S&P 500: Beginning Of A Breakdown?

Satendra Singh | Nov 30, 2020 12:27AM ET

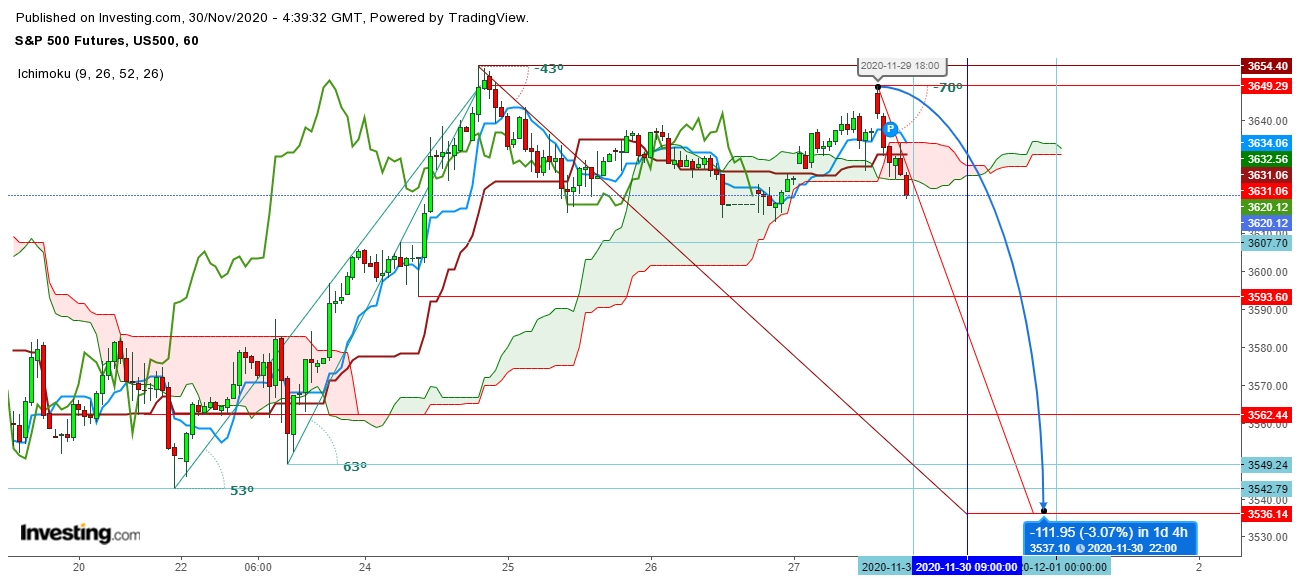

On analysis of the movements of the S&P 500, US Dollar, WTI Crude, and Gold futures, I find that this collective slide looks evident enough to show the primary symptoms of the next crash in global equity markets. The S&P 500 futures could nosedive anytime during December; since constant rejection above 3655 from the last four trading sessions.

On the other hand, prevailing bearishness pushed the gold futures below $1,792, while the WTI crude oil futures have crossed the level of $45 amid hopes of speedy economic recovery. All these uneven developments have only extended the level of uncertainty which could result in some odd moves in global equity markets very soon.

A sudden steep fall in gold prices looks evident enough to reflect the weakening risk appetite across markets while on the other constant a sliding dollar confirms that the global equity markets look ripe enough for a sudden meltdown. I find that before a steep fall, the S&P 500 Futures could once again retest their recent highs, even could new peak levels.

Extreme exhaustion could follow this sudden surge if we find it during the first week of December. There is no doubt that this will be the advent of a recessionary phase shortly. The current prevailing uncertainty could lead to the next market crash before Christmas.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.