rebound this morning.

- In our opinion, no positions are currently justified from the risk/reward point of view.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.