Earnings Estimates: Why Not All News Is Grim

Brian Gilmartin | Mar 29, 2020 02:21AM ET

Amid all the doom and gloom, here are the companies that have announced that they will looking to add to their workforce in the coming months:

- Walmart (NYSE:WMT): 150,000 workers to be hired

- Pepsi: 15,000 addi’l workers to be hired

- PapaJohn’s: 20,000 workers to be hired

- CVS: 50,000 workers to be hired

- Dollar General (NYSE:DG): 143,000 workers to be hired

- PizzaHut: 30,000 workers to be hired

- Oreo: 1,000 workers

- Honeywell (NYSE:HON): 500 workers to be hired

This list is by no means comprehensive or scientific. A list was kept on my desk as I read the wires on Briefing.com or heard the headline on CNBC.

Not all the news is grim.

———————————-

Of the 11 sectors of the S&P 500, here is the sector ranking from highest to lowest as a percentage of the S&P 500 market cap (as of Thursday, 3/26/20):

- Tech: 25.7%

- H/Care: 15%

- Financials: 11.7%

- Comm Serv: 10.7%

- Cons Discr: 9.9%

- Industrials: 8.4%

- Cons Spls: 7.6%

- Ute’s: 3.5%

- Real Estate: 3%

- Energy: 2.7%

- Basic Mat: 2.4%

- SP 500: 100%

The top 3 sectors are 53% of the S&P by market cap, while the bottom 4 sectors are 11%. The top 5 sectors today are roughly 75% of the S&P 500’s market cap.

Source: IBES by Refinitiv

Here is the ranking in mid-February ’20 near the peak of the S&P 500:

- Tech: 24.6%

- H/Care: 13.8%

- Financials:15.3%

- Comm Serv: 10.5%

- Cons Discr: 9.9%

- Industrials: 9.0%

- Cons Spls: 7.1%

- Ute’s: 3.4%

- Real Estate: 3%

- Energy: 3.8%

- Basic Mat: 2.5%

- SP 500: 100%

No question, the Financial sector has had the biggest loss of S&P 500 market cap over the last 6 weeks.

S&P 500 Earnings Update: (Source: IBES by Refinitiv)

- Fwd 4-qtr est: $162.51 vs last week’s $168.25

- Rate of change: -2.81% vs +0.50 basis points last week

- PE ratio: 15.6x

- Fwd S&P 500 earnings yield: 6.39% vs last week’s 7.30%

This was the week where S&P 500 earnings reality caught up with what everyone was expecting as “expected” 2020 S&P 500 EPS is now below the expected $163 – $164 EPS for 2019.

S&P earnings are now officially “negative” in terms of expected growth for 2020.

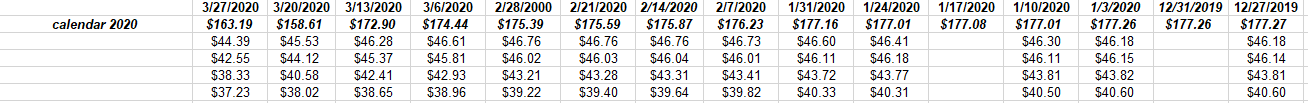

Here is a table from the earnings spreadsheet that shows the “bottom-up” estimate for the S&P 500’s 2020 EPS (updated weekly)

The 2nd quarter 2020 (as you’d expect) is seeing the sharpest cuts to the number.

The 3rd and 4th quarter is still holding up relatively better in terms of negative revisions, which supports the notion that by May – June ’20 the US economy could start to recover.

Hope readers find that helpful.

2020 S&P 500 ‘expected” EPS growth is now negative by -0.5%, and this will likely get worse.

The final calendar 2019 S&P 500 EPS “actual” will be published Wednesday. It should come in around $163 – $164.

Walgreens (WBA) is the sole company of interest (to me) reporting this coming week.

Summary / conclusion: By the numbers, those compiling or constructing S&P 500 estimates are still expecting a stronger 2nd half to 2020. Q1 ’20 numbers will likely be tough and the Q2 ’20 guidance will be horrid. Thus watching Q3 and Q4 ’20 numbers will provide some insight to investors but it will have to be digested in light of the headlines around the virus.

The sector weights as a percentage of the S&P 500 market cap is fascinating. Technology’s relative performance has actually been decent, with the QQQ’s returning -10% as of last night, versus the -21% SPY return. Investors are getting good “alpha” by holding large-cap tech.

CNBC was reporting Friday night, of numerous insiders buying shares at JP Morgan. The stock is down from $141 to low $90’s in this drawdown.

Take all of this as one opinion. In this kind of environment, circumstances change quickly. Take all opinions with a healthy dose of skepticism.

Some high-yield ETF’s (HYG) were added today for clients in small amounts as the Fed seems to want to backstop everything. Here was an article published last night by this blog thinking that maybe a bottom will be found by the S&P 500 in the next 4 – 6 weeks. Adding some HYG was a way for me to get decent yield for clients i.e. +5% in the HYG – with some risk-adjusted equity-like return.

I do think the Fed wants the bond markets functioning properly.

Here are the three S&P 500 technical levels being watched for a successful retest of S&P 500 lows in the next month:

- 2,346.58 – December ’18 low

- 2,191.86 – Low for this drawdown made March 23rd, 2020.

A close below those levels is not good.

Thanks for reading.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.